ChatGPT’s XRP analysis reveals a bullish breakout above $3.05 as Ripple’s banking license application accelerates while 42 banks reportedly attempt to block approval, positioning XRP for a potential surge toward $3.15 or consolidation above $3.00 psychological support with a 3.57% daily rally and volume explosion to 130.77 million.

With RSI neutral at 53.55 and MACD histogram building positive momentum despite bearish line, the next directional move could be meaningful as banking license speculation accelerates.

ChatGPT’s XRP analysis synthesizes 24 real-time technical indicators, banking license developments, SEC deadline pressure, and institutional collaboration metrics to assess XRP’s 90-day trajectory amid regulatory inflection between continued consolidation and explosive institutional adoption momentum.

Technical Analysis: Strong Bullish Recovery Above All EMAs

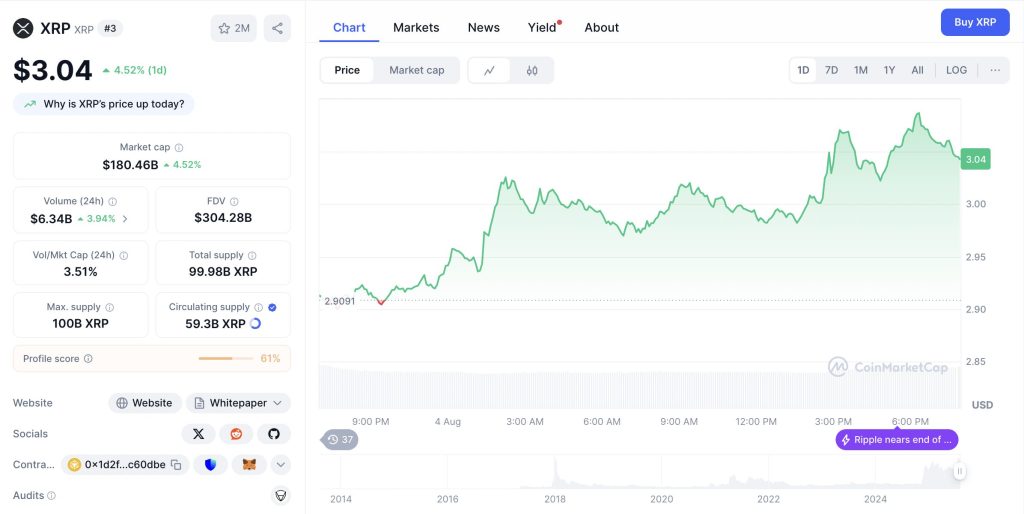

XRP’s current price of $3.05 reflects an impressive +3.57% daily surge from the opening price of $2.95, establishing a trading range between $3.08 (high) and $2.93 (low). This 4.9% intraday range demonstrates controlled volatility typical of bullish breakout attempts.

The RSI at 53.55 sits in healthy neutral territory with substantial room for continued upward movement without overbought conditions.

Moving averages reveal exceptional positioning with XRP above all major EMAs: 20-day at $3.02 (+1.0%), 50-day at $2.79 (+8.5%), 100-day at $2.59 (+15.3%), and 200-day at $2.34 (+23.3%).

Volume analysis shows remarkable expansion to 130.77 million XRP, indicating massive institutional participation during the breakout attempt.

MACD shows mixed signs at -0.0668 below zero, but a positive histogram at 0.1314 suggests building momentum toward a potential bullish crossover.

ATR at 2.23 suggests a high volatility environment with potential for strong moves as regulatory catalysts accelerate.

Historical Context: Recovery from Summer Consolidation

XRP’s August performance demonstrates remarkable resilience with a strong recovery from recent consolidation, building on July’s explosive rally to $3.64.

The current breakout attempt showcases institutional confidence despite broader market uncertainty.

January’s $3.40 start, followed by spring correction to February’s $1.77 and March’s $2.09, established an accumulation base.

April-June consolidation between $2.18-$2.21 created a foundation for July’s explosive 40%+ rally toward $3.64.

August’s current momentum builds on July’s strength with today’s +3.57% surge demonstrating continued institutional interest.

Current pricing maintains a 20.45% discount to the all-time high while securing extraordinary 108,000%+ gains from 2014 lows, showing both remaining upside potential and proven institutional-grade appreciation capacity through regulatory cycles.

Support & Resistance: Multiple EMA Layers Provide Protection

Immediate support emerges at today’s low around $2.93, reinforced by the psychological $3.00 level and 20-day EMA at $3.02.

Key support demonstrates considerable depth with 50-day EMA at $2.79 (+8.5% buffer), 100-day EMA at $2.59 (+15.3% buffer), and 200-day EMA at $2.34 (+23.3% buffer).

This multi-layer structure provides institutional-grade risk management.

Resistance begins at today’s high around $3.08, followed by key psychological resistance at $3.10-$3.15.

Major resistance emerges at $3.20-$3.30, where previous consolidation highs create overhead pressure.

The setup suggests pullbacks would find multiple support levels, while a breakout above $3.08 could trigger rapid appreciation toward $3.15-$3.25 based on banking license momentum and institutional positioning.

Banking Shift: 42 Banks Block License Application

Ripple’s banking license application faces unprecedented opposition, with 42 traditional banks reportedly blocking approval. However, as of today, Aug 4, the application is live and publicly available.

This resistance validates XRP’s transformative potential for global finance.

The license pursuit allows direct SWIFT competition with access to $150 trillion annual payment volume.

Ripple’s BlackRock collaboration for real-world asset tokenization provides institutional validation despite banking resistance.

These partnerships suggest confidence in eventual license approval.

ChatGPT’s XRP Analysis: SEC Deadline Pressure Builds

ChatGPT’s XRP analysis reveals a key regulatory timeline with the SEC deadline approaching and no response filed.

Legal experts suggest the SEC has limited time remaining, creating urgency for a resolution that could eliminate final regulatory uncertainty.

The regulatory environment shows unprecedented momentum with established legal precedent and banking partnership validation.

SEC silence suggests potential settlement or appeal abandonment, both scenarios are favorable for institutional adoption acceleration.

Recent patent approval for payment infrastructure targeting SWIFT competition demonstrates Ripple’s strategic positioning beyond regulatory resolution.

Market Fundamentals: Strong Metrics Despite Market Headwinds

XRP maintains the third-largest cryptocurrency position with $181.77 billion market cap, demonstrating institutional validation during broader market uncertainty.

The 5.35% market cap increase contrasts with declining volume to $6.31 billion.

The 3.42% volume-to-market cap ratio indicates healthy trading activity, suggesting continued institutional interest despite market consolidation.

This moderate activity during positive price action validates underlying strength.

Circulating supply of 59.3 billion XRP represents 59.3% of the maximum 100 billion token supply, with a controlled release schedule supporting stability.

This tokenomics structure maintains scarcity while allowing ecosystem expansion.

Market dominance of 4.81% positions XRP as a major institutional cryptocurrency with substantial recognition and $305.6 billion fully diluted valuation reflecting growth expectations.

LunarCrush data reveals improving social performance with XRP’s AltRank surging to 68, indicating strong community engagement recovery.

Galaxy Score of 64 reflects building positive sentiment around banking developments and regulatory resolution.

Engagement metrics show substantial growth with 11.94 million total engagements (+159.34K), 52.84K mentions (+20.64K), and 8.7K creators contributing to discussions.

Social dominance of 4.25% demonstrates sustained attention during market consolidation.

Sentiment registers at a robust 81% positive, reflecting community optimism around banking license, SEC resolution, and institutional partnerships.

Recent themes focus on daily channel breakouts, banking resistance, and $6 price predictions.

Three-Month XRP Price Forecast Scenarios

Banking License Breakthrough (45% Probability)

Banking license approval combined with SEC case resolution could drive explosive appreciation toward $6.00-$8.00, representing 95-150% upside from current levels.

This scenario requires sustained volume above 100 million daily and a successful break above $3.15 resistance.

Extended Consolidation (35% Probability)

Delayed banking approval could result in consolidation between $2.80-$3.20, allowing technical indicators to reset while institutional positioning continues.

Support at EMA levels would likely hold with volume normalizing around 80-90 million daily.

Correction on Regulatory Delays (20% Probability)

Major regulatory setbacks could trigger selling toward $2.60-$2.80 support levels, representing 15-20% downside.

Recovery would depend on institutional buying at EMA support levels.

ChatGPT’s XRP Analysis: Banking Infrastructure Meets Technical Strength

ChatGPT’s XRP analysis reveals key convergence of banking license momentum, technical strength above all EMAs, and regulatory resolution timeline.

The bullish structure with positive daily momentum creates compelling upside potential.

Next Price Target: $6.00-$8.00 Within 90 Days

The immediate trajectory requires a decisive breakout above $3.08 resistance to validate continued institutional momentum over consolidation.

From there, banking license acceleration could propel XRP toward $6.00 psychological milestone, with sustained institutional adoption driving toward $8.00+, representing new cycle highs.

However, failure to break $3.08 would indicate extended consolidation to $2.80-$3.00 range as the regulatory timeline extends, creating an optimal accumulation opportunity before the next banking approval wave drives XRP toward $15+ targets, validating the global payment infrastructure replacement thesis.

The post ChatGPT’s XRP Analysis: Bullish Setup Above $3.05 Despite 42-Bank Blockade on Ripple appeared first on Cryptonews.

BREAKING: A former SEC attorney confirms that

BREAKING: A former SEC attorney confirms that