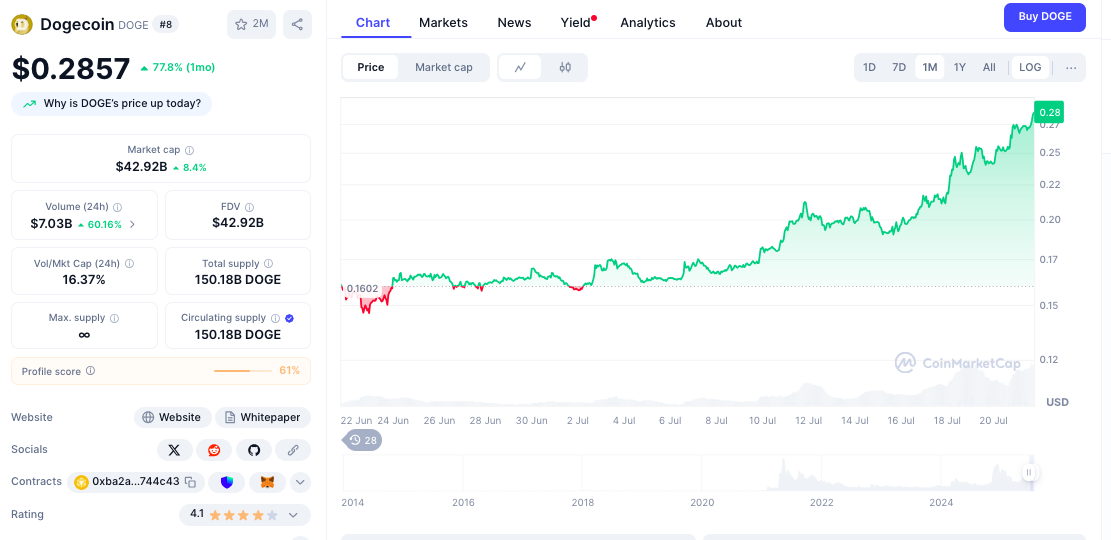

ChatGPT’s AI model processed 42 live indicators, revealing explosive momentum as Dogecoin (DOGE) rockets 2.70% to $0.28115 following an extraordinary 41.67% weekly surge driven by Bit Origin’s $500M treasury facility and institutional accumulation exceeding 1.08 billion DOGE.

DOGE is trading with a high RSI of 85.95, while testing the key $0.30 psychological resistance ahead of potential positive catalysts.

The following analysis synthesizes ChatGPT’s 42 real-time technical indicators, corporate treasury developments, ETF speculation momentum, and altcoin season catalyst to assess DOGE’s 90-day trajectory amid historic weekly performance and extreme overbought conditions, warning of correction risk.

Technical Explosion: Extreme Overbought Indicates Correction Risk

Dogecoin’s current price of $0.28115 reflects exceptional daily gains of 2.70%, completing an extraordinary 41.67% weekly surge toward 2021 cycle highs.

The massive $0.0218 intraday range represents 7.8% of the current price, indicating institutional accumulation and retail FOMO convergence during historic breakout acceleration.

RSI at the extreme 85.95 level presents strong warning signs, as historical analysis shows readings above 80 typically precede corrections of 15–25%.

This positioning suggests unsustainable momentum, requiring a healthy pullback toward the $0.24–$0.26 support level before a continuation toward higher targets.

MACD readings indicate strong bullish momentum, with a positive histogram at 0.01227, confirming the acceleration phase. However, extreme RSI levels create a binary scenario.

DOGE either achieves a decisive breakout above the $0.30 psychological level or experiences a sharp correction for a technical reset before the next leg up.

Corporate Treasury Shift: Bit Origin’s $500M Facility Validates DOGE

Bit Origin’s acquisition of 40.5 million DOGE, valued at under $500 million, represents major institutional validation of a meme coin treasury strategy.

The treasury facility structure provides flexible capital deployment, allowing continued DOGE accumulation during market volatility while maintaining upside participation.

The transformation began when professional traders noticed something unusual: massive buy orders flowing into DOGE markets over just two days.

Data revealed that institutional players had accumulated over 1.08 billion DOGE tokens, worth over $250 million.

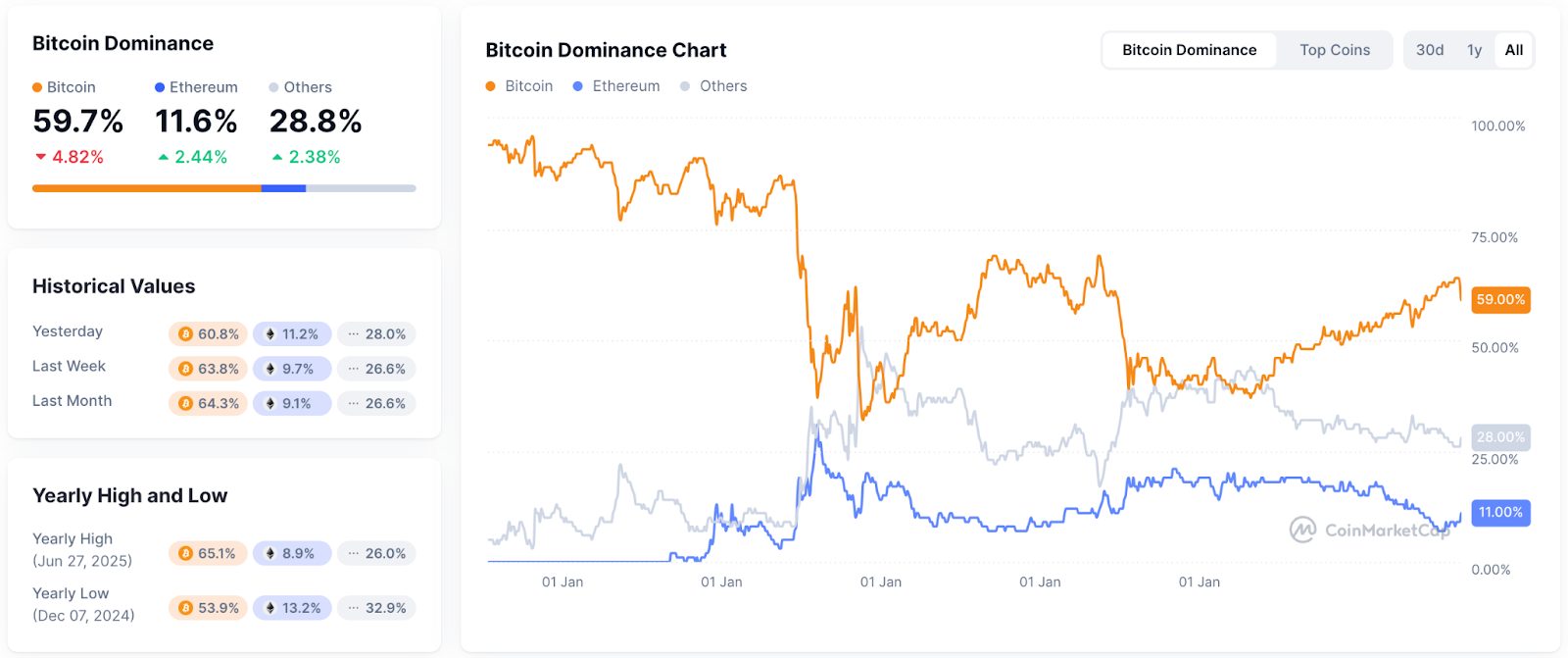

Altcoin Season Catalyst: Bitcoin Dominance Decline Drives Rotation

The decline in Bitcoin dominance triggers a massive capital rotation into altcoins, with DOGE receiving disproportionate flows due to cultural recognition and institutional validation.

The altcoin season catalyst creates optimal conditions for meme coin appreciation as institutional capital explores alternatives to Bitcoin concentration.

This rotation pattern historically precedes sustained altcoin appreciation cycles lasting 6–12 months.

Historical Context: Approaching 2021 Cycle Resistance Levels

DOGE’s current surge toward $0.30 approaches key resistance levels from 2021 cycle highs around $0.35–$0.40. The 75% recovery from June’s $0.16 lows demonstrates strong resilience and institutional confidence-building throughout the correction cycle.

Current price action represents a 156% discount to the May 2021 all-time high of $0.7376, providing compelling risk-reward dynamics for institutional investors seeking exposure to a culturally relevant cryptocurrency with proven community sustainability.

The approach toward historical resistance creates psychological importance as breaking above $0.35 would establish higher highs, potentially triggering massive retail FOMO and institutional recognition, accelerating toward double-digit targets during continued altcoin season momentum.

Support & Resistance: EMA Strength Validates Institutional Positioning

Immediate support emerges at today’s low around $0.26428, reinforced by psychological support at $0.25000–$0.26000.

The exceptional EMA positioning, with prices 27–34% above all major moving averages, confirms the success of institutional accumulation and extraordinary trend strength.

The 20-day EMA provides strong support at $0.21223 and the 200-day EMA at $0.20509, offering multiple safety nets during any correction periods.

Source: TradingView

Key resistance begins at the psychological $0.30000 level, followed by major resistance at $0.31000–$0.32000.

Breaking above this zone, despite an extreme RSI, would indicate continued momentum toward historical resistance at $0.35000–$0.37000, representing previous cycle highs.

Market Metrics: Historic Volume Validates Breakout Authenticity

DOGE maintains $42.92 billion market capitalization with an exceptional 24-hour trading volume of $7.03 billion, representing a massive 105.6% surge.

The volume-to-market cap ratio of 16.37% indicates intense institutional and retail participation, validating the authenticity of the breakout.

The explosive volume surge to 2.26 billion DOGE confirms an acceleration in institutional positioning ahead of ETF speculation and validation of corporate treasury adoption.

Market dominance of 1.06% with a circulating supply of 150.18 billion DOGE provides controlled tokenomics that appeal to institutional treasury strategies, while maintaining sufficient liquidity for continued professional participation during appreciation cycles.

LunarCrush data reveals exceptional community engagement with AltRank reaching 9, indicating top-tier social performance among all cryptocurrencies.

A Galaxy Score of 78, with 11.26 million total engagements, indicates that DOGE is receiving massive attention during breakout periods.

A social dominance of 2.75% with 48,220 mentions and 9,230 creators validates sustained community interest in corporate treasury adoption and ETF speculation narratives.

Recent themes have focused on $1-$2 price targets and institutional validation, rather than meme-driven speculation.

The 80% positive sentiment reflects community confidence in the institutional adoption thesis, which supports DOGE’s evolution toward legitimate treasury asset status rather than a purely speculative trading vehicle, appealing to professional investors.

90-Day DOGE Price Forecast

ETF and Corporate Treasury Rally (Bull Case – 40% Probability)

Successful ETF approval speculation and continued corporate treasury adoptions could drive appreciation toward $0.35–$0.45, representing 40–58% upside.

This scenario requires breaking above the $0.30 psychological barrier despite extreme RSI levels and sustained institutional positioning confirmation.

Technical targets include $0.35, $0.40, and $0.50, based on historical resistance levels and institutional flow projections.

The ETF catalyst, combined with corporate adoption, could trigger a sustained meme coin season, benefiting DOGE’s cultural positioning.

Extreme Overbought Correction (Base Case – 45% Probability)

A healthy pullback from extreme RSI levels, toward $0.24–$0.26, could extend over 2–4 weeks while institutional positioning develops gradually.

Support at the EMA cluster, around $0.20–$0.22, would likely hold during the correction, with volume normalizing to around 1-1.5 billion DOGE daily.

This consolidation provides additional accumulation opportunities while preserving uptrend structure for eventual continuation.

Deep Technical Correction (Bear Case – 15% Probability)

Breaking below EMA support at $0.21 could trigger a deeper correction toward $0.18–$0.20, representing a 28–36% downside.

The strong corporate adoption backdrop and altcoin season momentum limit extreme downside scenarios, with major support at $0.18–$0.20 providing a foundation for future recovery cycles during continued institutional validation.

DOGE Forecast: Meme Culture Excellence Meets Corporate Treasury Shift

DOGE’s current positioning reflects a mix of cultural relevance, institutional validation, and technical breakout momentum during optimal altcoin season conditions.

The analysis reveals that the meme coin is positioned at a historic inflection point between a speculative asset and a corporate treasury standard.

The corporate treasury shift, with a $500 million facility and institutional accumulation, establishes a precedent for meme coin business adoption beyond pure speculation.

The extreme RSI at 85.95 creates a binary outcome, where DOGE either achieves a decisive breakout above $0.30, targeting $0.45+, or experiences a healthy correction to reset technical indicators.

The post ChatGPT’s 42-Indicator DOGE Analysis Flags Extreme $0.30 Breakout appeared first on Cryptonews.

We’re excited to announce!

We’re excited to announce!

https://t.co/sCEPstE2QC

https://t.co/sCEPstE2QC

(@Cryptollica)

(@Cryptollica)