ChatGPT’s AI model processed 42 live indicators, revealing consolidation momentum as Bitcoin holds at $118,688 following a historic $123,091 ATH achieved on July 14, with a minimal daily movement of -0.06%, testing whether smart money accumulation overcomes emerging altseason rotation.

The market cap remains at $2.37 trillion, with institutional validation through Genius Group’s 200 BTC acquisition, which targets a 10,000-BTC treasury, as Goldman Sachs and BNY launch tokenized money funds.

The following analysis synthesizes ChatGPT’s 42 real-time technical indicators, institutional treasury developments, altseason implications, and smart money positioning to assess BTC’s 90-day trajectory amid a key inflection between continued dominance and altcoin rotation acceleration.

Technical Consolidation: Historic High Pause Creates Decision Point

Bitcoin’s current price of $118,688 reflects a minimal 0.06% daily movement, representing healthy consolidation after reaching a historic all-time high of $123,091 on July 14.

The $2,347 intraday range represents 2.0% of the current price, demonstrating controlled volatility typical of institutional accumulation phases.

RSI at a healthy 63.83 provides optimal reading with room for continued appreciation without overbought concerns, suggesting sustainable consolidation rather than trend exhaustion.

This technical reset creates a foundation for the next major move while maintaining bullish structure above all EMAs.

MACD indicators exhibit a concerning divergence, with the line at -141.12 below zero, despite a positive histogram at 2,895.80, creating mixed signals that require careful monitoring.

The divergence suggests a potential momentum shift, while the histogram indicates building pressure for directional resolution.

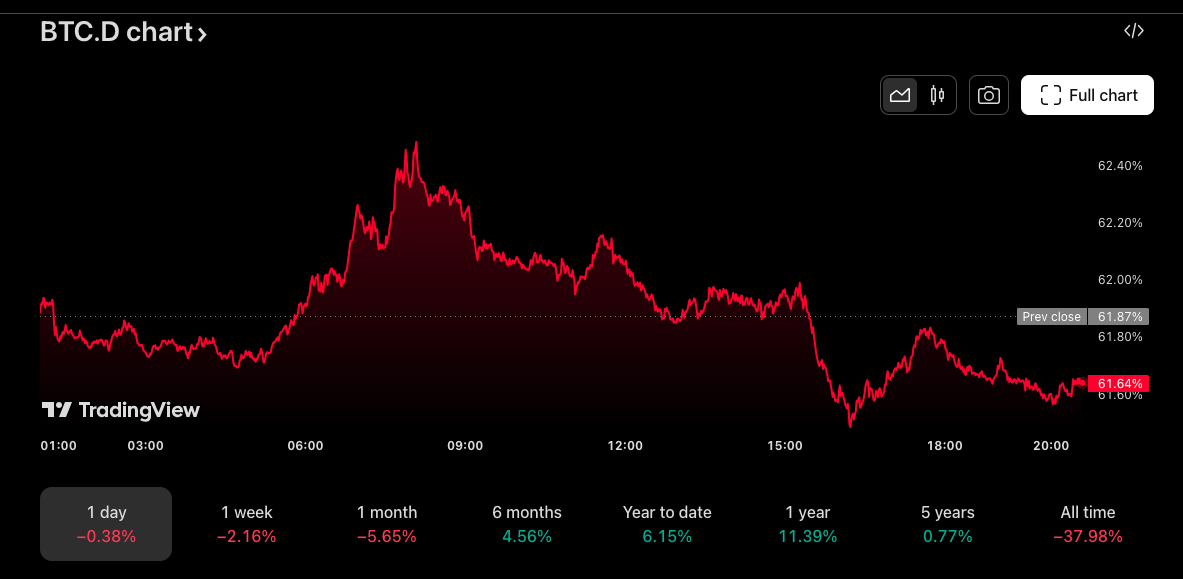

Altseason Looming: Dominance Shift Threatens BTC Leadership

Bitcoin’s market dominance at 61.64% faces pressure from emerging altseason dynamics as institutional capital explores high-performance blockchain alternatives.

The dominance level near multi-year highs creates vulnerability to rotation as altcoins demonstrate superior performance metrics.

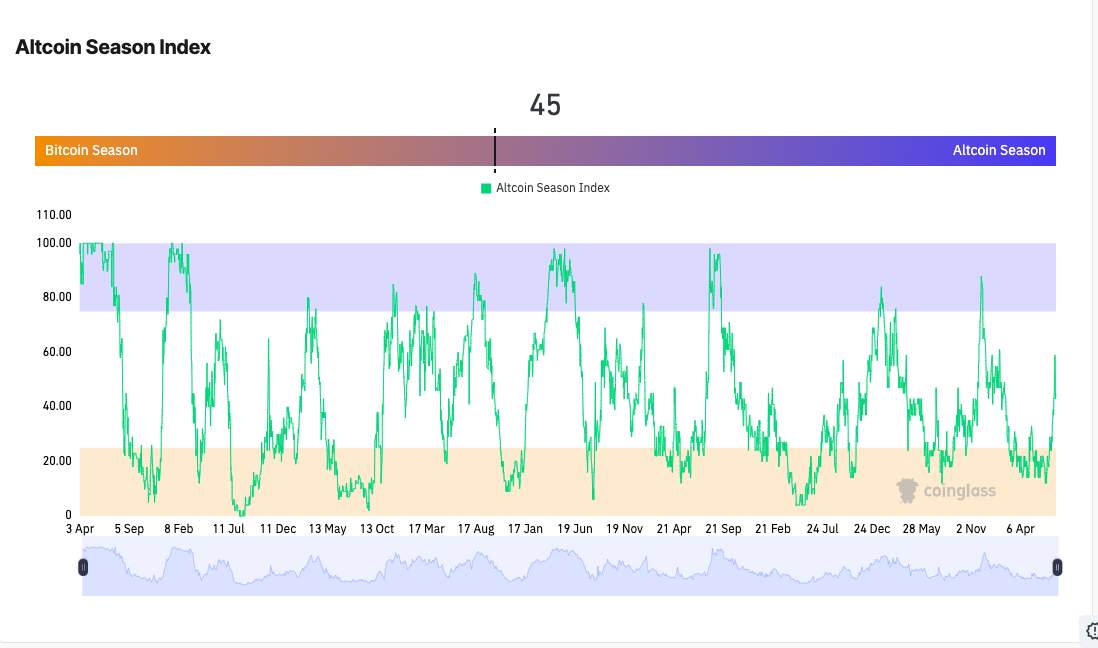

Altseason Index holding above 44 indicators potential capital flow from Bitcoin toward altcoin alternatives offering higher growth potential.

This rotation pattern has historically preceded a strong decline in BTC dominance as institutions diversify beyond Bitcoin-only strategies toward broader crypto exposure.

Smart Money Accumulation: Institutions Drive Treasury Expansion

Despite altseason uncertainty, institutional treasury adoption accelerates, with Genius Group boosting its holdings to 200 Bitcoin while targeting an ambitious 10,000-BTC treasury accumulation.

This aggressive institutional strategy demonstrates a sophisticated long-term position that transcends market rotation concerns.

The launch of tokenized money funds by Goldman Sachs and BNY represents the mainstream financial infrastructure’s embrace of cryptocurrency technology.

Japanese AI companies are targeting 3,000 BTC treasury allocations, and UK firms raising $135 million for Bitcoin strategies demonstrate a global momentum in institutional adoption.

Quantum Computing Threat: Long-term Security Concerns Emerge

Emerging quantum computing developments pose a potential long-term security risk, with 7 million Bitcoin potentially vulnerable within a 3-year timeline.

This technological threat creates underlying uncertainty for institutional adoption strategies requiring multi-decade security assurance.

While the quantum threat remains distant, institutional treasury managers must consider technological evolution in their long-term allocation decisions.

Security concerns could accelerate the development of quantum-resistant alternatives, potentially impacting Bitcoin’s institutional adoption.

Market Dynamics: Ancient Wallet Activity and Institutional Flows

The ancient Bitcoin wallet activation, after 14.5 years, involves moving 3,962 BTC worth $468 million, demonstrating long-term holder distribution patterns.

These historic movements typically indicate cycle maturation rather than bearish sentiment among original adopters.

The wallet’s cost basis of $0.37 per Bitcoin in January 2011 versus the current $118,688 price represents an extraordinary 32,000,000% appreciation, validating Bitcoin’s long-term store-of-value thesis for institutional adoption consideration.

Support & Resistance: EMA Structure Maintains Bullish Framework

Immediate support emerges at today’s low around $117,103, reinforced by 20-day EMA support at $115,993.

The exceptional EMA positioning, with the price above all major moving averages, confirms the success of institutional accumulation despite the consolidation phase.

Major support extends through the 50-day EMA at $111,273 and the 100-day EMA at $105,992, providing multiple safety nets during any correction periods. This support structure appeals to institutional risk management, which requires defined downside protection.

Key resistance begins at today’s high around $119,450, followed by psychological resistance at $120,000-$121,000.

Breaking above this zone would indicate continuation toward major resistance at $125,000-$130,000, representing the next institutional milestone targets.

Bitcoin’s social dominance, reaching 43.06% during its recent all-time high achievement, represents a concerning retail FOMO indicator.

Historical analysis reveals that spikes in social dominance often precede short-term corrections, particularly when retail participation peaks.

Community sentiment at 80% positive, with declining engagement metrics, reflects typical consolidation-phase behavior while maintaining institutional confidence in the long-term adoption thesis.

Professional investors recognize social dominance peaks as opportunities for distribution.

Regulatory Progress: Tokenized Funds Validate Infrastructure

Goldman Sachs and BNY tokenized money fund launches represent a regulatory milestone, validating cryptocurrency infrastructure for traditional financial services.

These developments provide institutional confidence for continued Bitcoin treasury allocation.

Societe Generale’s entry into making markets in Bitcoin and Ethereum ETPs demonstrates the European institutional embrace of cryptocurrency trading infrastructure.

This regulatory progress supports sustained institutional adoption, regardless of short-term altseason dynamics.

90-Day BTC Price Forecast

Institutional Momentum Continuation (Bull Case – 45% Probability)

A successful $120K breakout, combined with continued treasury adoption, could drive appreciation toward $130,000-$140,000, representing a 10-18% upside.

This scenario requires institutional accumulation overcoming altseason rotation pressures with sustained volume confirmation.

Technical targets include $125K, $130K, and $140K based on institutional flow projections and treasury adoption momentum.

The infrastructure development could attract additional conservative capital seeking digital store-of-value exposure.

Altseason Rotation Impact (Base Case – 40% Probability)

Extended consolidation between $115K-$125K could persist through Q3 2025 as capital rotates toward altcoin alternatives during institutional diversification.

This scenario allows for a decline in dominance while maintaining structural support.

Support at the EMA cluster around $111K-$116K would likely hold during rotation, with volume declining toward 50-60 billion daily.

This sideways action presents an opportunity for altcoin appreciation while preserving Bitcoin’s institutional foundation.

Dominance Breakdown (Bear Case – 15% Probability)

Breaking below the $115K support level could trigger a deeper correction, potentially targeting the $105K-$110K range, representing an 11-17% downside.

This scenario would require strong institutional demand disappointment or accelerated altseason momentum.

The strong treasury adoption backdrop limits extreme downside scenarios, with major support at $105K-$110K providing a foundation for recovery during continued institutional validation cycles.

BTC Forecast: Digital Gold Meets Institutional Evolution

Bitcoin’s current positioning reflects the convergence of historic achievement, institutional treasury adoption, and emerging altseason uncertainty.

The 42-indicator analysis reveals that the cryptocurrency is at a key juncture between continued dominance and diversification pressure.

Next Price Target: $125,000-$130,000 Within 90 Days

The immediate trajectory requires a decisive breakout above $120K resistance to validate continued institutional dominance over altseason rotation.

From there, treasury adoption momentum could propel Bitcoin toward the $125K psychological milestone, with sustained institutional flows driving it toward $130K-$140K, representing new cycle highs.

However, failure to break the $120K resistance would indicate extended consolidation in the $115K-$118K range as altseason rotation accelerates, creating an optimal institutional accumulation opportunity before the next treasury adoption wave drives Bitcoin toward $150K+ targets, validating the digital gold thesis.

The post ChatGPT’s 42-Indicator Bitcoin Analysis Flags Key $120K Test Amid Altseason Uncertainty appeared first on Cryptonews.

Tokenized money market funds by Goldman Sachs and BNY Mellon could lead a shift toward real-time asset mobility and programmable finance.

Tokenized money market funds by Goldman Sachs and BNY Mellon could lead a shift toward real-time asset mobility and programmable finance.