Chainlink (LINK) is showing signs of renewed bullish momentum, with both technical patterns and on-chain metrics signaling the potential for strong upward moves.

According to IntoTheBlock, the Oracle platform saw more than $120 million worth of LINK tokens withdrawn from exchanges within the past month.

Keep an eye on altcoin exchange flows👀

$LINK has seen consistent outflows from exchanges over the past month, hinting at ongoing accumulation. In total, net outflows surpass $120 million worth of LINK in the last 30 days.

The notable accumulation indicates unwavering investor confidence in Chainlink’s short-term price movements.

Furthermore, LINK has broken out of a prolonged consolidation range on the daily chart, signaling bullish momentum.

Maintaining the prevailing performance could trigger explosive surges to $20, a more than 50% increase from current prices of $13.

Chainlink sees over $120M in exchange outflows

Copy link to section

LINK boasts bullish on-chain signals, with more than $120 million worth of tokens withdrawn from exchanges within the past 30 days.

Such trends indicate traders moving their assets from exchanges to self-custody, often confirming long-term holder conviction of the asset’s performance.

Chainlink’s ongoing collaborations and integrations likely contributed to the surge in accumulation over the past month.

The crypto project continues to dominate the RWA tokenization sector with its decentralized offerings.

Moreover, the accumulation could reflect investors’ trust that LINK has bottomed and readiness for impressive price gains in the upcoming sessions.

The massive outflows add weight to LINK’s bullish breakout, supporting robust uptrends for the alt.

LINK overpowers a descending wedge

Copy link to section

Amidst the optimism, analyst ALLINCRYPTO observed a key technical formation.

He believes a “major run for Chainlink is inevitable” as the alt prints a bullish setup.

Any $LINK holders in the house?? Major run for Chainlink is inevitable at this point… ⏰

Meanwhile, LINK broke out of a descending wedge formation that confined its price actions for months.

Buyers have pushed prices beyond the pattern’s upper boundary, signaling adequate momentum for continued rallies.

A falling wedge breakout often precedes significant rallies, and the surge in accumulation makes it credible.

The breakout happened beyond $12, with LINK hovering at $13.45 at press time.

The altcoin trades at the vital $13 – $13.50 range. A close beyond this region would confirm a bullish continuation for Chainlink.

The soaring volume and robust candlesticks highlight potential buyer resurgences.

Maintaining this outlook could support breakouts to $18 and $20, an approximately 53% gain from LINK’s current price.

Extended upsides will open the gates toward $24 – $26.

However, enthusiasts should watch broad market developments.

Broader crypto market today

Copy link to section

Cryptos trade in green today as Bitcoin nears the $90,000 resistance, trading at $88,657.

A decisive BTC close beyond $90,000 would support short-term rallies for altcoin and support LINK’s surge to its upside targets.

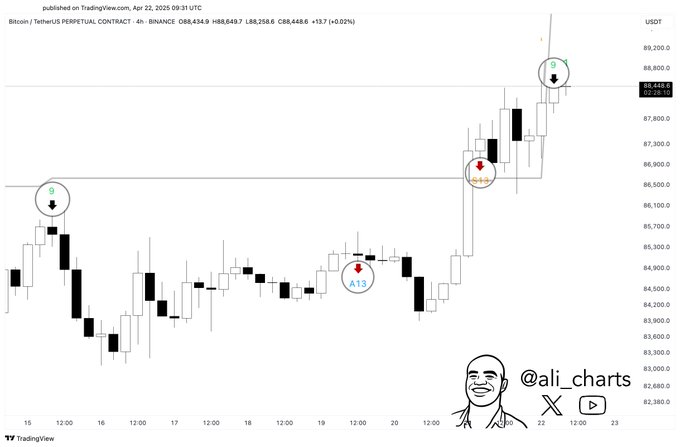

Analyst Ali Charts revealed a possible near-term Bitcoin retracement on the 4H chart.

Bitcoin’s failure to surpass the $90,000 mark will likely delay Chainlink’s anticipated surge.

Bulls should maintain LINK prices above $12 to support potential rallies for the alt.