Cathie Wood is back shopping. ARK Invest just picked up 41,453 shares of Coinbase stock, worth about $6.9 million.

What makes it interesting is the timing. Just weeks ago, ARK was trimming exposure. Now they are stepping back in as COIN tries to stabilize.

Key Takeaways

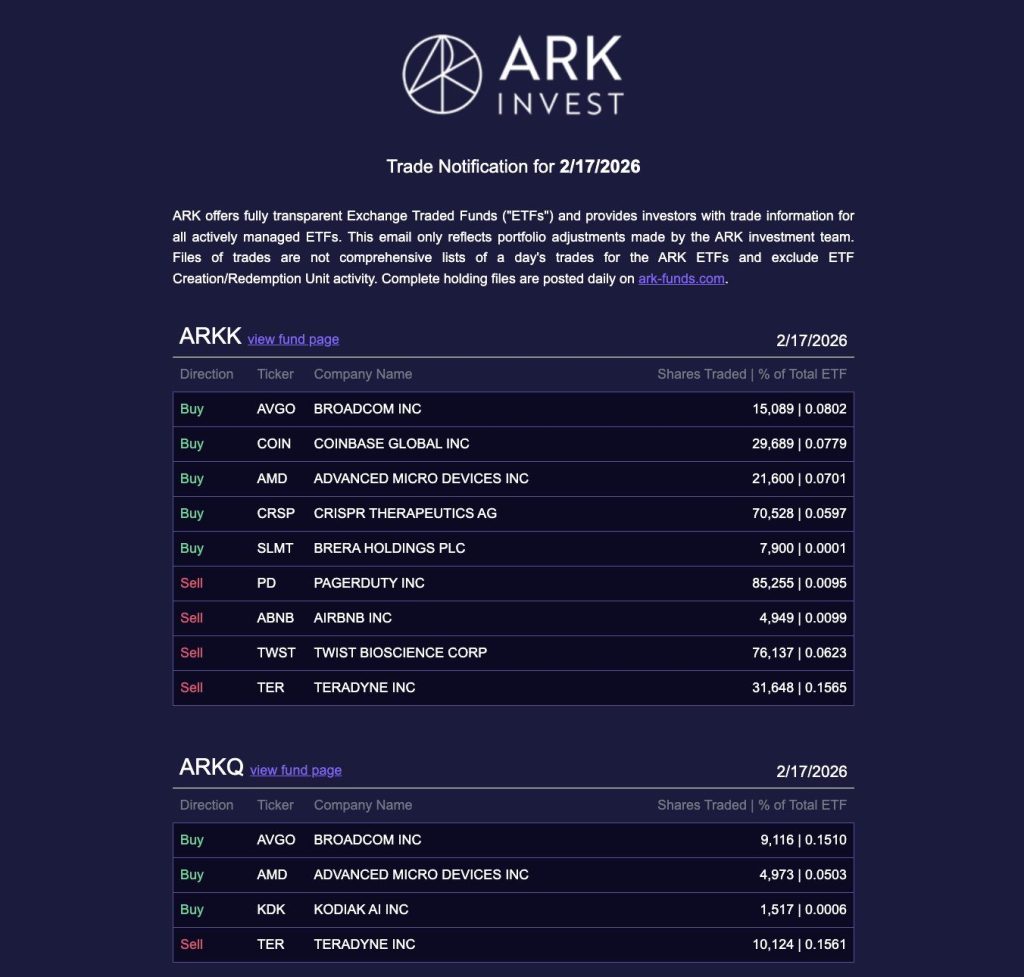

- The Buy: ARK purchased 41,453 shares worth $6.9 million across three ETFs on Feb. 18.

- The Split: The majority went to the flagship Innovation ETF (ARKK), which took 29,689 shares ($4.9 million).

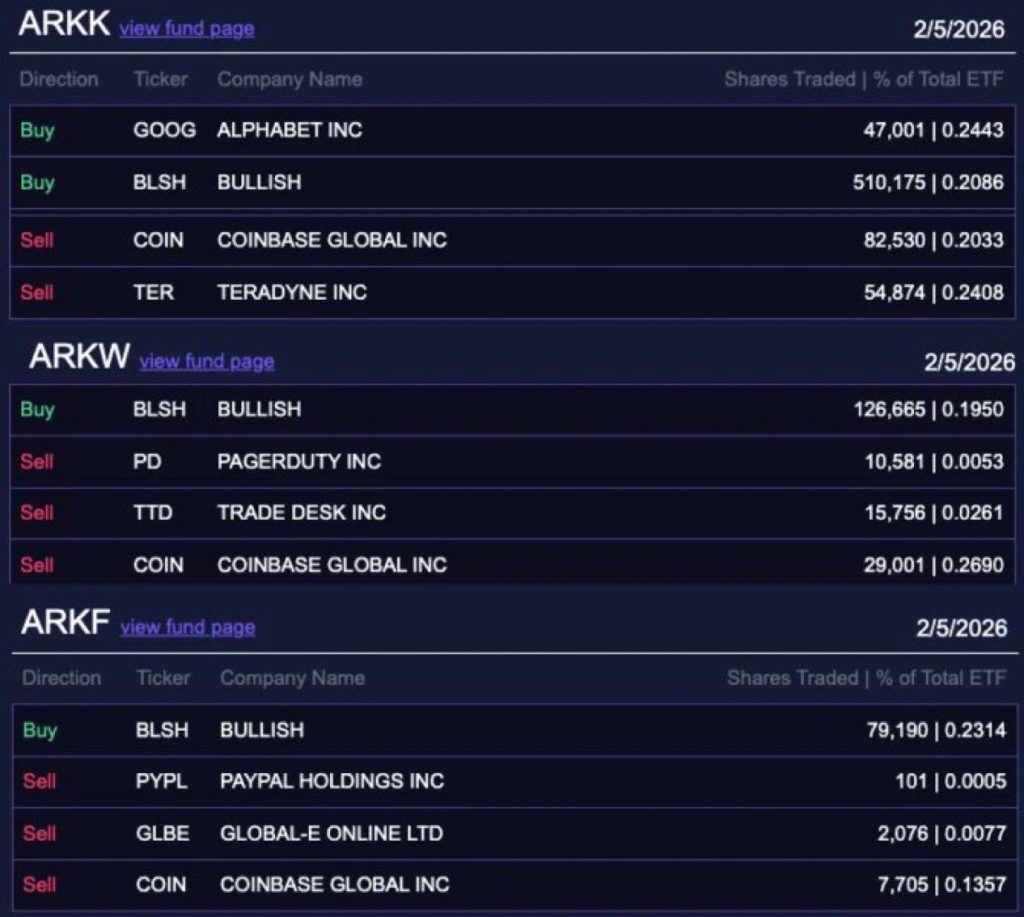

- The Pivot: This reverses a selling streak from early February where ARK offloaded $17.4 million in COIN.

Is This a Tactical Pivot?

Just a few weeks ago, ARK was heading the other way. The firm dumped about $17.4 million worth of COIN on Feb. 5 and Feb. 6 while the broader market was sliding. At the same time, it rotated capital into the crypto exchange Bullish.

Now the script has flipped. That fresh $6.9 million buy suggests ARK sees value at these levels. It looks like the classic buy the dip play they are known for.

For traders watching ETF flows, this matters. ARK usually caps positions around 10% of a fund. The earlier selling and latest add likely reflect portfolio balancing, not panic. It feels more like weight management than a change in long term conviction.

Why ARK Just Bought $6.9M in Coinbase Stock

The accumulation was spread across three key funds. The flagship ARK Innovation ETF (ARKK) led the charge with a $4.9 million allocation. The Next Generation Internet ETF (ARKW) added $1.2 million, while the Fintech Innovation ETF (ARKF) picked up $704,000.

This buying activity occurred as COIN rebounded. Shares closed up 1% Tuesday at $166.02 and have gained 8.4% over the last five trading days. Technically, the stock is trying to find support after falling 28% year-to-date.

Market observers note that such purchasing often precedes potential rallies. Similar technical signals are flashing elsewhere in the market, with some analysts warning of extreme funding rates that could trigger squeeze scenarios.

According to the firm’s disclosures, COIN remains a heavyweight in the portfolio. It is the seventh-largest holding in ARKK (4% weighting) and the third-largest in ARKF (5.6% weighting).

What Does This Signal for COIN Stock?

ARK’s return to the buy side suggests confidence despite Coinbase’s mixed earnings. The company recently reported a $667 million net loss for Q4, driven largely by unrealized crypto losses.

However, analysts remain bullish. Bernstein maintained an outperform rating with a $440 price target—implying over 200% upside. This optimism is partly fueled by expectations that historical capital inflows could boost retail trading volume in the coming months.

Regulatory clarity also looms large. With discussions heating up in Washington, specifically regarding upcoming market structure bills, the fundamental case for Coinbase could shift rapidly. For now, Cathie Wood is betting that the current price is a discount, not a distress signal.

Discover: Here are the crypto likely to explode!