Bitcoin is steady around $89,300, but traders are shifting their attention away from short-term price moves. The main issue now is that Bitcoin is falling behind silver, which has jumped to record highs above $117 per ounce. This growing gap is changing how investors view momentum.

Silver is drawing in capital as a hard-asset hedge, while Bitcoin is having trouble reaching its previous highs. Many traders now call this split ‘ugly’ instead of just a short-term blip. This isn’t about Bitcoin crashing. It’s about investors moving away from BTC as precious metals gain momentum.

Silver’s Surge Exposes a Shift in Market Leadership

Silver’s rise has been quick and strong. Prices nearly reached $118, up about 60% so far this year, thanks to safe-haven buying, limited supply for industry, and speculation. Meanwhile, Bitcoin is still stuck below $95,500, a level it has failed to break several times.

Because of this, the BTC/Silver ratio has dropped sharply. Many traders watch this ratio to see where money is flowing. When it falls for a long time, it usually means investors prefer physical or inflation-protected assets over riskier trades. In the past, Bitcoin often moved with metals, but now that link has broken.

Silver is gaining momentum. Bitcoin is staying in a tight range.

Rekt Capital Flags a Rare EMA Warning for Bitcoin

Adding to concerns, analyst Rekt Capital has pointed out a rare crossover between Bitcoin’s 21-week and 50-week exponential moving averages. This signal just appeared at the latest weekly close and last happened in April 2022, right before Bitcoin’s biggest bear market of that cycle.

EMA crossovers don’t predict timing by themselves, but traders watch them because they show the health of long-term trends. A bearish crossover means Bitcoin might need more time and stability before it can lead again, especially as other hard assets keep outperforming.

Bitcoin Price Prediction: Breaking the Downtrend Could Lead to $95K–$98K

Looking at the 4-hour chart, Bitcoin price prediction is bullish as BTC is steady above $86,000 and making higher lows, but it’s still stuck below a falling trendline from the $95,500 high. This forms a descending wedge, which usually signals the trend is running out of steam instead of starting a new sell-off.

Candlestick patterns back this up. Long lower wicks between $88,500 and $89,000 show buyers are active on dips, and smaller candle bodies mean selling is slowing down. Bitcoin is also moving back above short-term EMAs, with the 50-EMA and 100-EMA coming together near $91,000 to $91,200, which is now a key area to watch.

Momentum is picking up, but it’s still under control. The RSI is moving up toward the mid-50s, showing a recovery that isn’t overdone.

If Bitcoin can break and stay above $91,200, it could move up to $93,300, then $95,500, and possibly even $98,000. But if it can’t hold $88,500, that move will be delayed and Bitcoin will likely stay in a range above $86,000.

Trade view: If Bitcoin breaks above $91,200, it could head toward $95,500 to $98,000. If it falls below $86,000, the focus returns to consolidation, not a crash.

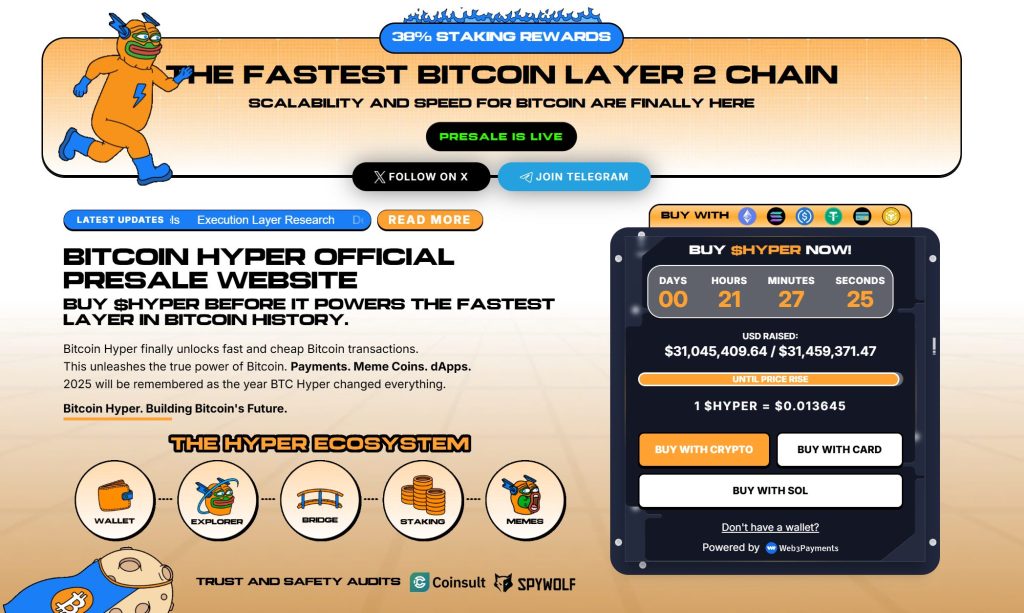

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31 million, with tokens priced at just $0.013645 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale