Brazil is considering a new tax on the use of cryptocurrencies for international payments, a move that could reshape how the country’s fast-growing digital asset sector handles cross-border transfers.

According to officials familiar with ongoing discussions, the government is reviewing whether its financial transaction tax, known as the IOF, should apply to certain crypto operations that the central bank recently reclassified as foreign-exchange transactions.

The proposal follows a Reuters report citing two officials who said the Finance Ministry is examining how to extend the IOF to transfers involving virtual assets and stablecoins.

These assets were formally defined as forex instruments under new central bank rules announced this month. Crypto transactions are currently exempt from the IOF, though Brazilians must pay income tax on capital gains above a monthly threshold.

Stablecoins Reclassified as FX Instruments as Brazil Tightens Oversight of $42.8B Market

The Finance Ministry has declined to comment publicly, and officials involved in the discussions stressed that the goal is to close a regulatory gap rather than raise new revenue.

Even so, the measure could bolster public finances at a time when Brazil is struggling to meet fiscal targets.

Brazil’s crypto market has expanded rapidly, driven by soaring stablecoin usage. Federal tax authority data shows crypto transactions reached 227 billion reais ($42.8 billion) in the first half of 2025, a 20% increase from the previous year.

Roughly two-thirds of that volume involved USDT, the dollar-backed stablecoin issued by Tether, while Bitcoin accounted for just 11%.

Authorities say the classification of stablecoins as forex instruments reflects their widespread use as a low-cost way for Brazilians to hold dollar balances and make international payments.

Regulators argue the shift is necessary to prevent stablecoins from being used as a channel for regulatory arbitrage in the foreign-exchange market.

The new central bank rules take effect in February 2026 and cover a broad range of activities.

Any purchase, sale, or exchange of stablecoins will be treated as a foreign-exchange operation, as will international transfers using virtual assets, card-based settlements, and the movement of assets to or from self-custody wallets.

While the definitions do not automatically trigger IOF obligations, they create the legal foundation for new federal tax guidance.

The federal tax authority this week expanded reporting requirements to include transactions executed through foreign platforms operating in Brazil.

Officials say greater visibility over crypto flows could make it easier to identify underreported import payments, with one Federal Police source estimating that more than $30 billion in annual imports may be conducted through stablecoin transfers to avoid customs duties and other taxes.

Brazil Tightens Grip on Digital Assets With Stricter Tax Rules

Brazil’s evolving tax policy sits alongside broader changes to how the country treats digital assets.

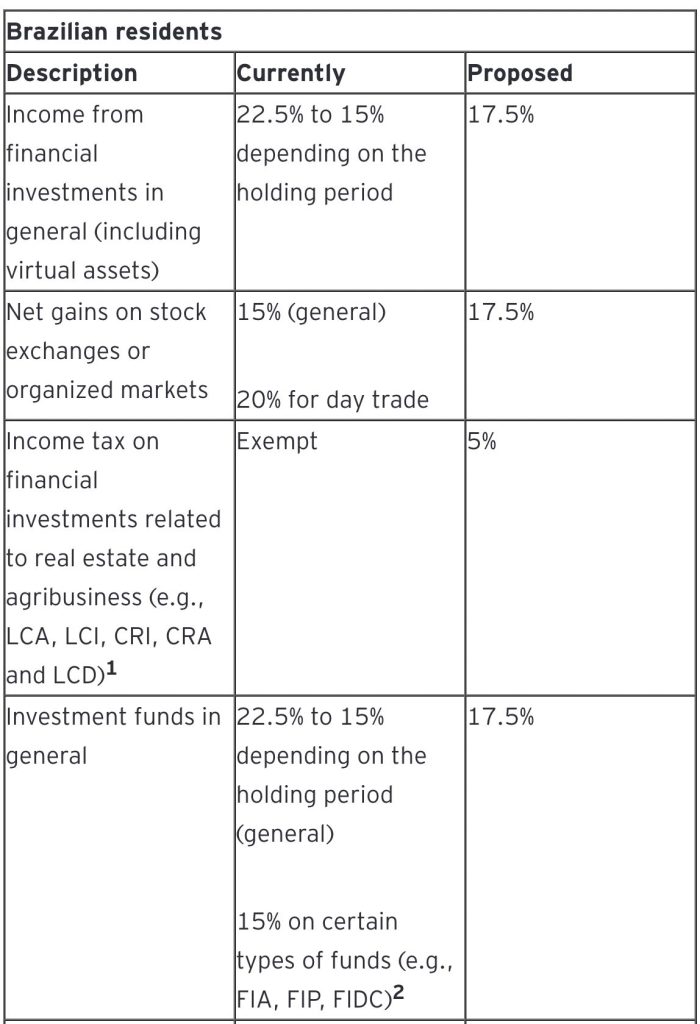

In mid-2025, the government implemented a flat 17.5% tax on crypto gains above a monthly threshold and introduced new reporting rules for holdings over 5,000 reais.

Taxable events include selling, exchanging, or receiving cryptocurrency as payment, as well as mining.

Brazilians must file through the Federal Revenue Service’s online portal, with monthly declarations required for offshore transactions above 30,000 reais.

Brazilian lawmaker Eros Biondini proposed a bill in June to scrap all crypto taxes for long-term holders, calling current levies excessive. The measure would overturn 2023 rules and remove crypto tax provisions from the code.

Though facing a long legislative path and possible vetoes, the proposal shows rising political tension over digital-asset regulation in one of the world’s top crypto markets.

The post Brazil Plans Crypto Tax Crackdown on Cross-Border Payments to Close Loophole: Report appeared first on Cryptonews.