Sundry Photography/iStock Editorial via Getty Images

The Industrial Select Sector (XLI) rose for the third week in a row for the week ending Nov. 17 (+2.98%), and so did the SPDR S&P 500 Trust ETF (SPY) which rose +2.31%.

Year-to-date, XLI has climbed +7.53%, while SPY has soared +17.88%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +11% each this week. YTD, only 2 out of these 5 stocks are in the green.

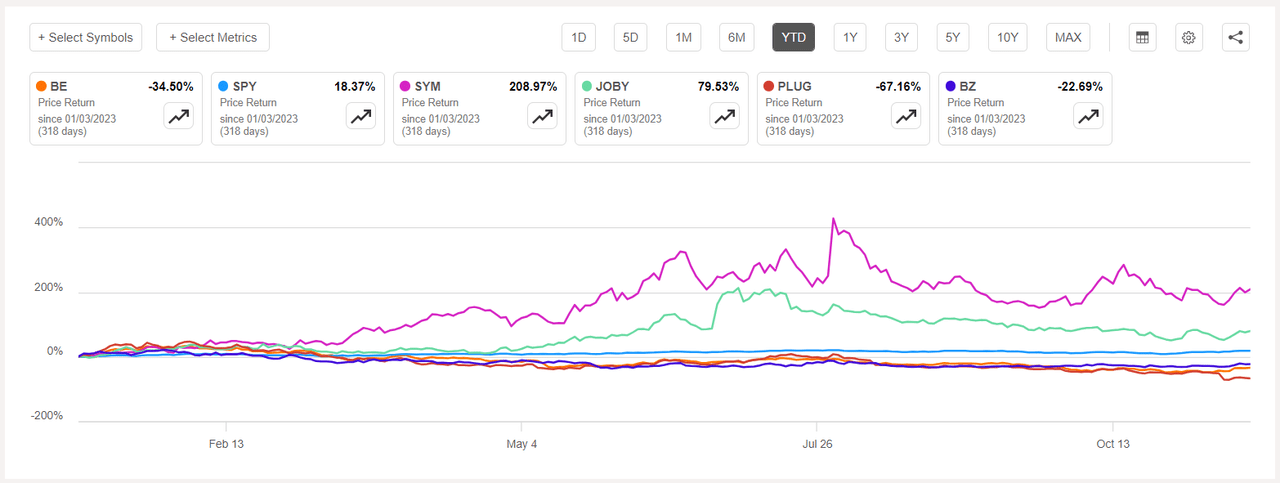

Bloom Energy (NYSE:BE) +19.26%. The San Jose, Calif.-based company rose +16.40% on Tuesday, and was among alternative energy stocks which gained after the latest U.S. inflation data raised hopes that the Federal Reserve was nearing an end to its rate-hiking campaign.

Bloom has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Sell. The stock has a factor grade of D- for Profitability and A+ for Growth. The average Wall Street Analysts’ Rating disagrees and has Buy rating, wherein 9 out of 25 analysts tag the stock as Strong Buy. YTD, -34.26%.

Symbotic (SYM) +18.55%. Shares of the company, which provides warehouse automation systems, leapfrogged from the decliners list it found itself in last week to land a spot among the gainers, with the most gains on Tuesday (+8.20%). The shares have made it to our gainers and losers list several times; and YTD, the stock has rocketed +211.56%, the most among this week’s top five gainers for this period.

The SA Quant Rating on SYM is Hold with score of A+ for Momentum and D for Valuation. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 8 out of 14 analysts tag the stock as Strong Buy.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Joby Aviation (JOBY) +18.80%. The electric air-taxi maker’s stock also swapped places from the losers’ list from last week. YTD, the stock has soared +83.28%.

The SA Quant Rating on JOBY is Hold with score of B+ for Momentum and D- for Profitability. The average Wall Street Analysts’ Rating concurs with a Hold rating of its own, wherein 2 out of 7 analysts view the stock as such.

Plug Power (PLUG) +13.31%. The Latham, N.Y.-based company’s shares were among the alternative energy stocks which rose on Tuesday (+21.90% for Plug). However, YTD, the stock has slumped -67.66%, the most among this week’s top five for this period. The SA Quant Rating on PLUG is Strong Sell which is in stark contrast to the average Wall Street Analysts’ Rating of Buy.

Kanzhun (BZ) +11.97%. The Chinese online recruitment platform’s Q3 results beat estimates on Tuesday sending the stock up +5.19%. The stock rose even higher the following day +7.21%. The SA Quant Rating on BZ is Hold, which differs from the average Wall Street Analysts’ Rating of Buy. YTD, BZ -18.70%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -3% each. YTD, 2 out of these 5 stocks are in the red.

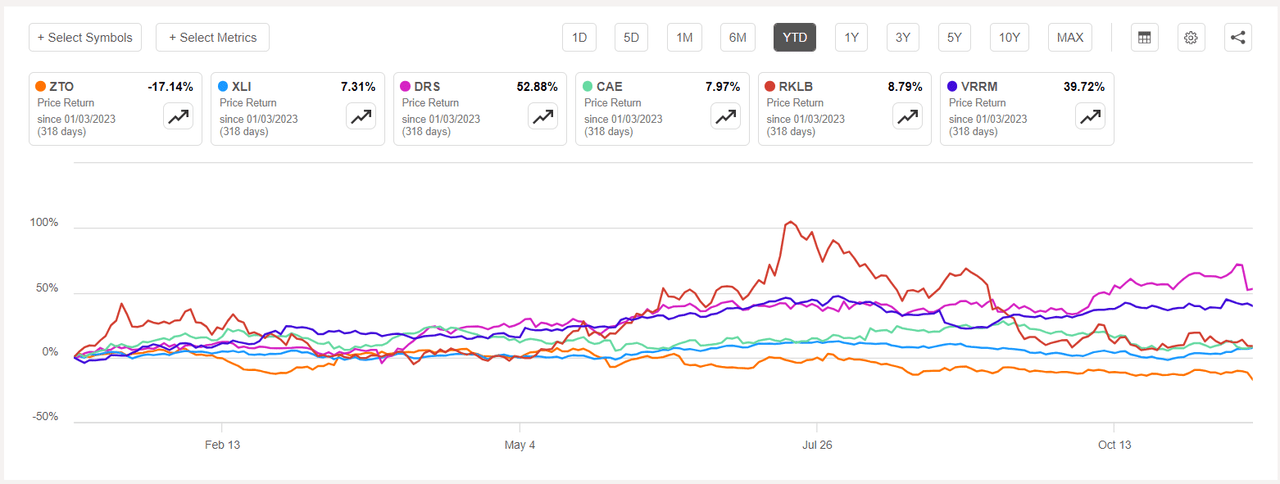

ZTO Express (NYSE:ZTO) -6.51%. The Chinese logistics services provider’s stock fell the most on Friday (-6.20%) after mixed Q3 results post market on Thursday. YTD, the stock has fallen -14.98%, the most among this week’s top five decliners for this period.

The SA Quant Rating on ZTO is Buy with a factor grade of B for Profitability and C for Momentum. The rating is in stark contrast to the average Wall Street Analysts’ Rating of Strong Buy, wherein 14 out of 19 analysts view the stock as Strong Buy.

Leonardo DRS (DRS) -6.26%. The Arlington, Va.-based defense electronic system maker’s stock tumbled -11.21% on Thursday after the company announced (post market Wednesday) the start a secondary offering of 16.5M common shares by a selling shareholder Leonardo US Holding, a subsidiary of Leonardo S.p.A.

The average Wall Street Analysts’ Rating on DRS is Strong Buy, wherein 3 out of 4 analysts tag the stock as such. YTD, the stock has soared +45.23%, the most among this week’s top five decliners for this period.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

CAE (CAE) -3.76%. The Canadian aero-defence company, which provides simulation training services, saw its stock dip -3.88% on Tuesday following its second quarter results. YTD, +8.63%.

Rocket Lab USA (RKLB) -3.66%. The space company’s stock dipped the most on Thursday (-4.09%). YTD, +11.67%. The SA Quant Rating on RKLB is Hold with score of D- for Profitability and B- for Growth. The average Wall Street Analysts’ Rating differs and has a Buy rating, wherein 5 out of 9 analysts view the stock as Strong Buy.

Verra Mobility (VRRM) -3.52%. The Mesa, Ariz.-based company has a SA Quant Rating of Strong Buy, while the average Wall Street Analysts’ Rating is Buy. YTD, the shares have risen +44.47%.