Bitcoin is trading near $102,930, down from last month’s $115,000 high, as long-term holders, some dating back to Bitcoin’s earliest days, begin unloading their coins. 2025 has now become the most active year for “Satoshi-era” wallet movements, signaling a historic shift in holder behavior and market psychology.

Early Whales Trigger Market Anxiety

Blockchain data reveals several wallets from the 1990s transferring thousands of Bitcoin in recent weeks. A notable case involved an early miner moving 3,500 BTC, worth $361 million, followed by similar sales totaling more than $1 billion.

These sell-offs may weaken near-term support around $105,000–$106,000, already a key technical ceiling.

Market strategist Ted Pillows pointed out that despite $530 million in ETF inflows, Bitcoin still dropped—evidence that whale selling is overpowering institutional demand. He cautioned that without a strong recovery above $108,000, BTC could revisit the $99,000–$100,000 range.

- Whale transactions from 2010–2012 wallets exceeded $2 billion in October alone.

- ETF inflows remain positive, but market liquidity is thinning around $103K.

- On-chain activity suggests redistribution, not panic selling.

Long-Term Holders Shift Focus

Erik Voorhees, founder of ShapeShift and early Bitcoin investor, explained that veteran holders aren’t motivated by short-term gains. “They don’t view $100,000 as significant. Bitcoin is the asset they measure value in,” he said.

For these early adopters, BTC’s utility as a decentralized financial system outweighs its temporary price fluctuations.

Voorhees added that not every old-wallet movement represents selling; some may reflect custody restructuring or long-term storage updates, often misinterpreted by analysts tracking whale behavior.

Bitcoin Price Forecast: BTC Eyes Breakout Above $103K as Triangle Pattern Tightens

While selling from early holders adds short-term pressure, it also signals maturity in the Bitcoin market. These long-dormant coins are finding new owners, potentially through ETFs or institutional channels, broadening market depth.

As the technical picture tightens within a symmetrical triangle near $103,000, traders are watching for a breakout toward $107,500 or a pullback toward $99,200. Yet many analysts see this as a natural phase of redistribution before Bitcoin’s next expansion cycle.

If momentum aligns with improving liquidity and renewed ETF demand, Bitcoin could retest $116,000 by year-end, reaffirming its long-term bullish structure.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

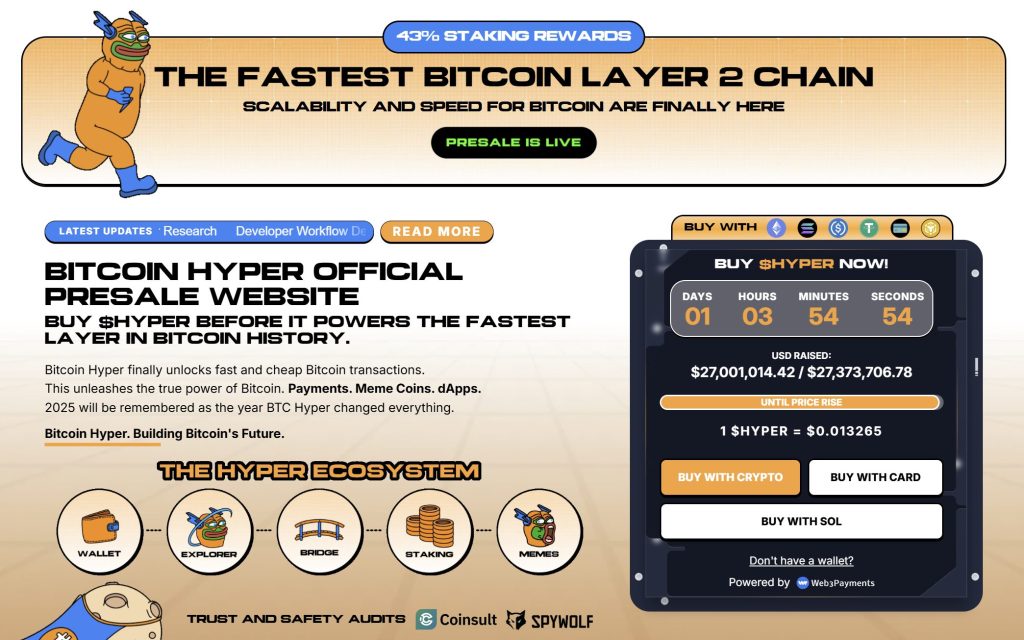

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.

Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $27 million, with tokens priced at just $0.013265 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Why Early Bitcoin Millionaires Are Suddenly Selling – And What It Means for The Whole Crypto Market appeared first on Cryptonews.