Japan’s central bank is scheduled to hold its Monetary Policy Meeting (MPM) on December 18–19, 2025, with markets anticipating a possible rate hike to 0.75% from 0.5%, a move that could flip the global risk trade and significantly impact the Bitcoin price prediction outlook.

Japan’s Rate Hike Is Risky For Bitcoin

Analysts view the potential rate hike as ending the “Carry Trade” era.

Higher rates make yen assets more appealing, prompting investors to pull capital from overseas holdings like crypto.

This strengthens the yen, raises borrowing costs worldwide, and dampens Bitcoin speculation, historically causing 20-30% price drops.

Macro investor Afsheen Jafry explained that while markets focus on Powell and the Fed, the BOJ actually controls something more fundamental: global liquidity flows.

“When the BOJ tightens, capital floods back to Japan. When they ease, it floods out, and crypto is always first in line to catch that overflow,” she noted.

She cited July 2024 when the BOJ’s rate increase triggered a massive selloff, crushing Bitcoin from $73,000 to $53,000.

“That wasn’t random. That was carry trade unwinding on a massive scale.”

The BOJ also holds roughly ¥83 trillion ($534 billion) in ETFs accumulated since 2010, representing 7-8% of Japan’s ETF market.

Reports indicate officials plan gradual sales of these ETFs starting in January 2026.

These sales would reverse years of liquidity injections, potentially pressuring Japanese stocks and reducing global risk appetite.

Bitcoin Price Prediction: Defending $80K Support Critical for Price Recovery

Bitcoin is holding firm above the $80,000 level after November’s sharp drop, showing buyers are defending this key support that has held since late 2024.

The recent push toward the upper $80,000s hints at early signs of recovery, but BTC remains trapped below the critical $100,000 to $109,000 resistance zone.

Breaking through this range could flip momentum and confirm a true reversal. Otherwise, this bounce may fade.

RSI has climbed from oversold levels into the mid-40s, signaling that selling pressure is cooling, though upside momentum is not yet convincing.

If Bitcoin keeps holding $80,000, a retest of $100,000 is likely, with $109,000 as the next target. On the flip side, a breakdown could send BTC sliding toward the $62,000 to $71,000 demand zone.

As Bitcoin prepares for its next move, traders are pouring millions of dollars into presales, investing in meme coins before they list on exchanges.

Don’t Miss Out on One of the Hottest Meme Presales Right Now

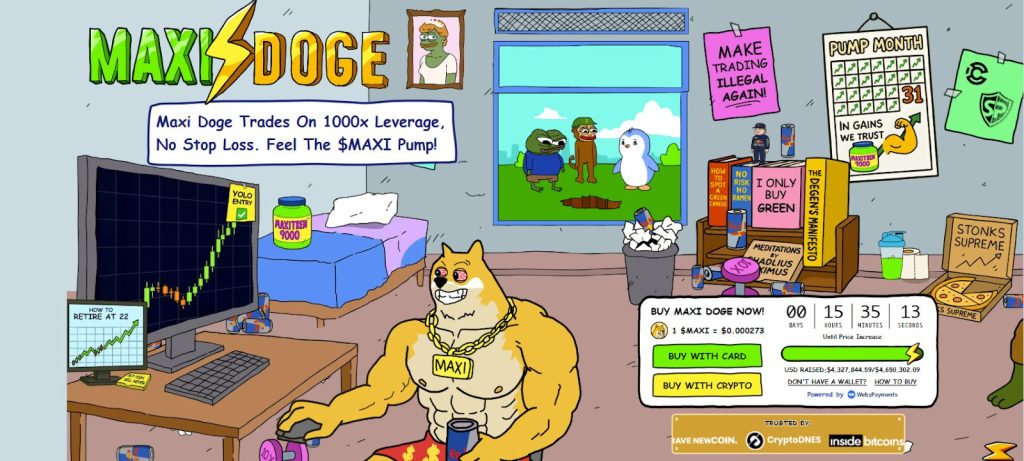

Maxi Doge ($MAXI) has quickly become one of the most talked‑about presales in crypto, gathering millions in early support and standing out in a crowded meme coin market.

This is not just another token, it’s a high‑energy community‑driven play built for traders who want early exposure before listings hit major exchanges.

The MAXI presale has established an alpha channel where traders exchange tips, early trade ideas, and hidden opportunities to capitalize on the upcoming bull run.

Traders are already comparing $MAXI’s momentum to Dogecoin’s early days, with strong social engagement and visibility rising fast.

To get involved before the next price increase:

- Visit the official Maxi Doge presale site

- Connect any compatible wallet, or download Best Wallet if you need one

- Buy using crypto like USDT or ETH, or use a bank card in just a few clicks

Visit the Official Maxi Doge Website Here

The post Bitcoin Price Prediction: Japan’s Next Rate Hike Could Flip the Global Risk Trade – Is Bitcoin the Big Winner? appeared first on Cryptonews.

The Bank of Japan is expected to raise rates to 0.75%, a level not seen since 1995, and

The Bank of Japan is expected to raise rates to 0.75%, a level not seen since 1995, and

During the last 3 BOJ rate hikes, BTC drops 20%+…

During the last 3 BOJ rate hikes, BTC drops 20%+…