Bitcoin is trading at around $96,466, a modest rebound but still far from the highs seen earlier this year. The market’s concern now centers on a single chart: the rising average purchase cost of spot Bitcoin ETF inflows.

According to data highlighted by Jim Bianco of Bianco Research, the $59 billion that has flowed into the first ten spot Bitcoin ETFs since January 2024 now carries an average cost basis of $90,146. With Bitcoin trading only slightly above that level, aggregate unrealized profits have shrunk to roughly $2.94 billion, or 4.7%.

Bianco argues this matters for one reason: if ETF buyers turn net sellers, liquidity could thin quickly. His point is blunt, money market funds would have generated larger gains over the same 22-month period, raising questions about Bitcoin’s performance relative to traditional assets.

2025 Performance Lag Raises Concerns

So far, 2025 has been challenging for the broader crypto market. Bitcoin opened the year at $93,463, slipped below that level last week, and is now up only 2.6% year-to-date. Ethereum has fared worse, dropping 3.7% since January after starting the year at $3,331.

ETF behavior adds another layer of stress. One trading session alone saw $869.9 million in net outflows, amplifying the selloff and pushing the Crypto Fear & Greed Index to one of its lowest readings of the year.

The chart shared by Bianco shows this shift clearly: unrealized ETF profits peaked near $23.9 billion on October 6, 2025, before collapsing to $7.8 billion in November.

Voices of Optimism Remain

Not everyone shares the pessimism. Bitwise CEO Hunter Horsley told CNBC he views current levels as a “reasonable entry point,” arguing Bitcoin continues to gain market share from gold.

Michael Saylor echoed similar confidence, saying that his firm remains sound even if Bitcoin dropped 80%, pointing to its five-year average annual return of 50%, outperforming major asset classes.

Bitcoin Price Forecast – Technical Outlook

Bitcoin price prediction is slightly bullish as BTC is attempting to stabilize after breaking below a long-term ascending trendline, a structural shift that still favors sellers. The price is holding above the $94,500–$92,000 demand area, but repeated failures to reclaim the 20-EMA show recovery attempts are fragile.

The RSI at 34 reflects weakening momentum with no bullish divergence in sight. A daily close below $92,000 opens a path toward $91,600, then $83,000. A reclaim of $103,000 with a bullish engulfing candle shifts momentum toward $106,700.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

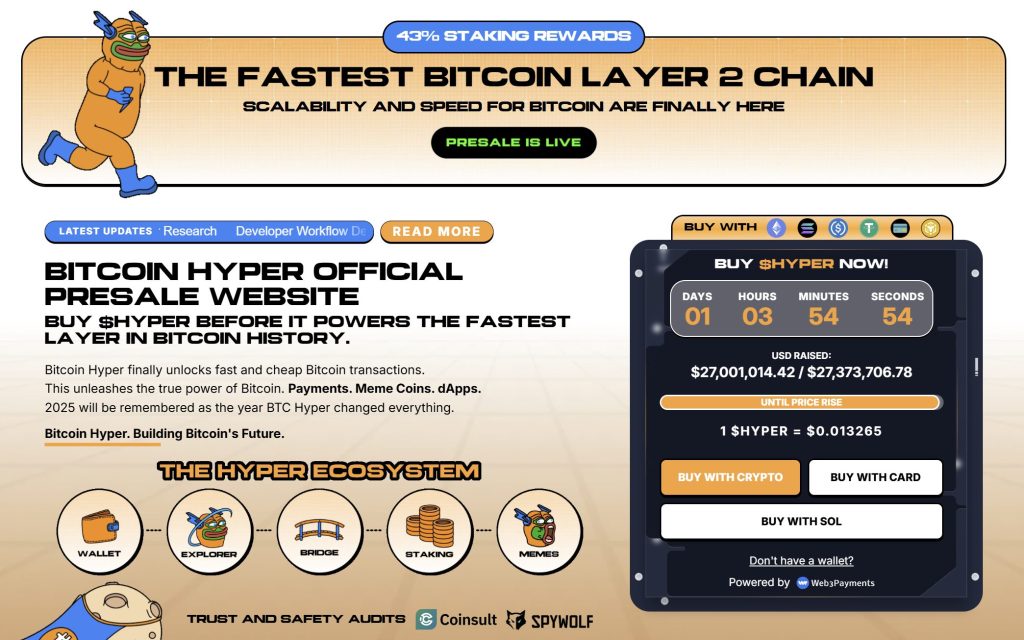

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $27 million, with tokens priced at just $0.013265 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: BTC Liquidity Crisis Looms? Bianco Ties 2025 Performance to This Key Chart Metric appeared first on Cryptonews.