Canaan’s stock surged on Tuesday after the Bitcoin mining chipmaker delivered its strongest quarterly performance in years, posting a 104% jump in revenue and a return to positive gross profit despite a steep downturn in the broader crypto market.

The rally sent shares of Canaan up roughly 16% by mid-morning, briefly approaching the $1 mark, according to Yahoo Finance.

The bounce comes even as the stock remains more than 53% below its nine-month high near $2, a period that coincided with Bitcoin trading above $126,000. Bitcoin has fallen about 26% since then.

Canaan Surges to $150M Q3 Revenue on Strong Miner Sales and Peak Self-Mining Output

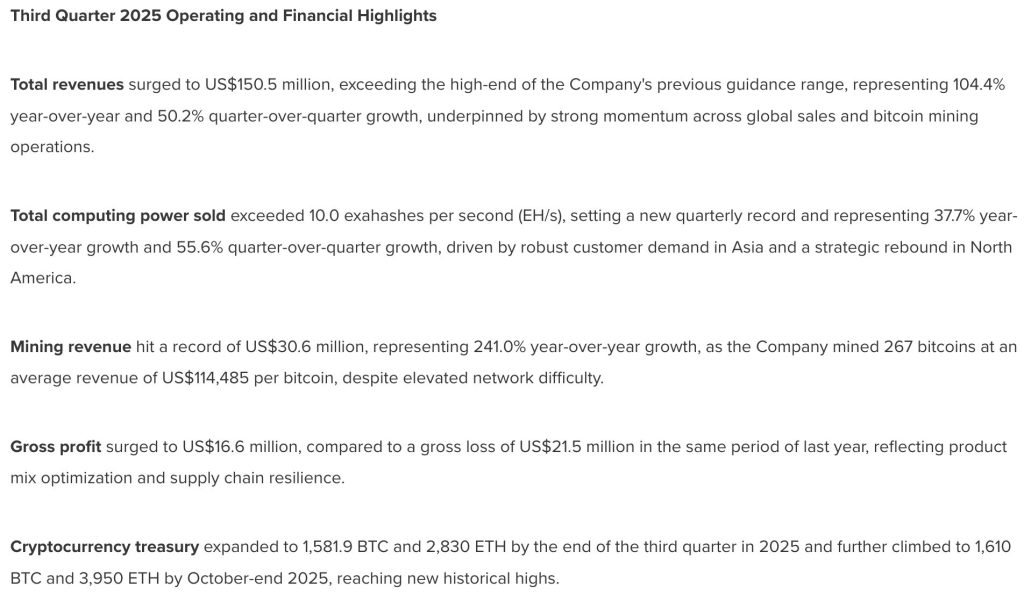

The Singapore-based manufacturer reported $150.5 million in revenue for the third quarter, exceeding its own guidance and marking a 50% increase from the previous quarter.

The results were fueled by a sharp rise in mining machine sales and record self-mining output. Canaan sold more than 10 exahashes per second of computing power in the quarter, a new company record, and expanded its self-mining capacity to 9.3 EH/s.

Mining revenue climbed to an all-time high of $30.6 million after the firm mined 267 BTC at an average revenue of $114,485 per coin, even as network difficulty remained elevated.

Product sales totaled $118.6 million. Canaan’s gross profit reached $16.6 million, reversing a $21.5 million loss in the same period a year earlier.

The improvement was driven by stronger pricing, a better product mix, and lower inventory write-downs.

Despite the strong operational turnaround, the company still posted a net loss of $27.7 million. Operating expenses rose, and several non-cash valuation adjustments weighed on the bottom line.

Canaan also reported record-high crypto holdings, ending September with 1,582 BTC and 2,830 ETH. By the end of October, its stash grew to 1,610 BTC and 3,950 ETH, valued at more than $161 million at recent market prices.

The earnings report extends a series of operational developments for Canaan.

The company recently fulfilled a 50,000-unit order of its Avalon A15 Pro miners for a U.S. customer, its largest sale in three years, and began a gas-to-compute pilot in Alberta, Canada, converting stranded natural gas into power for mining and high-density compute workloads.

In late October, Canaan rolled out its next-generation Avalon A16 series and guided fourth-quarter revenue to a range of $175 million to $205 million, citing continued demand from North America and Asia.

Canaan Ramps Up Mining Focus After Shutting AI Unit, Lands $72M Strategic Backing

The strong quarter comes during a period of strategic shifts. Earlier this year, Canaan shut down its AI semiconductor division after the unit generated just $900,000 in revenue in 2024 while accounting for 15% of operating expenses.

The company said the division no longer aligned with its long-term plans, and it has since doubled down on its core Bitcoin mining business.

Canaan also launched its first U.S.-based production run, replicating its Malaysian operations as part of a push to reduce exposure to tariffs and shorten delivery times for North American buyers.

The company’s efforts have unfolded as several major U.S. miners report robust results of their own.

HIVE Digital Technologies recently posted record quarterly revenue of $87.3 million, a 285% increase from last year, driven by its expanded Bitcoin operations and high-performance computing unit.

TeraWulf also reported an 87% revenue jump to $50.6 million in the third quarter, supported by higher Bitcoin prices and additional income from AI-focused hosting services.

Meanwhile, Greenidge Generation’s stock spiked more than 30% last week after the miner secured a long-awaited air permit renewal from New York State, clearing a major regulatory hurdle.

Canaan added another milestone earlier this month, announcing a $72 million strategic investment led by BH Digital, Galaxy Digital, and Weiss Asset Management.

The deal, structured as an equity purchase without warrants or derivatives, closed on November 6 and will add around 63.7 million American depositary shares to institutional ownership.

The post Bitcoin Miner Canaan Soars 16% After Shock 104% Revenue Spike, Defying Bitcoin’s Crash appeared first on Cryptonews.