Bitfarms, a major North American publicly traded Bitcoin miner, is officially preparing to leave the mining business behind.

The company announced Thursday that it will wind down its Bitcoin operations over 2026 and 2027 after posting a steep $46 million loss in the third quarter, nearly double its $24 million loss during the same period last year.

Bitcoin mining firms across the U.S. and Canada have been rushing to capture the booming demand for AI compute, but Bitfarms has become the first major player to openly say it plans to abandon Bitcoin mining entirely.

The company will now focus on high-performance computing and AI infrastructure.

Bitfarms Abandons Bitcoin Mining Following Deep Losses, Shifts to AI Infrastructure

The company detailed its transition plans alongside earnings, revealing that its 18-megawatt facility in Washington State will become the first Bitfarms site fully converted to support HPC and AI workloads.

The facility is expected to run up to 190 kilowatts per rack, use advanced liquid cooling, and support validated designs optimized for Nvidia’s next-generation GB300 GPUs.

Bitfarms said it has already signed a fully funded $128 million binding agreement with an American infrastructure provider for IT equipment and materials for the conversion.

The company expects the site to be completed by December 2026, operating at an industry-leading power usage effectiveness (PuE) between 1.2 and 1.3.

CEO Ben Gagnon said the Washington facility represents less than 1% of Bitfarms’ total developable portfolio but could still generate more income than the company has ever earned from Bitcoin mining.

With nearly $1 billion in liquidity, the company plans to pursue a GPU-as-a-Service model, which could serve as the financial foundation as Bitcoin revenues decline.

Bitfarms currently operates 12 data centers across North America with 341 megawatts of installed capacity and a 1.3-gigawatt development pipeline.

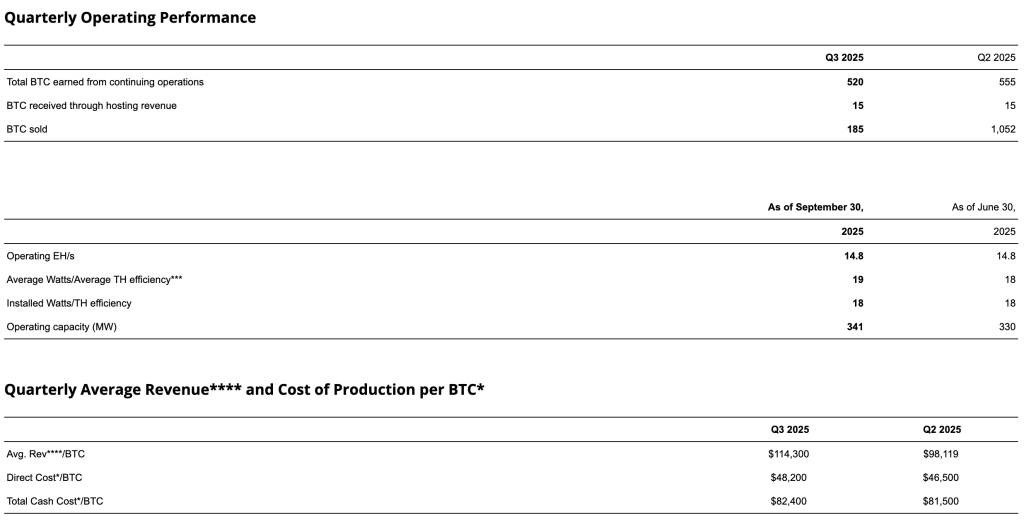

Despite confidence in its shift to AI, the company’s Q3 results highlight the financial strain of mining in 2025.

Revenue rose 156% year-over-year to $69 million, though still below analyst expectations, while the company mined 520 BTC during the quarter at an average direct cost of $48,200.

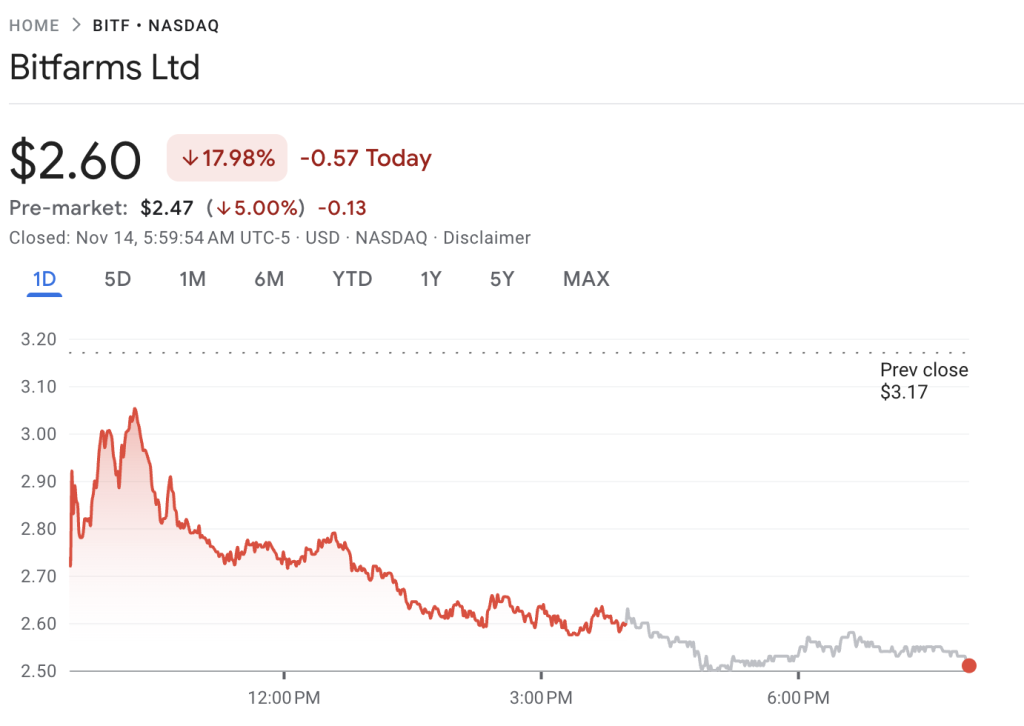

According to Bitcoin treasury data, Bitfarms held 1,827 BTC as of Wednesday. Shares of Bitfarms (BITF) fell sharply following the announcement, dropping nearly 18% to $2.60 on Thursday and slipping further in after-hours trading.

The stock is now down more than 51% over the last month.

Under Financial Scrutiny, Bitfarms Upsizes Debt Deal and Joins Mining Industry’s AI Pivot

The transition is unfolding during a period of turbulence for the company.

Earlier in the year, Bitfarms disclosed accounting errors in its 2022 and 2023 reports, prompting a proposed investor class action alleging weaknesses in its financial reporting controls.

The company also expanded a major debt financing deal in October, upsizing a planned convertible note sale from $300 million to $500 million due to strong investor demand.

The notes, maturing in 2031, carry a 30% premium conversion price at $6.86 per share.

The broader mining sector is also shifting. Marathon Digital recently announced it would expand into AI compute alongside record revenue.

IREN signed a multiyear $9.7 billion AI compute deal with Microsoft, giving the tech giant access to its infrastructure.

These moves reflect the rising view that AI offers higher margins, steadier demand, and fewer regulatory uncertainties than Bitcoin mining.

Bitfarms’ pivot also comes during a volatile period for the cryptocurrency itself.

Source: Cryptonews

Bitcoin fell nearly 3% over the last 24 hours to $99,441, its lowest level in six months.

Corporate accumulation also slowed significantly in October, with public and private companies adding only 14,447 BTC, the smallest monthly increase of 2025.

Even the largest treasury holder, Michael Saylor’s Strategy, saw its dominance fall from 75% to 60% amid slower purchases and rising competition from firms like Metaplanet and Coinbase.

The post Bitcoin Miner Bitfarms Ditches BTC for AI After Shocking $46M Loss appeared first on Cryptonews.