Bitcoin has slipped below $95,000 this week after retreating from recent highs near $98,000, yet institutional demand signals are flashing their strongest readings in months as U.S. spot ETF inflows surge beyond statistical extremes.

Despite the price pullback, on-chain data shows tightening sell-side pressure and renewed accumulation, suggesting whales may be loading up during the consolidation.

Glassnode’s latest market pulse confirms that Bitcoin remains in a consolidation phase rather than in a trend deterioration, with the 14-day RSI cooling from 63.6 to 61.0 while remaining above neutral territory.

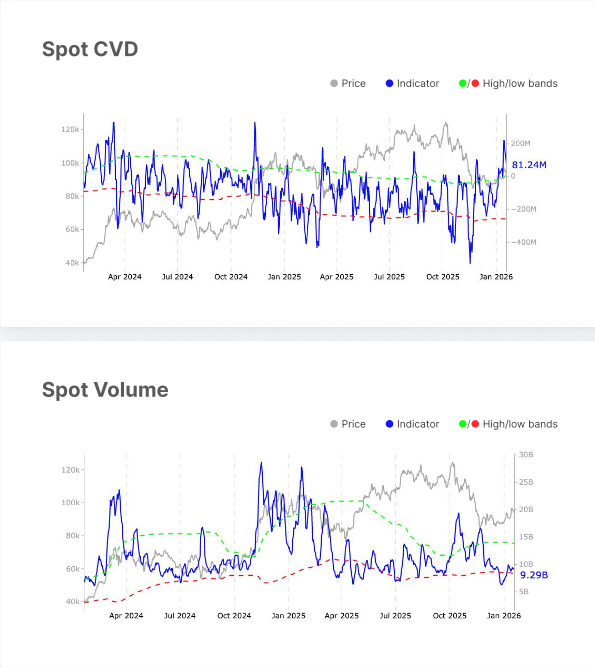

Spot trading volume climbed modestly from $8.8 billion to $9.3 billion, accompanied by a dramatic shift in net buy-sell imbalance that broke above its upper statistical band, soaring from -$4.6 million to $81.2 million, a 1,877% increase indicating an aggressive reduction in sell-side pressure.

ETF Demand Reaches Statistical Extremes

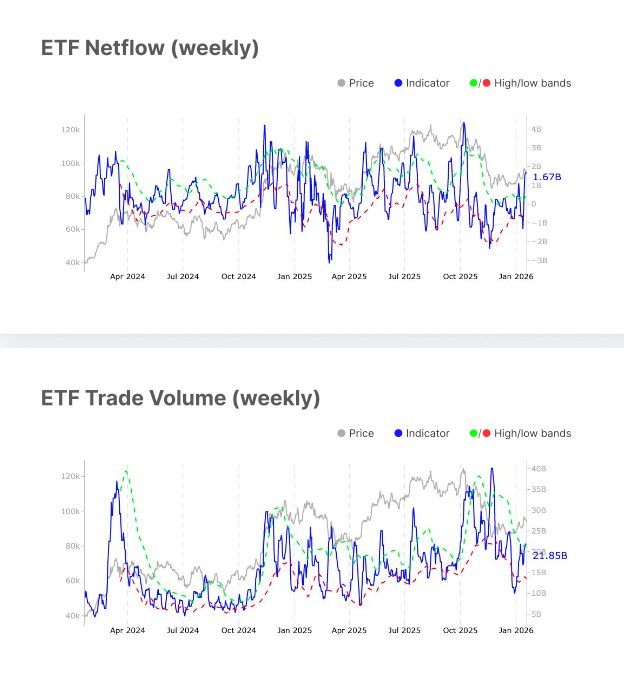

U.S. spot Bitcoin ETF flows executed a sharp reversal last week, swinging from $1.3 billion in outflows to $1.7 billion in inflows and pushing activity well beyond statistical norms.

The extreme reading indicates renewed institutional accumulation, with weekly ETF trading volume surging from $16.8 billion to $21.8 billion and both metrics sitting above their historical ranges.

BlackRock’s IBIT dominated the inflow surge, capturing $1.035 billion during the January 12–16 trading week and accounting for nearly three-quarters of total Bitcoin ETF demand.

CryptoQuant CEO Ki Young Ju confirmed the institutional accumulation trend, stating, “Institutional demand for Bitcoin remains strong.“

He noted that U.S. custody wallets (typically holding 100 to 1,000 BTC each) added 577,000 BTC worth $53 billion over the past year, with flows continuing into January despite price consolidation.

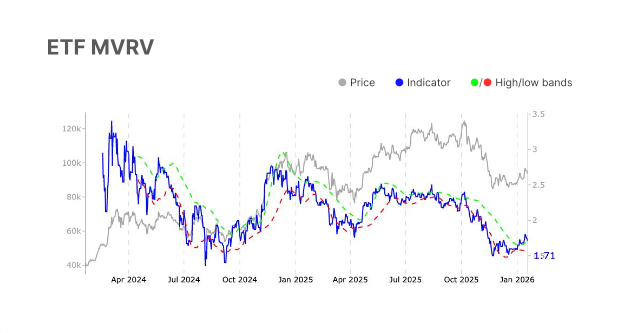

The ETF MVRV ratio edged up to 1.71, sitting just above its upper statistical band and indicating ETF holders remain comfortably in profit.

Glassnode analysts flagged this elevated profitability as introducing a mild near-term profit-taking risk, though overall sentiment remains constructive as institutions continue to build positions.

Mixed Derivatives Positioning Amid Cooling Leverage

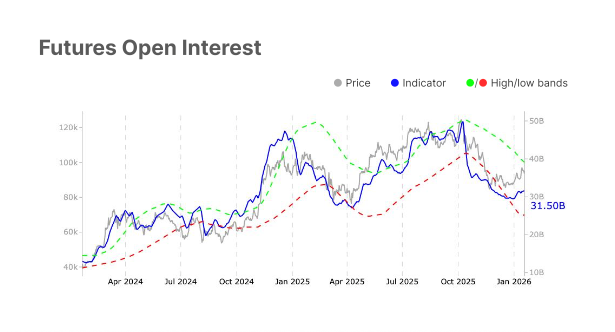

Futures markets sent mixed signals as open interest rose from $31.0 billion to $31.5 billion, reflecting what Glassnode analysts term as “cautious” rebuilding of speculative engagement.

Funding rates collapsed by 60.6%, from $1.5 million to $0.6 million daily, indicating sharply reduced long-side urgency and a more balanced positioning after recent exuberance.

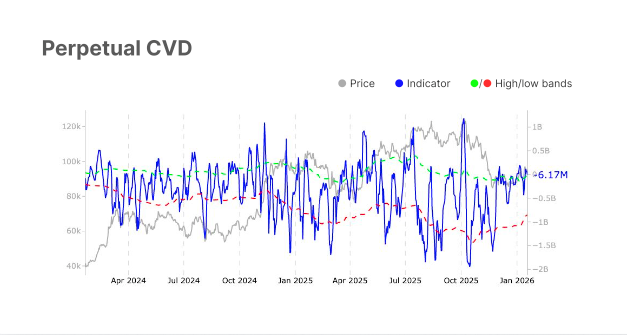

Perpetual cumulative volume delta improved from -$437.7 million to -$6.2 million, breaking above its upper statistical band.

Options markets continued to price elevated uncertainty, with open interest rising from $29.96 billion to $32.89 billion while the volatility spread widened from 42.8% to 44.6%, near the upper end of its historical range.

On-Chain Activity Stabilizes With Cautious Improvement

Fundamental blockchain metrics showed tentative recovery across multiple indicators.

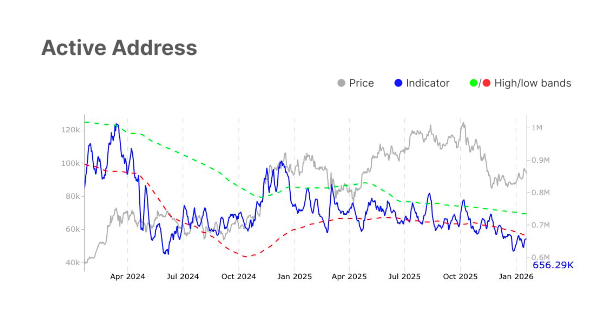

Active addresses increased 3.8% to 656,294, remaining below the lower statistical band but suggesting improving network engagement without speculative excess.

Entity-adjusted transfer volume rose 3.9% to $8.6 billion, maintaining balanced on-chain activity.

Bitcoin fee volume climbed 13.2% to $241,100, rising above the lower statistical band.

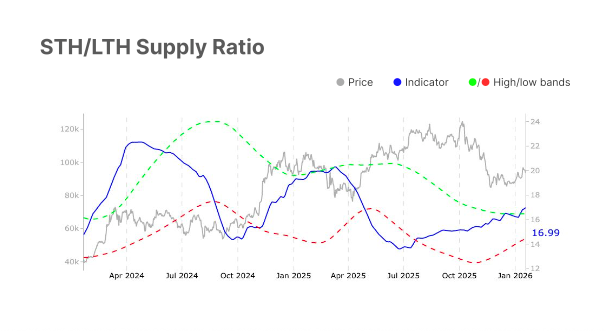

The short-term-to-long-term holder supply ratio also increased from 16.7% to 17.0%, moving above its upper statistical band amid growing trading activity alongside potentially higher volatility.

Realized cap change also improved from -0.3% to -0.1%, indicating stabilizing capital flows and easing sell-side pressure.

The percent of supply in profit rose from 70.6% to 75.1%, while net unrealized profit/loss improved from -8.1% to -3.8%, with both metrics indicating reduced market stress and recovering investor sentiment.

Ethereum ETFs particularly demonstrated strength in December, with Fidelity’s FETH attracting $59.25 million and Grayscale’s Ethereum Mini Trust adding $39.21 million, ranking among the top 10 U.S. ETPs by net inflows.

January flows accelerated further, with spot Ethereum ETFs capturing $479 million during the Jan. 12–16 week, led by BlackRock’s ETHA at $219 million.