Bitcoin exchange-traded funds (ETFs) bounced back sharply on September 24, recording $241 million in net inflows after two straight days of investor withdrawals, according to data from SoSoValue.

The turnaround comes after a combined $244 million in outflows on September 23 and a larger $439 million exit the day before, as markets adjusted to the Federal Reserve’s recent rate cut and awaited fresh U.S. inflation data.

Bitcoin ETF Holdings Near $150B After Strong Daily Inflows

BlackRock’s iShares Bitcoin Trust (IBIT) led yesterday’s inflows with $128.9 million, bringing its cumulative net inflows to $60.78 billion and total net assets to $87.2 billion.

Ark Invest and 21Shares’ ARKB followed with $37.7 million in net inflows, raising its historical total to $2.18 billion. Fidelity’s FBTC also attracted $29.7 million, while Bitwise’s BITB added $24.7 million.

Smaller inflows were recorded by VanEck’s HODL at $6.4 million and Grayscale’s BTC fund at $13.5 million.

In total, Bitcoin spot ETFs now hold $149.7 billion in assets, equal to 6.62% of Bitcoin’s total market capitalization.

Cumulative inflows have reached $57.49 billion, while daily trading volume on September 24 came in at $2.58 billion.

The renewed demand highlights the resilience of Bitcoin products following heavy redemptions earlier in the week. On September 23, Bitcoin ETFs lost $103.6 million, led by Fidelity’s FBTC with $75.6 million in outflows and ARKB with $27.9 million.

That followed an even steeper session on September 22, when Bitcoin funds shed $363 million, including $276.7 million from Fidelity’s FBTC alone.

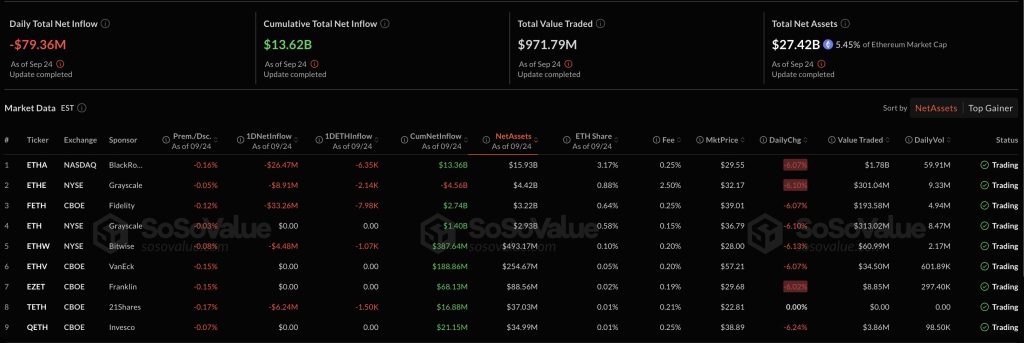

Ethereum ETFs, however, continued to see outflows. On September 24, ETH products recorded $79.4 million in net redemptions, extending a trend of sustained investor withdrawals.

Fidelity’s FETH saw the largest daily outflow at $33.2 million, followed by BlackRock’s ETHA with $26.5 million and Grayscale’s ETHE with $8.9 million.

Bitwise’s ETHW lost $4.5 million, while VanEck’s ETHV and Grayscale’s ETH fund reported no significant flows.

The redemptions build on heavy losses earlier in the week. On September 23, Ethereum ETFs saw $140.7 million in outflows, with Fidelity’s FETH leading at $63.4 million, followed by $36.4 million from Grayscale’s ETH product and $23.9 million from Bitwise’s ETHW.

A day earlier, on September 22, ETH funds posted $76 million in outflows, again led by Fidelity.

As of September 24, Ethereum spot ETFs hold $27.4 billion in assets, representing 5.45% of ETH’s total market value. Cumulative inflows now stand at $13.6 billion, despite the recent wave of redemptions.

Institutional Pause Weighs on Bitcoin—Armstrong Still Predicts $1M BTC

Institutional demand for Bitcoin has cooled after a strong start to September, with spot ETF inflows falling sharply.

According to Glassnode, net inflows dropped 54% last week to $931.4 million from $2.03 billion the week before.

Analysts said the slowdown points to a pause in institutional buying, even as overall accumulation remains intact.

Earlier this month, Bitcoin’s climb toward $118,000 was matched by heavy ETF inflows, including $741 million in a single day. But momentum has faded as retail traders continue selling.

CryptoQuant’s spot taker CVD indicator has remained sell-dominant since mid-August, raising concerns of a deeper correction into October if flows do not recover.

Bitcoin is currently trading below $110,600, down 6.9% in 24 hours.

Ethereum has also faced heavy pressure. Ether fell below $4,000 on Thursday, triggering a $36.4 million liquidation of one large position and contributing to a $331 million long squeeze in the past day, CoinGlass data shows.

Over the week, ETH traders have seen $718 million in long liquidations versus $79.6 million in shorts. The token is trading at $3,882, down 7.3% in 24 hours and 15% over the week.

Despite short-term weakness, optimism persists. Coinbase CEO Brian Armstrong said Bitcoin could reach $1 million by 2030, citing progress on U.S. legislation, potential government adoption, and rising institutional interest.

With ETF custody already concentrated in Coinbase, he argued that long-term fundamentals remain strong as supply tightens and sovereign demand potentially emerges.

The post Bitcoin ETFs Surge Back With Record $241M Inflows — ETH ETFs Still Bleeds appeared first on Cryptonews.