Bitcoin’s first meme-driven layer 2, Bitcoin Hyper, could soon prove to be one of the most explosive propositions from 2025’s burgeoning presale market.

Bitcoin (BTC) climbed past $117,000 on Wednesday after the U.S. Federal Reserve lowered interest rates by 0.25 points. For weeks, BTC had struggled to stay above $115,000 as traders waited for clarity from the FOMC meeting.

Now, with the market eyeing a return to its peak, investors believe an even bigger push will be needed to retest all-time highs. One contender is Bitcoin Hyper (HYPER), the fastest Bitcoin Layer-2 in development, which has already raised $16.5 million in its ongoing ICO.

Bitcoin Hyper is being billed as a potential new demand driver for BTC by creating an ecosystem where bitcoins can finally move beyond passive storage and into applications that were never possible on the base chain.

The current presale round offers HYPER at $0.012935 per token for the next 22 hours before the price moves to the next tier.

As Fed Policy Eases, Attention Turns to How Bitcoin Can Unlock New Utility

The Federal Open Market Committee (FOMC) voted to cut interest rates by 0.25 points, its first policy shift in months. Markets had largely priced in the move after a series of softer inflation prints and mounting pressure to ease financial conditions.

Fed officials also indicated that two more quarter-point cuts are likely this year, depending on how economic data unfolds.

In light of this, crypto markets saw a broad bump, with Bitcoin breaking above $117,000 as traders bet easier monetary policy could fuel the next leg higher. At its current price, BTC is only 5.7% away from its all-time high, and further cuts in the last quarter – historically Bitcoin’s strongest months – could set the stage for a new peak.

Yet, some analysts believe that rally could extend much further. BitMEX founder Arthur Hayes has suggested Bitcoin could hit $200,000 before the end of the year and argued in a recent interview with Kyle Chasse that the bull cycle is far from over and could potentially run well into next year.

To Hayes, liquidity created by currency debasement will inevitably flow into a hard asset like Bitcoin, reinforcing its role as a store of value.

However, the open question is whether rate cuts alone will be enough to push BTC toward his $200,000 target – or if additional sources of demand, such as Bitcoin’s expanding use in DeFi and other applications, will play a role.

That broader utility is what Bitcoin Hyper is aiming to unlock, potentially strengthening Bitcoin’s path higher while opening new opportunities of their own.

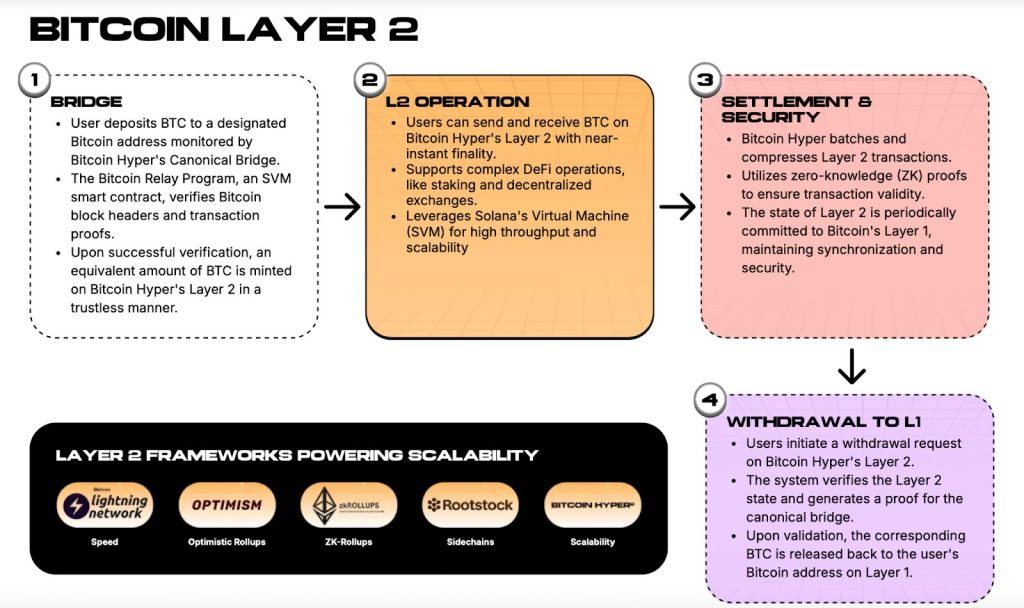

The Architecture of Bitcoin Hyper

Its team developed Bitcoin Hyper as Bitcoin’s fastest Layer-2, designed to make the network programmable at scale.

It achieves this by integrating the Solana Virtual Machine (SVM), the same execution layer that powers some of the fastest and most cost-efficient applications in crypto. This gives developers the ability to deploy high-performance dApps in Rust while still tying their activity back to Bitcoin.

Settlement remains anchored to Bitcoin through a canonical bridge, the sole entry point into the Hyper ecosystem. Users lock BTC into the bridge, which then mints an equivalent wrapped BTC inside the Layer-2.

That wrapped BTC becomes the medium of exchange across dApps, and when users want to exit, the wrapped version is burned and the original BTC is released back to them.

In practice, this design merges the best of both worlds: dApps running at Solana-grade speed and efficiency, while ultimate security and settlement remain secured by Bitcoin’s base layer – the most decentralized and immutable ledger in existence.

If Bitcoin Reaches $200K, How Much Will HYPER Be?

At its core, HYPER is the utility token of the Bitcoin Hyper network. It powers every transaction as gas, secures the chain through staking, and serves as the governance asset that shapes the Layer-2’s future.

Every dApp, stablecoin, lending protocol, or game deployed on Bitcoin Hyper will require HYPER to function – making it the medium of activity for Bitcoin’s programmable economy.

At its current presale price of $0.012935, HYPER carries a fully diluted valuation of about $272 million based on its 21 billion token supply.

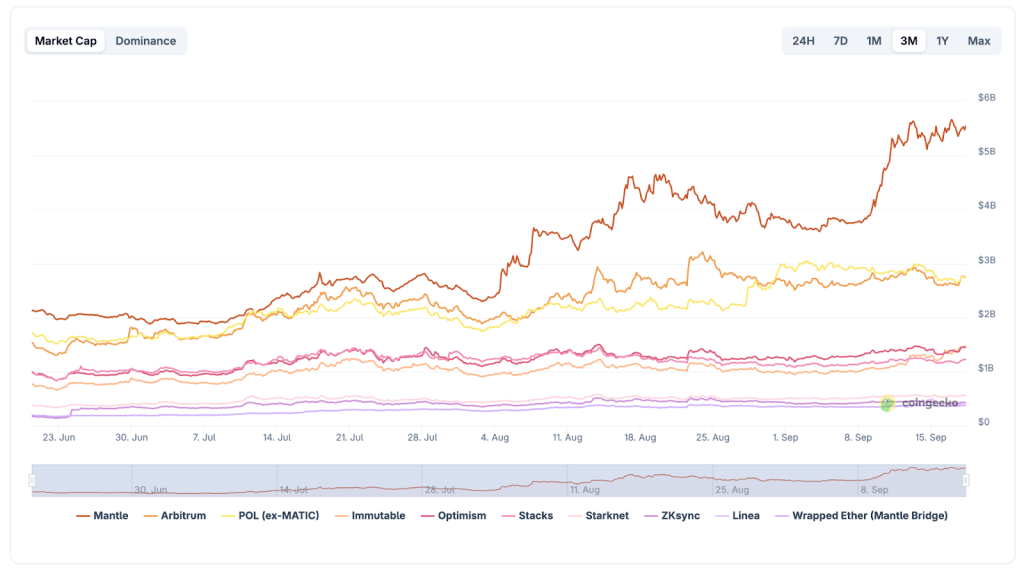

On the surface, that may sound sizable, but in the context of Layer-2 tokens it’s tiny. Ethereum’s leading Layer-2s command multi-billion valuations – Mantle (MNT) at around $5.5 billion, Arbitrum (ARB) at $2.7 billion, and Optimism (OP) at $1.4 billion.

Now layer in Bitcoin’s upside. If just 1% of BTC’s circulating supply, or about 195,000 BTC, were bridged into Hyper at a $200,000 Bitcoin price, that would represent nearly $39 billion of value circulating inside the ecosystem.

Against HYPER’s $272 million valuation today, that’s more than 140 times the locked value compared to the token’s market cap. Even if HYPER captured only a fraction of that – say a valuation in line with Ethereum’s L2 leaders – early buyers would be looking at multiples well beyond the presale entry price.

The Only Way to Ensure You Maximize HYPER Gains

The only way to avoid arriving too late is by securing HYPER while it’s still in presale. Right now, tokens are available at early-stage pricing, which is the perfect window to get tokens before major exchange listings drive valuations higher.

Investors can purchase HYPER directly through the Bitcoin Hyper website using SOL, ETH, USDT, USDC, BNB, or even a credit card.

The Bitcoin Hyper team recommends using a Web3 wallet like Best Wallet, one of the best crypto and Bitcoin wallets in the market. You can already find HYPER under Best Wallet’s “Upcoming Tokens” – making it easy to buy, track, and claim once live.

Join the Bitcoin Hyper community on Telegram and X to stay updated.

Visit the Official Website Here

The post Bitcoin Back at $117K After Rate Cut – Are the Buying Floodgates Opening as Bitcoin Hyper ICO Tops $16.5M? appeared first on Cryptonews.

THE BIG PRINTING HASN’T EVEN STARTED

THE BIG PRINTING HASN’T EVEN STARTED

(@kyle_chasse)

(@kyle_chasse)