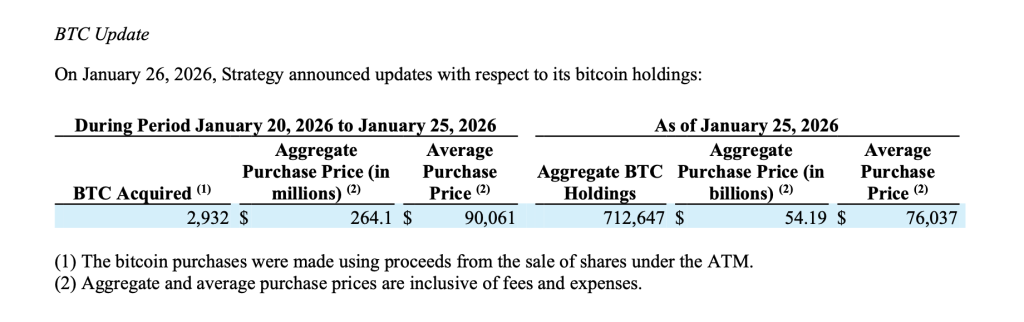

Michael Saylor’s Strategy has expanded its Bitcoin treasury again, acquiring an additional 2,932 BTC for approximately $264.1 million during the period from Jan. 20 to Jan. 25.

The company disclosed that the purchases were made at an average price of $90,061 per bitcoin, inclusive of fees and expenses.

The update reinforces Strategy’s position as the largest corporate holder of Bitcoin globally, continuing its multi-year accumulation strategy that has become central to its balance sheet approach.

Total Bitcoin Holdings Reach 712,647 BTC

Following the latest acquisition, Strategy reported that it now holds a total of 712,647 BTC as of Jan. 25.

The company said its aggregate Bitcoin purchases total roughly $54.19 billion, with an average acquisition price of $76,037 per bitcoin. The figures highlight the scale of Strategy’s long-term bet on Bitcoin as a treasury reserve asset, accumulated across multiple market cycles.

Strategy’s growing holdings show its belief that Bitcoin represents a superior store of value over time, particularly amid concerns around currency debasement and global macro uncertainty.

Strategy disclosed that the recent Bitcoin purchases were funded through proceeds generated from the sale of shares under its at-the-market offering program.

During the Jan. 20–25 period, the company sold approximately 1.57 million shares of its Class A common stock, generating net proceeds of about $257 million. Strategy also issued roughly 70,201 shares of its variable rate preferred stock, raising an additional $7 million.

In total, the company generated about $264 million in net proceeds, which were then deployed toward Bitcoin accumulation.

The disclosure also shows that Strategy retains significant remaining capacity for future issuances, including billions of dollars available across multiple stock and preferred equity programs.

Corporate Bitcoin Accumulation Continues Into 2026

Strategy’s continued purchases come as institutional adoption of Bitcoin remains a major theme entering 2026, with more companies exploring crypto as a long-term balance sheet asset.

The firm has consistently framed Bitcoin as a scarce, inflation-resistant reserve that can outperform cash and traditional holdings over extended time horizons. While the strategy remains controversial due to Bitcoin’s volatility, Strategy has maintained its commitment to accumulation even during periods of market weakness.

With over 712,000 BTC now on its balance sheet, Strategy’s exposure to Bitcoin price movements is unmatched among public companies, making it a key bellwether for corporate crypto adoption.

As the company continues leveraging equity issuance to fund purchases, investors will closely watch how its aggressive treasury strategy evolves alongside broader market conditions in 2026.