Michael Saylor, the billionaire co-founder and executive chairman of Strategy (formerly known as MicroStrategy), has disclosed another substantial Bitcoin acquisition worth over $500 million, continuing his company’s aggressive cryptocurrency accumulation strategy.

According to a June 30 filing with the U.S. Securities and Exchange Commission (SEC), Strategy purchased 4,980 Bitcoin for $531.1 million during the week ending Sunday, at an average price of approximately $106,801 per bitcoin.

Following this latest acquisition, MicroStrategy now holds 597,325 BTC valued at over $64 billion, purchased at an average cost of $70,982 per bitcoin for a total investment of approximately $42.4 billion, including associated fees and expenses.

MicroStrategy Now Controls 2.8% of All Bitcoin Ever Created

MicroStrategy’s Bitcoin holdings represent more than 2.8% of the cryptocurrency’s total supply cap of 21 million coins, generating unrealized gains of roughly $21.6 billion based on current market prices.

This year alone, MicroStrategy has accumulated 88,062 BTC worth $9.8 billion, compared to 140,538 BTC valued at $13 billion in 2024, according to company data.

The business intelligence firm’s Bitcoin yield has reached 19.7%, with 7.8% gained in the second quarter alone, moving closer to its targeted year-to-date yield goal of 25% by year-end 2025.

The purchases aligned with market expectations, as Saylor has developed a pattern of announcing Bitcoin acquisitions on Sundays through social media hints.

On June 29, Saylor updated his Bitcoin portfolio tracker with the message: “In 21 years, you’ll wish you’d bought more,” referencing his recent BTC Prague keynote presentation, in which he predicted that Bitcoin could reach $21 million per Bitcoin within two decades.

Bitcoin Treasury Shift: 134 Companies Now Following Saylor’s Playbook

Data from Bitcoin Treasuries indicates that 134 publicly traded companies have now incorporated Bitcoin into their corporate treasury strategies.

Recent adopters include Twenty One, Trump Media, and GameStop, following the model by Saylor and MicroStrategy.

Japanese investment firm Metaplanet announced on Monday that it acquired an additional 1,005 BTC, expanding its total holdings to 13,350 BTC.

Similarly, The Blockchain Group, described as Europe’s first Bitcoin treasury company, purchased 60 BTC, bringing its total to 1,788 BTC valued at approximately €161.3 million.

The trend has also gained momentum in the United Kingdom, where at least nine firms across various sectors, from web design startups to mining operations, announced Bitcoin purchase plans or disclosed recent acquisitions for their corporate treasuries during the past week.

Cryptocurrency exchanges are developing new products to capitalize on this corporate Bitcoin trend.

On June 28, Gemini launched a tokenized version of MicroStrategy (MSTR) stock for European Union investors, marking the exchange’s first tokenized equity offering in the region.

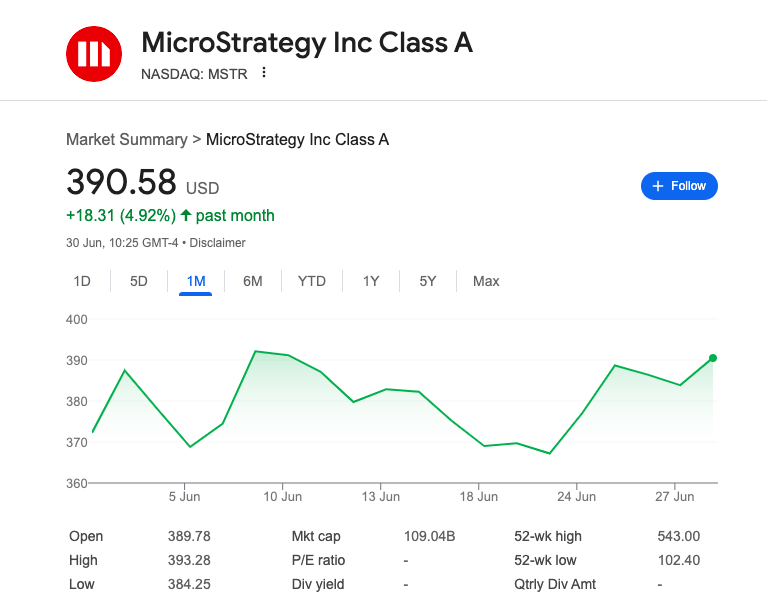

Strategy’s shares have responded positively to the Bitcoin accumulation, climbing 4.92% over the past month to trade at $390.58, according to Google Finance data.

Bitcoin Eyes $109K Breakout That Could Trigger $48.7M Liquidity Squeeze

Bitcoin experienced modest weekend gains, rising as much as 3% to reach $108,798 on Sunday, driven by the broader momentum in the cryptocurrency market.

Following the approach to the $108,000 level, traders, including Michael van de Poppe, founder of MN Capital, suggested that Bitcoin might experience a brief pullback before attempting to break through to new all-time highs.

Technical analysis indicates that $109,000 is a key resistance level on Bitcoin’s four-hour timeframe. “This is the area we need to break in order to have upward momentum,” van de Poppe noted.

Data from CoinGlass revealed concentrated trading interest around key price levels, with substantial bid activity below current prices and resistance clustering above $109,000.

Over $48.7 million in liquidity was positioned at $109,500.

If Bitcoin successfully breaks through liquidity levels between $110,000 and $112,300, the resulting short squeeze could push the cryptocurrency back into price discovery mode, potentially setting new record highs.

The post Billionaire Michael Saylor Announces New Bitcoin Purchase Worth $500 Million – What’s Going On? appeared first on Cryptonews.

The Blockchain Group has acquired 60 BTC for ~€5.5 million at ~€91,879 per bitcoin and has achieved BTC Yield of 1,270.7% YTD, 69.3% QTD. As of 6/30/2025,

The Blockchain Group has acquired 60 BTC for ~€5.5 million at ~€91,879 per bitcoin and has achieved BTC Yield of 1,270.7% YTD, 69.3% QTD. As of 6/30/2025,

London-listed companies are jumping on the Bitcoin bandwagon, aiming to boost share prices and mirror the success of Saylor’s Strategy.

London-listed companies are jumping on the Bitcoin bandwagon, aiming to boost share prices and mirror the success of Saylor’s Strategy.