Billionaire investor Ray Dalio is sounding the alarm once again and this time his recommendation is clear: allocate around 15% of your portfolio to Bitcoin (or gold) as a hedge against one of the most severe fiscal crises in U.S. history.

With national debt soaring beyond $37 trillion and currency devaluation becoming an ever-present concern, Dalio’s point cuts straight to the core of today’s macro risks.

If you’re looking to maintain a disciplined Bitcoin position over time, one tool stands out: Best Wallet (BEST).

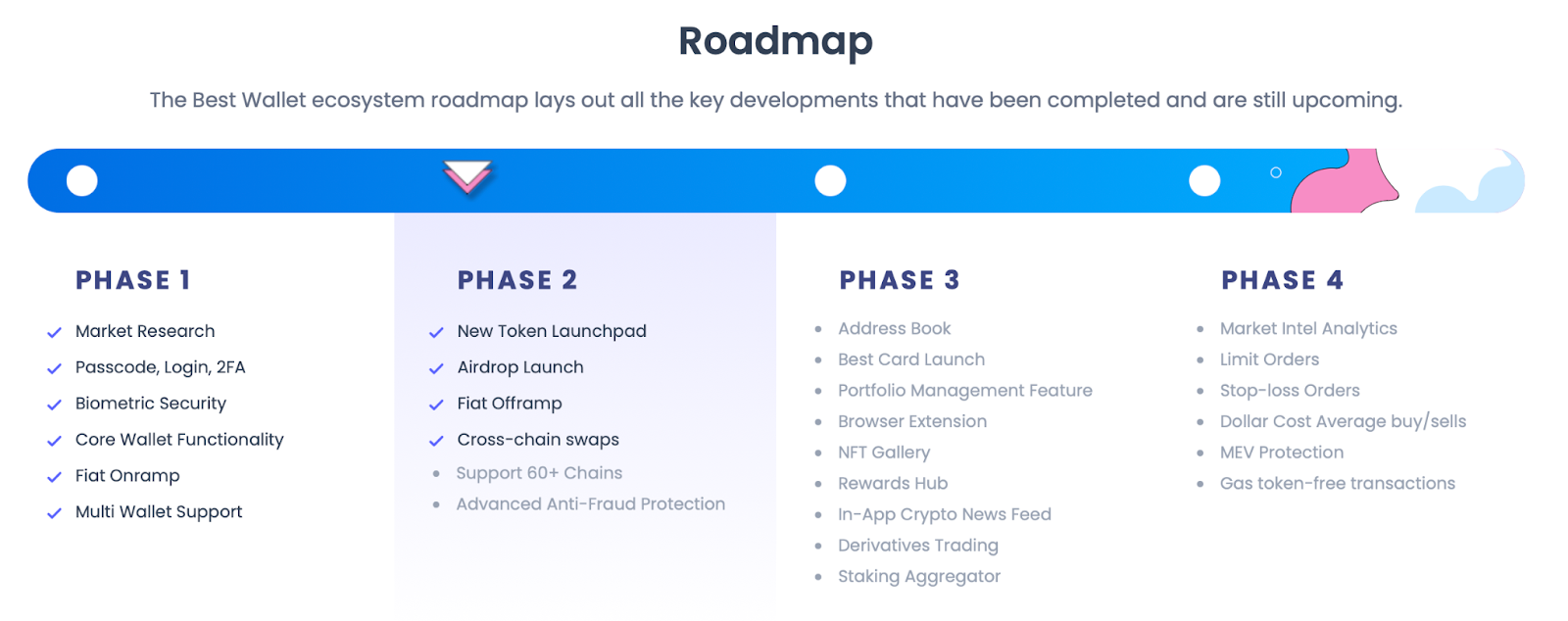

The leading Web3 wallet has bootstrapped over $14.3 million of early capital from investors recognizing its potential. Its roadmap includes features built specifically for long-term strategies, including one that perfectly aligns with Dalio’s BTC allocation advice.

The presale is ongoing, but only until the next funding phase. At $0.025365 per BEST token, this could be one of the final low-cost entry points before the price increases in under 34 hours as the next round kicks off.

Ray Dalio’s History of Accurate Market Calls Underscores His Bitcoin Hedge

Dalio, the former co-CIO of Bridgewater Associates, the largest hedge fund in the world, has a track record of getting big calls right.

He positioned his firm defensively before the 2008 financial crisis. He correctly warned of the Eurozone debt crisis, highlighting debt sustainability risks in Southern Europe, particularly Greece, Italy, and Spain. His concept of the “beautiful deleveraging” helped shape the broader debate around austerity and stimulus.

Through the 2010s, Dalio forecast an extended low-rate environment driven by central bank policy. He cautioned that excessive quantitative easing would debase fiat currencies over time, which is a key reason he turned bullish on gold, and later, on Bitcoin.

That money printing has only accelerated. U.S. M2 money supply has now surpassed $22 trillion. Over the same period, gold – the traditional hedge – climbed from around $1,096 per ounce to over $3,324.

Source: TradingView

But gold’s returns pale compared to Bitcoin. Over the last decade, BTC surged roughly 462,266,567% from its early price levels. And since 2020, it has gained an additional 16x, reaching a new all-time high just this month.

It’s no surprise Dalio has raised his suggested Bitcoin allocation to 15% (though he remains partial to gold). The Bitcoin narrative grows more compelling as a hedge against macroeconomic uncertainty, with strong tailwinds favoring hard-capped assets like BTC.

Institutional demand adds to this outlook. Heavy buy-side pressure suggests BTC’s price may have room to appreciate further.

The question for retail traders is: what’s the best way to follow Dalio’s advice and build and maintain a Bitcoin position? The answer is increasingly pointing toward Best Wallet.

Infrastructure Built for Bitcoin Accumulation and Long-Term Strategy

Best Wallet is quickly building a reputation as the leading crypto wallet, with features that align perfectly with today’s market demands.

Its transactional capabilities are powered by smart integrations with over 330 decentralized protocols and more than 30 cross-chain bridges, giving users access to deep liquidity and competitive pricing across multiple networks.

According to its roadmap, holding BEST tokens will also unlock gas token-free transactions. This design choice benefits both active traders and long-term holders by reducing costs and maximizing returns.

Onboarding has been made equally simple. With support for over 100 fiat currencies, even new users can easily convert traditional money to crypto, making BTC purchases straightforward through Best Wallet.

The upcoming Dollar Cost Averaging (DCA) feature is perhaps most relevant to long-term Bitcoin allocation. This tool, which will be launched in Phase 4 of its roadmap, will allow users to automatically invest incremental amounts into BTC at set intervals, smoothing out volatility over time.

Automated DCA removes the guesswork and emotional timing from investing, helping users steadily build exposure without the stress of short-term price swings.

By pairing automation with seamless onramps, Best Wallet makes disciplined Bitcoin accumulation easier than ever – exactly the approach that aligns with Dalio’s call for a sustained BTC position.

Best Wallet Adds TradFi Power to Its Web3 Ecosystem

Yet Best Wallet goes beyond crypto allocation. Part of its ongoing development focuses on integrating TradFi-style functionality directly into the wallet.

A key feature in this evolution will be Best Card, the upcoming debit card service that allows token holdings within the app to be used for real-world transactions.

That means if you’ve accumulated enough spare satoshis for your morning coffee, you can spend them instantly through Best Wallet in a fast, efficient, and seamless way.

The card also offers up to 8% cashback on purchases, with low-to-no fees for users holding BEST tokens.

Its attention to detail plus the consideration for real-world usability is part of why Best Wallet recently earned a WalletConnect certification, which testifies to its commitment to a smooth, reliable user experience across thousands of dApps.

Steady Accumulation Meets Alpha Opportunities in Best Wallet’s Upcoming Tokens

Aside from a strategic and disciplined Bitcoin accumulation, Best Wallet also caters to the high-beta opportunities in crypto. One feature in particular has become a favorite among its users for its track record of spotting early-stage projects with strong upside potential.

That feature is Upcoming Tokens. Designed to surface projects the team has identified as high-potential before exchange listings, it has consistently highlighted winners ahead of the market.

Its calls include Wall Street Pepe (WEPE), up 34.7% in the past two weeks, and Solaxy (SOLX), Solana’s first Layer-2 chain, which has climbed 34% in just the past week.

Past standouts include Pepe Unchained (PEPU), which peaked at a 700% gain, Catslap (SLAP), which delivered returns exceeding 7,000%, and BTC Bull (BTCBULL), which saw a 112% return for many Best Wallet users who explored the project in Upcoming Tokens.

For users seeking more than long-term BTC strategies, Upcoming Tokens provides a way to capture potential alpha in high-performing early projects.

Taken together, Best Wallet delivers a complete suite of features, combining stable, disciplined strategies with high-reward opportunities, all while building toward real-world utility through upcoming features like Best Card.

How to Get a 94% Staking Reward and a Stake in Best Wallet

If you see how Best Wallet is reshaping the way users manage Bitcoin and tap into emerging opportunities, the next step beyond using it is securing a stake in its ecosystem.

That comes through holding BEST tokens. With the abovementioned utility across the platform, the token’s demand is primarily driven by its 250,000 monthly active users – and that number is still growing.

Further boosting its value is the staking activity. Over 281 million BEST tokens are already locked in the independent staking protocol, earning a dynamic APY of 94%.

If you want a share of that rewards pool or a stake in one of the fastest-growing Web3 wallets, head to the Best Wallet presale site.

BEST tokens can be purchased directly in-app using a bank card or by swapping ETH or USDT.

Stay connected with the community on X, Telegram, and Discord, and visit Best Wallet to learn more.

Best Wallet is available for download on Google Play and the Apple App Store.

The post Billionaire Calls for Buying More Bitcoin as U.S. Debt Spirals – Best Wallet Automates the Strategy, ICO Hits $14.3M appeared first on Cryptonews.