Key Takeaways:

- HYPE is up nearly 1000% since launch, with $50 now in sight as fundamentals and revenue growth align.

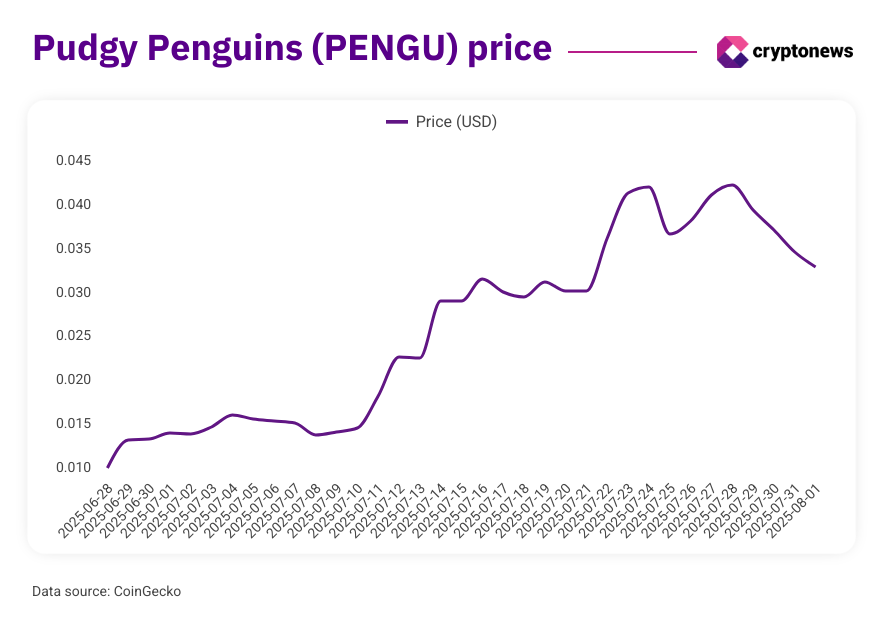

- PENGU led all meme coins in July, driven by airdrops, aggressive marketing, and ETF speculation.

- ARB gained 66% in a month, riding renewed interest in Layer 2 tokens and Ethereum infrastructure plays.

- Institutional capital is rotating, and altcoins are no longer just riding the wave — they’re making it.

From meme coins to Layer 2 tokens and breakout DeFi plays, July delivered big gains across the board. Some tokens doubled, others tripled, and many came from unexpected corners of the market.

Behind the numbers is something deeper. Real adoption, product traction, and shifting capital flows are driving the action. As new narratives emerge and old ones return with fresh momentum, the altcoin market is once again proving it can move fast and set the tone for what comes next.

Table of Contents

- In This Article

- In This Article

-

‘The Hype is Real’ For PENGU Price as ETF Buzz Fuels Meme Coin Rally

-

‘$50 is the Level to Watch’ as Hyperliquid Price Consolidates Near Highs

-

Arbitrum Price Jumps 66% With Renewed Layer-2 Interest

-

How Altcoins Are Rewriting the Summer Story

-

Key Crypto Events to Watch in August 2025

Show Full Guide

window.addEventListener(“DOMContentLoaded”, () => {

const header = document.querySelector(“.header_wrapper”);

const pageLegend = document.querySelector(‘#multiCollapse1’);

const pageLegendList = document.querySelector(‘#multiCollapse2’);

const pageLegendCollapse = new bootstrap.Collapse(pageLegend, {toggle: document.querySelector(“.toc-sticky”).classList.contains(‘sticky’)});

/**

* Changing current title

*/

(function (pageLegend) {

const titleNodes = pageLegend.querySelectorAll(‘.StepProgress-item__link’);

if (!titleNodes.length) return;

const titles = […titleNodes].map((itm, i) => ({

id: itm.getAttribute(‘data-id’),

text: itm.textContent,

level: itm.getAttribute(‘data-level’),

linkNode: itm,

titleNode: document.getElementById(itm.getAttribute(‘data-id’)),

index: i,

}));

/**

* Source: https://www.sitepoint.com/throttle-scroll-events/

* @param {Function} fn

* @param {number} wait

* @returns {(function(): void)|*}

*/

const throttle = (fn, wait) => {

let time = Date.now();

return function () {

if ((time + wait – Date.now()) {

const documentScrollTop = window.pageYOffset || document.documentElement.scrollTop || document.body.scrollTop || 0;

let current = 0;

// Title

titles.forEach((itm, i) => {

//console.log(itm)

const itmOffsetTop = itm.titleNode ? itm.titleNode.offsetTop – 100 : 0;

if (documentScrollTop >= itmOffsetTop) {

document.getElementById(‘toc-current-title’).innerHTML = itm.text;

document.getElementById(‘toc-current-title’).setAttribute(‘data-current-id’, itm.id);

document.getElementById(‘toc-current-title’).setAttribute(‘data-current-level’, itm.level);

current = i;

}

})

// close all list and open sub list if needed

if (document.querySelector(“.toc-sticky”).classList.contains(‘sticky’)) {

document.querySelectorAll(‘.subList-in-progress’).forEach((el) => {

el.children[1].classList.remove(‘show’);

el.getElementsByClassName(‘icon-chevron-down’)[0].classList.remove(‘up’);

});

const currentEl = titles[current];

currentEl.linkNode.classList.add(‘show’);

}

titles.forEach((itm, i) => {

itm.linkNode.parentNode.parentNode.classList.remove(‘current’, ‘is-done’);

if (current > i) {

itm.linkNode.parentNode.parentNode.classList.add(‘is-done’)

};

if (current === i) {

itm.linkNode.parentNode.parentNode.classList.add(‘current’);

};

})

}

changeCurrentTitle();

document.addEventListener(‘scroll’, throttle(changeCurrentTitle, 50));

})(pageLegend);

/**

* Collapse

*/

(function (pageLegend, header) {

const icon = pageLegend.parentNode.querySelector(“.collapse-action-btn i”);

const collapseToggle = (status) => (e) => {

if (!e.target.isEqualNode(pageLegend)) return;

icon.classList.toggle(“up”);

const containerHeight = pageLegend.getBoundingClientRect().height;

const showSubtitleContent = () => {

const currentId = document.getElementById(‘toc-current-title’).getAttribute(‘data-current-id’);

const currentLevel = document.getElementById(‘toc-current-title’).getAttribute(‘data-current-level’);

const currentSubTitle = currentLevel == 3 ? document.querySelector(`a[data-id=”${currentId}”]`).parentNode.parentNode.parentNode : false;

if (!currentSubTitle) return;

new bootstrap.Collapse(currentSubTitle, {toggle: false}).show();

}

showSubtitleContent();

console.log(status + ‘fdsfsd’ + containerHeight);

if (status === ‘shown’ && document.querySelector(“.toc-sticky”).classList.contains(‘sticky’)) {

document.querySelector(‘html’).classList.remove(‘overflow-hidden’);

pageLegend.classList.add(‘overflow-auto’);

pageLegend.style.height = `calc(100vh – ${header.getBoundingClientRect().height + document.querySelector(‘.toc-sticky__open’).getBoundingClientRect().height + 16}px)`;

} else if (status === ‘hide’) {

document.querySelector(‘html’).removeClass(‘overflow-hidden’);

pageLegend.classList.remove(‘overflow-auto’);

pageLegend.style.height=”auto”;

}

}

pageLegend.addEventListener(‘shown.bs.collapse’, collapseToggle(‘shown’));

pageLegend.addEventListener(‘hide.bs.collapse’, collapseToggle(‘hide’));

})(pageLegend, header);

/**

* Collapse sub-titles

*/

(function (pageLegend) {

const collapseEls = pageLegend.querySelectorAll(‘.collapse’);

collapseEls.forEach(function (el) {

const toggleArrowDirection = function (e) {

if (!e.target.isEqualNode(el)) return;

const id = this.getAttribute(‘id’);

document.querySelector(`.collapse-action-btn[data-bs-target=”#${id}”] .icon-chevron-down`).classList.toggle(‘up’);

}

el.addEventListener(‘shown.bs.collapse’, toggleArrowDirection);

el.addEventListener(‘hide.bs.collapse’, toggleArrowDirection);

})

})(pageLegend);

/**

* Collapse main title

*/

(function (pageLegendList) {

const icon = pageLegendList.parentNode.querySelector(“.collapse-action-btn i”);

const collapseToggle = () => (e) => {

if (!e.target.isEqualNode(pageLegendList)) return;

icon.classList.toggle(“up”);

}

pageLegendList.addEventListener(‘shown.bs.collapse’, collapseToggle());

pageLegendList.addEventListener(‘hide.bs.collapse’, collapseToggle());

})(pageLegendList);

(function (pageLegendList) {

const collapseEls = pageLegendList.querySelectorAll(‘.collapse’);

collapseEls.forEach(function (el) {

const toggleArrowDirection = function (e) {

if (!e.target.isEqualNode(el)) return;

const id = this.getAttribute(‘id’);

document.querySelector(`.toc-sticky-list .collapse-action-btn[data-bs-target=”#${id}”] .icon-chevron-down`).classList.toggle(‘up’);

}

el.addEventListener(‘shown.bs.collapse’, toggleArrowDirection);

el.addEventListener(‘hide.bs.collapse’, toggleArrowDirection);

})

})(pageLegendList);

/**

* Sticky functionality

* Source: https://stackoverflow.com/questions/17893771/javascript-sticky-div-after-scroll

*/

(function (header, pageLegendCollapse) {

// set everything outside the onscroll event (less work per scroll)

const target = document.querySelector(“.toc-sticky”);

const targetListStatic = document.querySelector(“.toc-sticky-list”);

if (!target || !header) return;

const headerHeight = header.getBoundingClientRect().height;

const targetHeight = targetListStatic.getBoundingClientRect().height;

// -headerHeight so it won’t be jumpy

const stop = targetListStatic.offsetTop + headerHeight + targetHeight;

const docBody =

document.documentElement || document.body.parentNode || document.body;

const hasOffset = window.pageYOffset !== undefined;

const applySticky = function () {

// cross-browser compatible scrollTop.

const scrollTop = hasOffset ? window.pageYOffset : docBody.scrollTop;

// if user scrolls to headerHeight from the top of the target div

if (scrollTop >= stop) {

pageLegendCollapse.hide();

// stick the div

target.classList.add(“sticky”);

//target.style.marginTop = `${headerHeight}px`;

} else {

pageLegendCollapse.show();

// release the div

target.classList.remove(“sticky”);

target.style.marginTop = “”;

}

}

applySticky();

window.addEventListener(‘scroll’, applySticky);

})(header, pageLegendCollapse);

jQuery(‘span.show_moretoc’).click(function () {

jQuery(‘span.show_moretoc’).hide();

jQuery(‘.ms_hidetoc’).show();

});

});

‘The Hype is Real’ For PENGU Price as ETF Buzz Fuels Meme Coin Rally

Pudgy Penguins (PENGU) became one of the most talked-about projects in crypto this summer. In July, its token PENGU not only led meme coins by market cap performance but also outperformed nearly the entire market. Ethena (ENA) and Story Protocol (IP) followed in distant second and third.

Pauline Shangett, CSO at ChangeNOW, credits the team’s execution and visibility strategy as key growth drivers:

That kind of move doesn’t just happen out of nowhere. A massive airdrop, listings on over 130 exchanges… The team clearly knows what they’re doing.

The project also benefited from built-in brand recognition, thanks to its roots in the Pudgy Penguins NFT collection. But recent developments have taken things to another level — especially with institutional interest heating up. Shangett points to a surprising but very real shift in sentiment around meme coins:

And look, if you still think meme coins are a dying trend, I’d say you’re not paying attention. Interest is coming back strong, the hype is real, and we’re seeing public companies and big names jumping in. The fact that Canary Capital filed for a spot ETF on PENGU and the SEC actually picked it up for review — that’s huge. A few years ago, that would’ve sounded like a joke.

‘$50 is the Level to Watch’ as Hyperliquid Price Consolidates Near Highs

Hyperliquid (HYPE) is one of the standout crypto projects of 2025 — not just because of the soaring price of its native token HYPE, but also due to its product’s growing appeal. Somewhat unexpectedly, the project gained wider attention after the March incident involving Jelly-my-Jelly (JELLY), where a trader attempted to drain the HLP vault. While it initially sparked criticism, the episode ended up driving visibility, and momentum.

Dean Chen, Analyst at Bitunix Exchange, explains why Hyperliquid’s model is resonating:

Hyperliquid is a decentralized perpetual exchange built on its own Layer 1, combining CEX-like speed with DeFi transparency. With regulators scrutinizing centralized platforms, HYPE’s native-DeFi model could gain traction.

Launched at $3.81, HYPE now trades around $40 — a nearly 1000% gain. Chen sees room for more upside if key levels break:

Strong support at around $37. A breakout above $46.1 could open the door to a test of the $50 zone.

HYPE’s rally appears to be moving in lockstep with the protocol’s fundamentals. Despite being a relatively new player, Hyperliquid has already climbed into the top 10 crypto protocols by revenue. In July, it even outpaced Ethereum — a long-standing leader in network activity — and left Tron behind, despite the latter’s reputation for cheap and fast transactions.

Arbitrum Price Jumps 66% With Renewed Layer-2 Interest

Arbitrum (ARB) made a quiet but notable return this summer. Long seen as a cornerstone of Ethereum’s scaling future, it struggled for months to convert ecosystem strength into token performance. That finally began to shift in July: the price of ARB climbed from $0.30 to $0.50 — a 66% increase in just one month.

Dean Chen sees Arbitrum as a structural leader in the Layer-2 race, but notes risks beneath the surface:

Arbitrum remains a leader among Ethereum L2s, with steady ecosystem growth. However, high whale concentration may lead to short-term volatility. Key to watch is whether L2 adoption continues outpacing Ethereum’s native scaling progress.

Much like Ethereum, which surged in July on ETF inflows and renewed developer momentum, Layer-2 tokens may be set to benefit from rising market confidence. Chen highlights the next technical setup for ARB:

Critical support at $0.31–$0.32. A sustained rally toward $0.51 could attract fresh inflows.

Markus Levin, co-founder of XYO, points to renewed activity across Layer-2 ecosystems — and how institutional flows into Ethereum are lifting the broader infrastructure around it:

Layer-2 scaling solutions such as Arbitrum and Optimism, and NFTs/GameFi, driven by resurging marketplace activity and growing user engagement. Recent institutional inflows, notably through Ethereum ETFs like BlackRock’s ETHA, have significantly tightened the available supply, reinforcing ETH’s bullish momentum. These sectors continue to attract capital thanks to Ethereum’s infrastructure improvements and investor preference for mature, proven platforms.

How Altcoins Are Rewriting the Summer Story

From Hyperliquid’s parabolic rise to PENGU’s surprise ETF moment and Arbitrum’s quiet comeback, July proved that altcoins can move markets — and not just follow them. Real revenue, real adoption, and renewed retail interest are starting to converge, and tokens once seen as speculative side bets are now driving the story forward.

As capital rotates into new narratives and infrastructure plays, August could push these trends further — or expose which ones are just short-term hype. Either way, the next wave won’t be about potential. It’ll be about follow-through.

Key Crypto Events to Watch in August 2025

- Early August – Orca (ORCA) Launchpad Goes Live. New token launches and ecosystem activity could attract liquidity.

- Early August – OpenAI GPT-5 Release. AI-related tokens may see renewed volatility following OpenAI’s model upgrade.

- August 2 – Ethena (ENA) Token Unlock (~$22M). Significant supply increase that could affect short-term price dynamics.

- August 3 – Optimism (OP) Superchain Upgrade. A key milestone for Optimism’s L2 roadmap and the broader Superchain ecosystem.

- August 12 – Aptos (APT) Token Unlock (~$49.7M). Large unlock event to watch, with potential impact on circulating supply and price pressure.

- August 15 – Avalanche (AVAX) Token Unlock (~$38.9M). Avalanche sees another major unlock as market watches for reactions.

- August 15 – FTX Creditor Distribution. Next round of payouts for FTX creditors, with possible effects on overall market sentiment and liquidity.

- August 27 – Nvidia Earnings Call. Key macro-tech event. Strong AI earnings could influence risk appetite across equities and AI-linked tokens.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

The post August 2025 Crypto Outlook: Bitcoin’s Next Target $140K? appeared first on Cryptonews.