The Arbitrum ($ARB) token is climbing again, slowly rising to $0.327 after a 7% drop from its 24-hour high of $0.3887. With a market cap of $1.62 billion and $506 million in daily trading volume, Arbitrum holds the 47th spot on CoinMarketCap. At press time, the asset is trading at $0.3275.

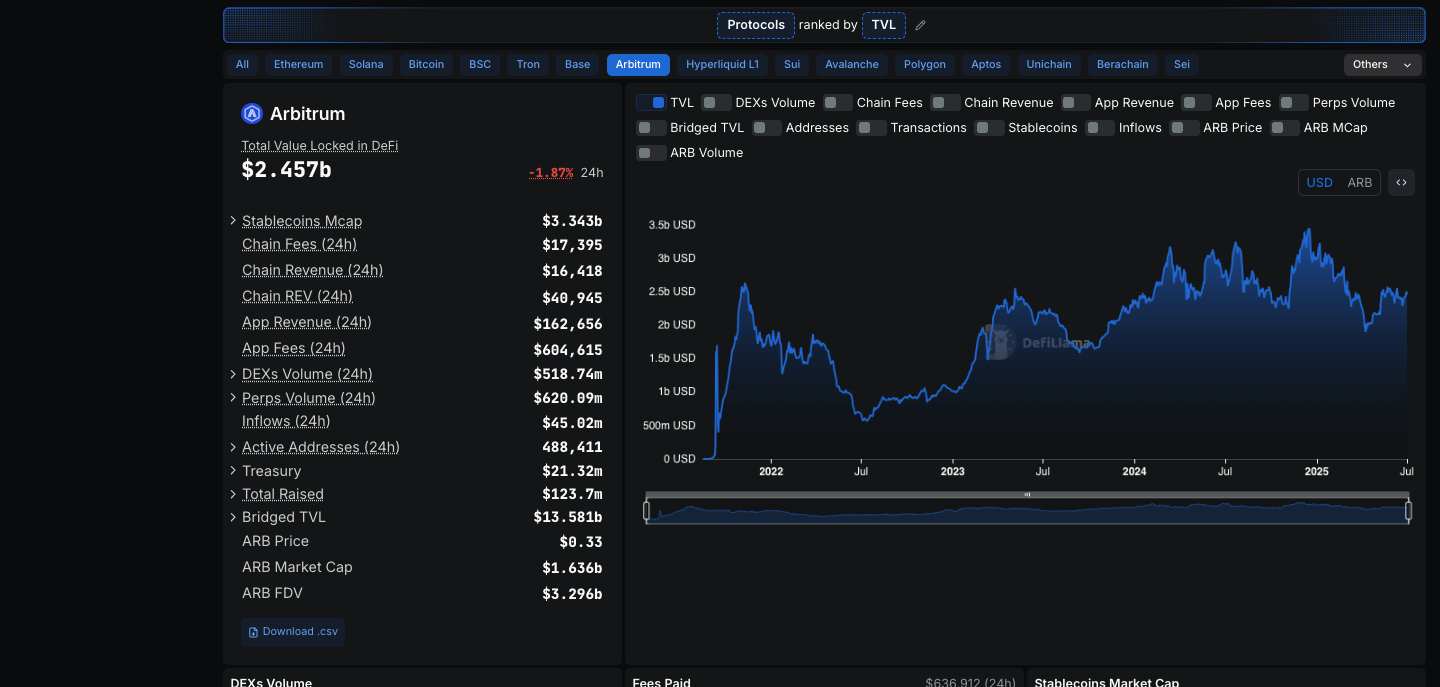

Arbitrum’s Dominance: The Ethereum L2 Leader With $2.4B TVL

Arbitrum is one of the largest Ethereum Layer-2 networks, known for its low fees and high scalability. These features have drawn both developers and users to the platform.

The $ARB token was launched with an airdrop in March 2023 and has since experienced steady price growth. Despite this, the token still trades 86% below its all-time high of $2.39.

Arbitrum holds a dominant position among Layer-2 solutions, with many expecting its leadership to continue. The network boasts a substantial $2.4 billion in total value locked, reinforcing its strong market presence.

Major decentralized protocols such as Aave and Uniswap rely on Arbitrum as their primary DeFi hub, processing transactions through its bridge. This institutional trust reinforces Arbitrum’s position as the leading Layer 2 choice for Ethereum.

Arbitrum leads other Layer-2 networks, such as Base, Starknet, and Optimism, in terms of daily activity and total value locked (TVL). However, it still falls behind larger altcoins, such as Polygon and Avalanche, in market capitalization. Earlier this year, Arbitrum briefly entered the top 40 but lost ground due to market shifts toward meme tokens and gaming projects.

As of July 1, the network supports over 1 million active wallets and has processed 1.89 billion transactions. Beyond DeFi, NFT platforms like Magic Eden are driving activity on Arbitrum, showcasing its versatility across various blockchain sectors.

Arbitrum has also partnered with Robinhood, a major U.S. trading platform. The update was confirmed during a fireside chat in France, which featured Ethereum co-founder Vitalik Buterin and Arbitrum developers.

The trading app will launch a tokenized stock product on Arbitrum One and later on a custom Robinhood L2 blockchain in its bid to offer EU users tokenized U.S. stocks and ETF tokens.

Binance, the world’s largest crypto exchange, has also introduced new $ARB trading products. These include an algorithmic trading bot for the ARB/USDC pair, offering strategies like dollar-cost averaging.

Whale activity on Arbitrum is increasing. A wallet linked to the Gelato Network recently transferred $5 million worth of $ARB tokens (approximately 20 million tokens) to market maker GSR. These tokens were later deposited on Binance, indicating possible accumulation by a whale.

Can $ARB Climb to $0.59?

The $ARB/USD chart reveals a concerning rounded top formation following its rejection at the $0.389 resistance level. This bearish pattern emerged on June 30 as buying momentum faded, evidenced by progressively lower highs and diminishing trading volume—classic signs of distribution.

The subsequent price action unfolded in three distinct phases: an initial decline to $0.35, a brief bullish counterattack that lifted prices to $0.37, and ultimately a rejection that drove ARB down to establish new support at $0.321.

Market structure currently presents a clear battleground. Bulls are pushing for a rebound, targeting the key resistance level at $0.37. A decisive breakout above this point, especially with solid trading volume, could disrupt the bearish trend and pave the way for a move toward $0.40.

Yet on-chain data reveals a slowdown in whale accumulation, indicating hesitation among major investors. This caution could cap upward momentum, leaving the rally vulnerable to resistance.

Conversely, failure to hold the $0.321 support would confirm the bearish scenario, likely triggering a cascade of liquidations that could propel $ARB toward the $0.30 psychological level. In a more severe downturn, the $0.28-$0.26 zone may become the next major support area.

Traders should monitor both volume patterns and order book depth around these key levels, as the current technical setup presents a high-probability inflection point for ARB’s medium-term trajectory.

The post Arbitrum ($ARB) Defies Market Slump: Can the Ethereum L2 Leader Hit $0.59 Next? appeared first on Cryptonews.