Shares of Greenidge Generation Holdings surged more than 30% at Monday’s open after the Bitcoin mining and power-generation company secured a major regulatory breakthrough with New York State.

The company announced that it had reached an agreement with the New York State Department of Environmental Conservation (NYSDEC) to renew its Title V Air Permit for its Dresden, New York facility, ending a years-long legal battle that once threatened its operations in the state.

The five-year permit, finalized on Friday, allows Greenidge to continue running its combined power-generation and cryptocurrency-mining operation while committing to substantial emissions cuts that go beyond state climate targets.

Greenidge to Slash Emissions 44% by 2030 Under New York Settlement

Under the terms, Greenidge must cut its permitted greenhouse gas output by 44% from prior limits and its actual emissions by 25% by 2030, surpassing the Climate Leadership and Community Protection Act’s (CLCPA) statewide reduction goal of 40%.

“This new permit includes historic emissions reductions that go far beyond anything required by the CLCPA,” said company president Dale Irwin, calling the deal proof that Greenidge can operate as a “responsible cryptocurrency business” that supports the grid during peak demand while remaining environmentally compliant.

The agreement marks a dramatic turnaround from 2022, when the state initially denied Greenidge’s air permit renewal after environmental backlash. The decision sparked a lengthy legal dispute that ended in late 2024, when a New York Supreme Court judge ruled in Greenidge’s favor.

The new settlement formally ends all outstanding lawsuits and administrative appeals between the company and the state, allowing operations to proceed without interruption.

Regulators said the new permit brings the facility fully in line with state climate law and marks the first such condition in a Title V renewal requiring actual emissions reductions by a specific percentage.

Greenidge’s Dresden site operates as both a power producer and Bitcoin miner, capable of diverting power to the state grid within minutes, a sharp improvement from the 14-hour response time in 2022. The company said it has steadily increased grid contributions since then, strengthening energy reliability for upstate residents.

The agreement was praised by the International Brotherhood of Electrical Workers (IBEW), which represents many of the site’s employees.

Greenidge Reduces Debt Load and Expands Power Operations

Greenidge originally purchased the Dresden facility in 2016, converting it from a coal-fired plant into a natural gas-powered operation that began supplying electricity to the grid in 2017.

The company launched its Bitcoin mining activities in 2019, operating a behind-the-meter data center powered entirely by its own generation.

Since the purchase, Greenidge has invested more than $100 million in modernizing the site and now contributes nearly 10% of all local tax revenue in Yates County.

The company’s renewed footing in New York comes amid broader efforts to strengthen its balance sheet and refocus operations.

Earlier this month, Greenidge completed tender and exchange offers for its 8.50% Senior Notes due 2026, reducing outstanding debt through cash payments and exchanges for new 10.00% Senior Notes maturing in 2030.

In September, Greenidge sold its Mississippi mining facility for $3.9 million, following the termination of a planned sale in South Carolina, where it now plans to explore new development opportunities.

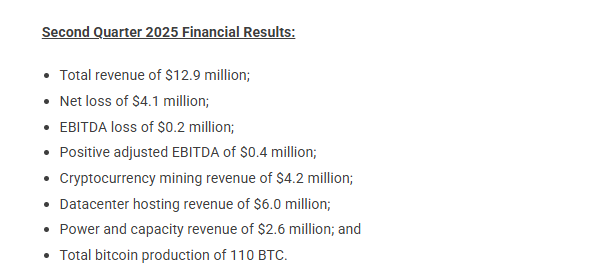

For the second quarter of 2025, the company reported a net loss of $4.1 million on $12.9 million in revenue, with energy availability at its Dresden plant reaching 99.6%.

The miner has also been expanding beyond Bitcoin. Through its GreenidgeAI initiative, the company seeks to repurpose part of its infrastructure to meet the growing demand for AI-focused GPU hosting.

Also, it continues to explore acquisitions of additional low-cost power sites across states like South Carolina and North Dakota.

The post NY Deal Sends Crypto Miner GREE Soaring Over 30% – Here’s What Happens Next appeared first on Cryptonews.

…

…