Helius Medical Technologies, now operating as HSDT Solana Company, has grown its Solana treasury to more than 2.2 million SOL tokens worth over $525 million, combined with cash holdings exceeding $15 million, the company announced on October 6.

The acquisition was made less than three weeks after the initial $500 million private placement closed on September 18, with the combined value already surpassing the gross proceeds from the original capital raise.

Cosmo Jiang, General Partner at Pantera Capital and Board Observer, noted the company is “focused on maximizing shareholder value by efficiently accumulating Solana.”

Institutional Solana treasury holdings have surged past $4 billion across 18 tracked participants controlling 3.1% of the circulating supply, according to Strategic Solana Reserve data.

Forward Industries leads with 6.8 million SOL valued at $1.69 billion, followed by Sharps Technology with 2.1 million SOL and DeFi Development Corp with just over 2 million SOL.

Multi-Billion Dollar Treasury Commitments Drive Corporate Adoption

Forward Industries closed a $1.65 billion private placement on September 11, led by Galaxy Digital, Jump Crypto, and Multicoin Capital.

Kyle Samani from Multicoin Capital became the Chairman of the Board.

At the same time, the company filed plans for a $4 billion equity program and partnered with Superstate to tokenize its stock on the Solana blockchain.

As mentioned earlier, Helius Medical secured $500 million through an oversubscribed placement led by Pantera Capital in September, with an additional $750 million in stapled warrants, potentially bringing total treasury capital to $1.25 billion.

Investors included Summer Capital, Arrington Capital, Animoca Brands, and HashKey Capital. Following the announcement, HSDT stock surged over 159% from $7.91 to $45.51 before settling at $19.63.

This month, VisionSys AI has unveiled plans for a $2 billion Solana treasury program in partnership with Marinade Finance, starting with a $500 million SOL acquisition over six months.

Australian fitness company Fitell Corporation also secured a $100 million credit line for its treasury strategy with plans to rebrand as Solana Australia Corporation.

The company added 216.8 million Pump.fun tokens, valued at $1.5 million, and appointed David Swaney and Cailen Sullivan as advisers.

One of the oldest and leading firms, SOL Strategies, commenced trading on Nasdaq under ticker STKE on September 10, with $94 million in holdings, managing 3.62 million SOL under delegation and participation from 8,812 unique wallets.

Sharps Technology announced a $100 million stock repurchase program on October 2, following its $400 million private placement in August.

However, STSS shares closed at $6.67, down 43% over the past month despite Solana rallying 55.5% across the same period.

DeFi Development Corp has also approved an increase in its repurchase program from $1 million to $100 million, with an initial threshold of $10 million requiring additional board notification.

Upexi Inc., which now holds 2 million SOL, valued at $377 million, has introduced an “adjusted SOL per share” metric, which stands at 0.0197, representing a 56% increase since launching the initiative.

The company also appointed former BitMEX CEO Arthur Hayes to its advisory committee.

Technical Indicators Suggest Binary Outcome at Multi-Year Resistance

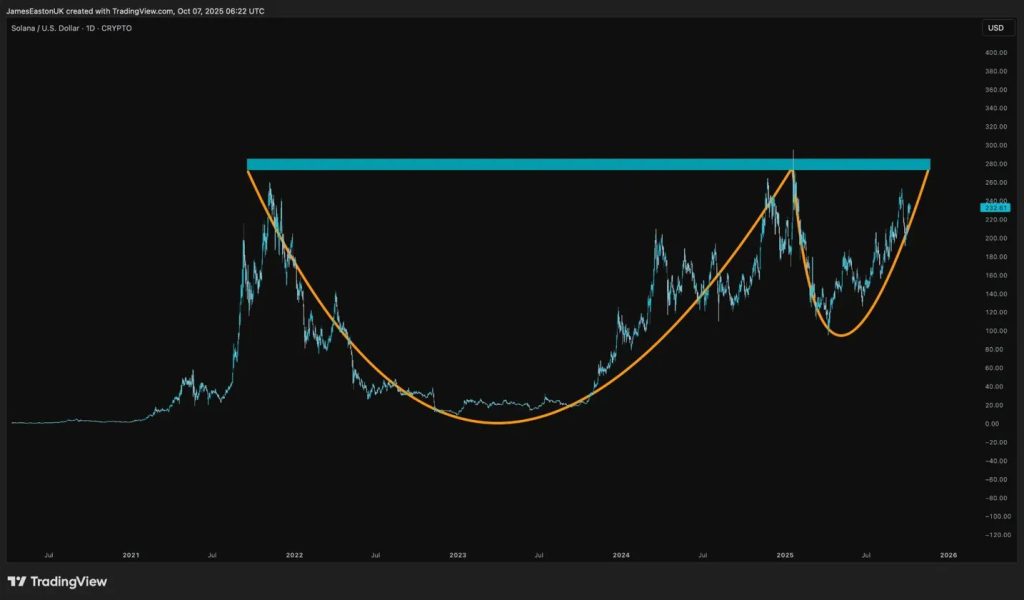

Multi-year chart analysis reveals a massive cup and handle formation, with SOL trading at $231.34, near critical resistance around $260-280, representing the 2021 cycle highs.

The pattern’s measured move theoretically targets a $400 – $500 range, representing 70-115% upside from current levels.

Weekly Fibonacci extensions project potential targets at $406.90, $672.37, $1,103.30, and ultimately $2,247.46.

SOL has recovered approximately 2,800% from 2022-2023 cycle lows near $8, successfully reclaiming most major Fibonacci retracement levels.

The consolidation near 2021 highs represents a critical decision point where SOL must either break through with conviction or face potential rejection.

Moreover, the final deadline for spot SOL ETF approval is just four days away, with analysts assigning high approval chances this week.

In September, SOL outpaced Ethereum with a 26% monthly gain, compared to ETH’s 8%.

Upcoming upgrades, including Firedancer, Alpenglow, and state compression, are expected to support further growth.

In fact, VanEck still maintains a bullish outlook, predicting SOL could reach $520 before year-end.

As it stands now, Solana faces binary outcomes at multi-year resistance around $260-280, where a successful breakout could drive advancement toward $350-400, supported by corporate treasury accumulation and potential ETF approval.

Failure at resistance could trigger a correction toward $150 – $180 support levels, with extended consolidation within $200 – $280 range also possible.

The post Nasdaq-Listed Solana Company Grows Treasury to $525M in SOL Holdings – Solana About to Explode? appeared first on Cryptonews.

VisionSys AI stock has fallen 57% after unveiling a $2B Solana treasury plan with

VisionSys AI stock has fallen 57% after unveiling a $2B Solana treasury plan with