The past few weeks have reminded traders how unforgiving crypto markets can be. A sharp correction erased billions in value, liquidating leveraged positions and shaking confidence across the board. Yet, for long-time participants, these violent resets often serve as the prelude to the next leg higher.

Market Recap: From $4.17T Peak to September Slump

The total cryptocurrency market capitalization hit an all-time high of $4.17 trillion on August 14. Since then, however, the market has been trapped in a tight consolidation range between $3.5T and $4T, showing signs of indecision.

That changed sharply between September 18–25, when the total market cap plunged nearly 9% in just seven days, sparking renewed fears about market fragility and casting doubt on whether this October — known informally as “Uptober” — would live up to expectations.

Historical Trends Say “Yes”: Q4 Is Traditionally Strong

Despite recent volatility, historical market behavior suggests October could still trigger a rally.

- Since 2010, October has delivered an average +29.23% return.

- November follows with an even stronger +37.64% average return.

These seasonal patterns are tied to everything from post-summer capital reallocation to institutional positioning before year-end. Analysts are now suggesting that low-cap tokens could surge by over 200% this October, especially if sentiment rebounds as expected.

Altcoin Season 3.0? Technicals Say It’s Possible

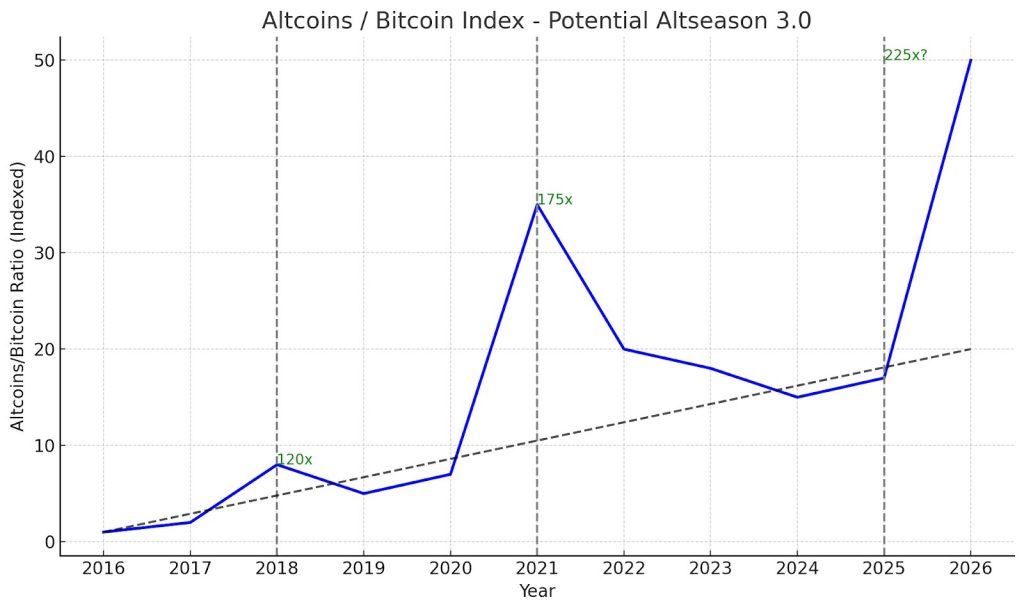

Another promising technical signal comes from the Altcoins/Bitcoin Index, which tracks the flow of capital between Bitcoin and the broader altcoin market. Since 2018, this index has been a reliable early indicator of altcoin rallies — and the current setup is beginning to mirror past bullish cycles.

In 2018, the index bounced from a key long-term trendline, triggering a 120x surge in select low-cap altcoins. A similar pattern repeated in 2021, when a second rebound from the same support level led to a 175x rally in the altcoin sector.

Now, in late 2025, the index is once again hovering at that same historical support, suggesting that the market could be on the verge of what some are calling Altcoin Season 3.0.

However, recognizing the season is only half the battle. Capitalizing on it requires identifying projects with strong fundamentals, committed communities, and real-world utility — the kind of projects most likely to outperform if the broader rally unfolds.

Bitcoin’s Outlook: Strength Returning Ahead of Uptober

While altcoins have struggled, Bitcoin appears to be stabilizing as September ends — historically one of its weakest months. The latest push from $109,000 to over $113,000 is more than just a technical bounce.

Several key indicators now point to renewed strength in the market:

- RSI on various timeframes is nearing 80 — signaling strong buying pressure.

- Daily trading volumes are climbing on major exchanges.

- Open interest in futures markets is rising — showing increased commitment.

- Order book depth is improving — liquidity is coming back.

This overall structure mirrors past pre-Uptober periods, where periods of sideways movement and fear gave way to multi-month bull runs. If history repeats, the current setup may be laying the foundation for the next broad market advance.

Institutional & Regulatory Tailwinds

While technical signals are pointing toward a potential market breakout, the underlying fundamentals are equally compelling — and may be the real driving force behind a strong October rally.

- Institutional players are stepping back in. Hedge funds and asset managers have been steadily increasing their exposure to Bitcoin, even during recent downtrends — a behavior historically associated with the early phases of extended bull runs.

- Corporate adoption continues to grow. Major payment platforms and publicly traded companies are integrating Bitcoin and other digital assets into their operations and balance sheets, reinforcing crypto’s role as a long-term store of value.

- Regulatory clarity is finally gaining traction. With spot Bitcoin ETFs now under serious review by U.S. regulators, the likelihood of approval is increasing. These developments are drawing attention from traditional capital markets and could unlock significant new inflows.

Together, these forces suggest that this October could mirror previous “Uptober” breakouts, where institutional capital and regulatory tailwinds combined to ignite multi-month rallies across the crypto market.

What This Means for Low-Cap Cryptos and Why XYZVerse Stands Out

With October historically marking the beginning of multi-month crypto rallies, low-cap tokens are often the biggest beneficiaries. These projects tend to move later than Bitcoin but with much more velocity. And when momentum returns, they’re usually the ones that post 100x or even 1000x gains.

That’s why investors are now turning their attention to early-stage opportunities with strong narratives, engaged communities, and real-world relevance. Among the standouts in this category is XYZVerse — a rising meme-powered project that blends viral energy with a functional ecosystem built around sports betting and community gamification.

XYZVerse: Building at the Crossroads of Memes and Sports

Instead of chasing tired animal themes, XYZVerse positions itself at the intersection of two powerful forces: meme culture and sports betting. This combination gives the project reach well beyond the typical meme coin crowd, attracting not only traders but also sports fans, bettors, and online communities that thrive on competition and entertainment.

The project is still in its presale phase, yet progress has been rapid. More than $15 million has already been raised, showing that momentum is building even before the token hits exchanges. For early participants, this stage offers a rare window into a project that is moving fast while still being under the radar.

Community-Driven Growth

As the market gears up for another potential Uptober breakout, XYZVerse is standing out with its strong, community-first approach. On Telegram (12K+) and X (nearly 20K), discussions are buzzing with presale updates, betting ideas, and fresh memes.

Crypto influencers are also bullish, pointing to XYZ’s mix of meme culture and real utility. For example, Michael Wrubel, a well-known investment analyst and YouTuber, recently shared a review of XYZVerse where he broke down its tokenomics, presale milestones, and roadmap — expressing a strongly bullish outlook on the project. His coverage added further visibility and fueled excitement across the community.

The XYZVerse Ambassador Program adds to this momentum, empowering members worldwide to promote and grow the ecosystem. This grassroots model ensures XYZ’s expansion is not just hype-driven but sustained by community engagement and loyalty.

$XYZ Price Growth and Post-Listing Projections

Since its presale launch, $XYZ has shown rapid and consistent price appreciation:

- Initial price: $0.0001.

- Current presale stage: $0.0055.

- Projected listing price: $0.10.

Join XYZVerse Presale Before the Next Stage Begins

This trajectory means that even before hitting exchanges, $XYZ has already delivered more than 5,000% growth from its starting price. By the time the presale closes, early buyers will have secured tokens at a 5x discount compared to the projected listing level.

Once $XYZ lists at $0.10, further growth will depend on market dynamics, liquidity inflows, and community momentum. Based on previous meme-driven altcoins with strong narratives, post-listing surges can be substantial:

- Conservative scenario: 2–3x from listing, targeting $0.20–$0.30 as liquidity builds.

- Moderate scenario: 5–10x if hype accelerates, targeting $0.50–$1.00 within the first major rally.

- High-growth scenario: If XYZ captures significant market attention, prices could follow the path of early Dogecoin or Pepe runs, with potential to exceed $1.00+ over a full altcoin season cycle

All the above-mentioned factors, combined with active community support and bullish influencer sentiment, create a strong base for demand once the token becomes available on both centralized and decentralized exchanges.

Conclusion

September’s slump showed just how fragile sentiment can be, with the total crypto market cap slipping nearly 9% in just one week. Yet, history tells a different story for October. Known as “Uptober,” this month has consistently delivered some of the strongest gains for both Bitcoin and altcoins.

With over $15M already raised in presale, an active community, and a clear sports-betting utility, XYZVerse has emerged as one of the most talked-about low-cap tokens heading into this cycle. Presale projects like XYZ often have the highest odds of breaking out, as they combine early-stage momentum with undervalued entry points before listing. If Uptober lives up to its reputation, XYZ could be among the biggest beneficiaries of Altcoin Season 3.0.

Visit the official XYZVerse website to learn more about the project: https://xyzverse.io/

Join social media channels to stay updated:

Telegram: https://t.me/xyzverse

X: https://x.com/xyz_verse

The post After Recent Crypto Shakeout, Which Coin Rises Next? appeared first on Cryptonews.