Bitcoin extended its rally into October, breaking above $117,000 for the first time since mid-September as fresh U.S. labor market data boosted expectations of Federal Reserve rate cuts.

The world’s largest cryptocurrency jumped more than 4% on the day, decisively shattering the $115,000 resistance zone.

The move came after the Automatic Data Processing (ADP), a U.S.-based payroll and HR management company, reported a surprise loss of 32,000 private payrolls in September, versus expectations for a gain of 45,000.

It marked the third decline in the past four months, indicating clear signs of economic weakness.

Labor Market Weakness Reignites Rate Cut Odds at 99%

Job openings rose by just 19,000 in August to 7.208 million, still near their lowest since January 2021. The three-month average fell to 7.26 million, a 4.5-year low and below pre-pandemic levels.

Meanwhile, the job vacancy-to-unemployment ratio dropped to 0.98, its weakest reading since April 2021.

That means there are now 157,000 more unemployed Americans than job vacancies, the widest gap since March 2021.

The disappointing data have sharply shifted monetary policy expectations.

According to the CME FedWatch Tool, traders now see a 99% chance of a 25 bps Fed rate cut at the next FOMC meeting.

A dovish Fed is widely viewed as a tailwind for Bitcoin, weakening the dollar and driving demand for risk assets.

This aligns with Bitcoin’s historical seasonality.

October, November, and December have consistently delivered strong returns, with “Uptober” often kicking off a year-end rally.

Historical Patterns Align: Will Q4 Deliver Bitcoin’s Next Mega Rally?

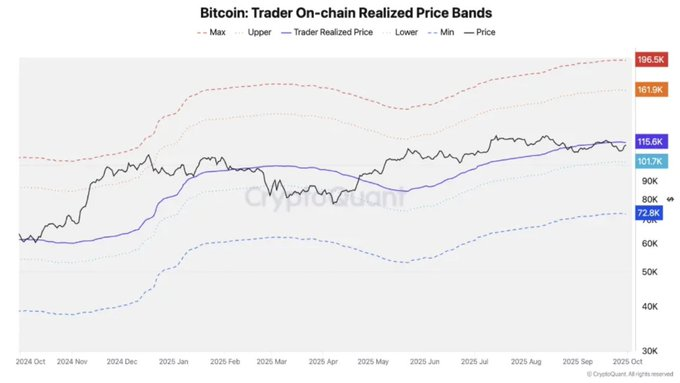

On-chain data from CryptoQuant shows Bitcoin entering Q4 with conditions supportive of a rally. By reclaiming the Trader’s Realized Price at $116K, Bitcoin has re-entered the bull phase of its cycle indicator.

Spot Bitcoin demand has grown steadily since July, now running at a 62,000 BTC monthly growth rate. Such sustained demand was also present during Q4 rallies in 2020, 2021, and 2024.

Whale holdings reinforce the bullish picture.

Large Bitcoin addresses are expanding at an annual rate of 331,000 BTC, compared to 255,000 in Q4 2024, 238,000 at the start of Q4 2020, and a contraction of 197,000 in 2021.

CryptoQuant estimates that these catalysts could expand Bitcoin’s potential Q4 target range toward $160,000–$200,000.

From a high-timeframe perspective, Bitcoin’s structure aligns with Wyckoff accumulation theory and broader macro liquidity cycles.

The monetary policy shift in January 2024 marked the beginning of an accumulation range, while the April 6 “spring” low provided the foundation for the current uptrend.

Within this structure, levels at $106,400 and $125,600 are identified as automatic reaction and support zones, while upside projections between $150,000 and $185,000 are considered major targets in the first quarter of 2026.

This suggests Bitcoin remains early in a larger bullish expansion phase, with pullbacks likely to serve as healthy corrections rather than the start of a deeper reversal.

Technical Analysis: Bitcoin Support at $108K, Resistance at $120K, Eyes on $135K+

On the technical front, Bitcoin is consolidating near $117,000 with clearly defined thresholds for both bullish continuation and potential reversal.

The key structural support sits near $108,131. Should price falls below this level, it would flip the outlook bearish.

However, as long as Bitcoin holds above the $113,000 to $118,000 range, the broader trend remains favorable for the bulls.

On the upside, immediate resistance lies at $120,000, a psychological barrier that, if broken, could open the path toward new all-time highs above $130,000.

Should momentum persist, targets in the $122,000 to $125,000 range come into focus, with extension projections pointing as high as $145,000 to $150,000.

The post U.S. Labor Market Declined in September, Fueling Rate Cut Odds – Bullish for Bitcoin’s Q4 Run? appeared first on Cryptonews.

THE ODDS OF AN OCTOBER RATE CUT IS NOW AT 100%.

THE ODDS OF AN OCTOBER RATE CUT IS NOW AT 100%.