The crypto market is up today, with the cryptocurrency market capitalization increasing by just 0.2%, now standing at $4 trillion. Just over half of the top 100 coins have appreciated over the past 24 hours. At the same time, the total crypto trading volume is at $164 billion.

Crypto Winners & Losers

At the time of writing, only two top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) appreciated 0.6%, currently trading at $114,540. It’s the best performer in the category.

Ethereum (ETH) dropped by 1.1%, now changing hands at $4,139. This is the third-highest decrease today.

Dogecoin (DOGE) is the only other green coin on this list, having increased by 0.6% to the price of $0.2334.

The highest drop is XRP’s 1.4% to $2.85, followed by 1.2% by Binance Coin (BNB), now standing at $1,010.

When it comes to the top 100 coins, one coin saw a double-digit rise: Pump Fun (PUMP) is up 20.6% to $0.006514. Other coins are up 4.4% and less.

On the other side, two coins recorded double-digit falls: Plasma (XPL) is down 14.4% to $0.96, while Aster (ASTER) dropped 11.2% to $1.62.

As October begins, the ‘uptober’ hype keeps growing. Many expect to see the market rising, basing their arguments on historical performances.

Meanwhile, Ripple CTO David Schwartz said he would step down from his role in the company at the end of the year after more than a decade. He will sit on the company’s board of directors and serve as CTO Emeritus.

‘We’re Approaching Cycle Bottom, Followed by Recovery’

According to Swissblock, “Bitcoin is in the process of finding a bottom.” They explain that markets move in cycles of stress and recovery, and when the former peaks, short-term traders are forced to sell at a loss.

“Capitulation stress often marks the end of downside phases, setting the stage for recovery,” they write. “At that exact point, the Impulse Signal collapses to zero. That’s the moment panic exhausts and new buyers step in.”

This reset happened only three times since early 2024: each marked a cycle bottom and was followed by a sustained recovery. “We are approaching that setup again.”

Moreover, Glassnode noted that Bitcoin market dominance increased by two percentage points to 59%, as the price increased as well.

The analysts note that this suggests “a healthier market structure, as BTC-led rallies have historically proven more sustainable than those driven by altcoins.”

Additionally, short-term holder RVT has compressed toward cycle lows, they write. This reflects “muted realized profits relative to network valuation.”

Notably, such resets historically “often align with periods of market detox, helping build a foundation for more durable recoveries,” Glassnode says.

‘Transformative Uptober’

Furthermore, Dom Harz, Co-Founder of BOB, commented that “with Bitcoin’s price remaining stable above $111,000, the stage is set for a potentially transformative Uptober for Bitcoin DeFi. Historically, Uptober’s bullish momentum has been driven by seasonal optimism and whale accumulation; however, this year feels different.”

He continues: “We have seen the convergence of both institutional backing and maturation across the Bitcoin ecosystem. Bitcoin is more embedded in the foundations of global finance, and institutional interest is at an all-time high. Unlike previous years, this Uptober will see more targeted inflows, which could be a breakout moment in accelerating Bitcoin DeFi, as investors will want to do more with their Bitcoin holdings, transforming it from a static store-of-value into a yield-bearing asset class.”

Levels & Events to Watch Next

At the time of writing on Wednesday morning, BTC trades at $114,540. It initially dropped to the intraday low of $112,736 before jumping to the daily high of $114,711.

The coin is currently up 1.7% in a week and 6% in a month.

Bitcoin is consolidating near $114,154. Should it move above $114,741, the coin could jump toward $116,150 and $117,850. After this, $120,000 would be possible as well. But a drop below $113,000 could lead to $112,600 and $111,680.

Ethereum is currently trading at $4,139. As the day began, the price fell from $4,180 to the low of $4,095.64, before jumping to the high of $4,197. It continued a choppy trade afterwards.

It’s down 0.8% in a week and 5.7% in a month. ETH is currently down 16.2% from its August all-time high of $4,946.

Investors are now looking to see if the price will fall below $4,030, after which it could dip below $4,000. Conversely, it could climb above $4,200, which could open doors for the $4,250 and $4,300 levels.

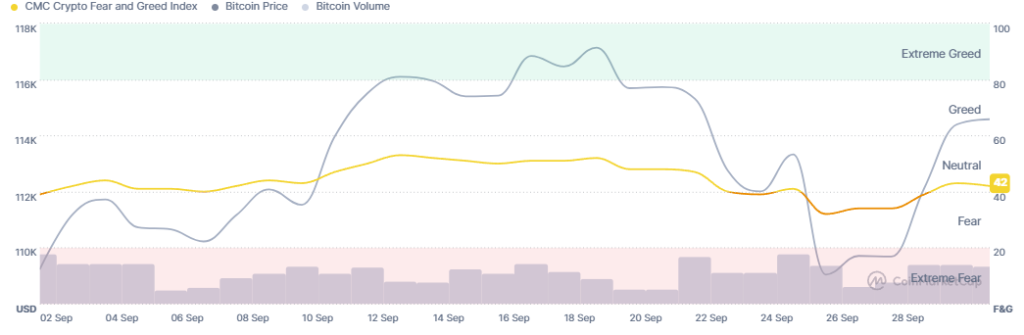

Meanwhile, the crypto market sentiment has seen a slight decrease, but is still moving in a very tight range within the natural zone. The crypto fear and greed index now stands at 42, compared to yesterday’s 43.

Market participants seem to be waiting for key signals that would point to the direction the market will take in the near term.

ETFs Stand Green

The US BTC spot exchange-traded funds (ETFs) saw the second green day in a row on Tuesday with $429.96 million in inflows. The cumulative net inflow now stands at $57.77 billion.

Of the 12 ETFs, four saw inflows, and there were no outflows. BlackRock took in $199.43 million, followed by Ark&21Shares’ $105.74 million.

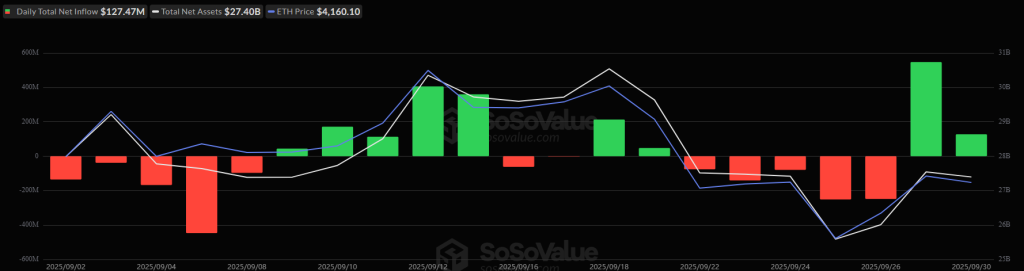

The US ETH ETFs also noted inflows of $127.47 million on 30 September. It was entirely recorded by BlackRock.

The cumulative total net inflow now stands at $13.8 billion.

Meanwhile, billionaire investor Tim Draper says retailers will eventually only accept Bitcoin. This will trigger organic spending, he argues.

Also, Deutsche Börse Group has signed a Memorandum of Understanding (MoU) with Circle Internet Financial to integrate regulated stablecoins into European capital markets, focusing on USDC and EURC. It will connect token-based payment networks with traditional financial infrastructure.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market has increased over the past day, and major stock indexes closed higher for a third straight session on Tuesday. By the closing time on 30 September, the S&P 500 was up by 0.41%, the Nasdaq-100 increased by 0.28%, and the Dow Jones Industrial Average rose 0.18%. Historically, the fourth quarter has been strong for US stocks.

- Is this rally sustainable?

We seem to be in a consolidation period. The market is currently pulling back from the latest rally, and it may see additional decreases before the ‘uptober’ kicks in.

The post Why Is Crypto Up Today? – October 1, 2025 appeared first on Cryptonews.

https://t.co/eNInot0Wst

https://t.co/eNInot0Wst  Deutsche Börse Group

Deutsche Börse Group