During the late US session, Bitcoin is trading at $112,167, with daily turnover of nearly $47.6 billion, holding steady despite recent market turbulence. Confidence in institutional adoption grew this week after Morgan Stanley confirmed it will add crypto trading via Zerohash to its E*Trade platform starting in late 2026.

Users will gain direct access to Bitcoin (BTC), Ether (ETH), and Solana (SOL), marking a significant step toward mainstream integration.

This particular move positions Morgan Stanley against rivals like Charles Schwab and Robinhood, both of which already offer crypto-linked products.

With Bitcoin representing around $2.25 trillion of the market’s $3.9 trillion value, Wall Street’s deeper involvement highlights how integral digital assets have become to global finance.

- Morgan Stanley’s E*Trade crypto launch set for late 2026

- Access to Bitcoin, Ether, and Solana at rollout

- Wall Street competition intensifies with Schwab, Robinhood

BlackRock’s ETF Profits Fuel Optimism

BlackRock’s booming ETF business is also reinforcing institutional confidence. According to Onchain Foundation’s Leon Waidmann, BlackRock’s Bitcoin and Ether ETFs are now generating $260 million in annual revenue, including $218 million from Bitcoin products alone.

The firm’s Bitcoin ETF has nearly $85 billion in assets under management, making it one of the largest globally, even compared to traditional funds.

Such inflows suggest Bitcoin is no longer viewed as speculative but as a profitable, scalable asset. Analysts argue these products could anchor BTC in retirement portfolios, potentially fueling a run toward $200,000 by year’s end if momentum continues.

SEC Exemption Could Unlock Growth

Adding to the bullish backdrop, SEC Chair Paul Atkins signaled plans for a crypto “innovation exemption” by December 2025. This initiative, part of Project Crypto, aims to reduce regulatory friction and modernize securities laws.

Potential exemptions could include ICOs, airdrops, and network incentives—opening the door for more ETFs and structured crypto products.

Atkins stressed that the U.S. must aim to become the global leader in digital asset innovation. Traders welcomed the announcement, with Bitcoin stabilizing around $111,000 as regulatory clarity boosted confidence.

Bitcoin Technical Forecast: Eyes on $110K

On the technical front, Bitcoin price prediction in the near term remains cautious. The breakdown below $115,000 pushed the price under both the 50-EMA ($114,300) and 200-EMA ($114,100), flipping them into resistance.

The chart shows a base forming near $112,000, with long lower wicks hinting at dip-buying, although momentum is weak, with the RSI at 38.

Failure to defend $112,000 could expose $110,850, then $108,750. Deeper selling might drag BTC to $107,250. Conversely, a recovery above $113,450 would open the path to $114,750–$116,150, and potentially retest $118,000.

While short-term participants may remain defensive, the broader uptrend of higher lows since summer is intact. If institutional inflows accelerate and macro liquidity gets better, Bitcoin could stage a rebound toward $120,000, framing this pullback as a long-term accumulation opportunity.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

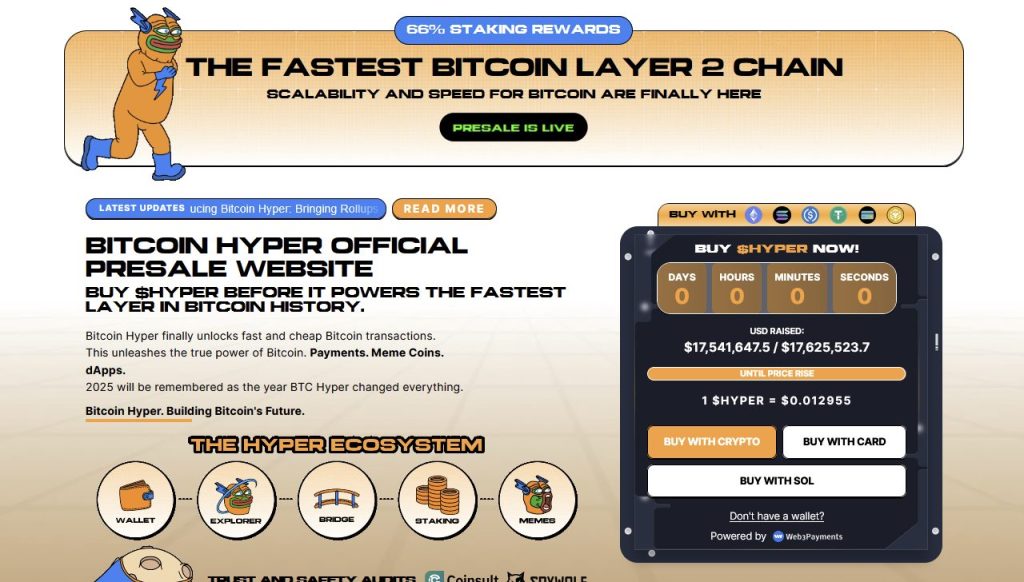

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.5 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012955—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Morgan Stanley’s Big Move Puts $120K in Sight appeared first on Cryptonews.