The crypto market is down today, with 92 of the top 100 coins in red over the past 24 hours. Overall, the cryptocurrency market capitalization has decreased by 0.2%, now standing at $3.96 trillion. At the same time, the total crypto trading volume is at $154 billion.

Crypto Winners & Losers

At the time of writing, three of the top 10 coins per market capitalization have increased over the past 24 hours, while five are down (not taking the two stablecoins into account).

Bitcoin (BTC) is unchanged over the past day, now trading at $115,118. This is the smallest decrease in this category, with 0.1%.

At the same time, Ethereum (ETH) dropped 0.7%, now trading at $4,237.

Binance Coin (BNB) is up the most today: 1.3% to the price of $843. It’s followed by XRP (XRP) and Cardano (ADA) with increases of 1.3% and 0.9%, now trading at $3 and $0.9223.

Solana (SOL) dropped the most in this category: 1.1% currently changing hands at $179.

Looking at the top 100 coins, eight recorded increases. OKB (OKB) and Provenance Blockchain (HASH) are up the most, having appreciated 9.8% and 9.3% to $124 and $0.02913, respectively.

On the other hand, Arbitrum (ARB) fell the most: 6% to $0.4931. It’s followed by Pi Network (PI), with a 5.9% drop, changing hands at $0.3519.

Investors are keeping an eye on several key events coming this week. For the crypto market, a significant one is the US Federal Reserve Chair Jerome Powell’s speech this Friday at the Jackson Hole Symposium, an annual gathering of the world’s central bankers.

The markets will seek to learn if the Fed is on its way to cut the lending rate at the next policy committee meeting in September, as many expect.

Last month, Powell said the central bank needed additional data on the impact of tariffs on inflation before making a decision.

‘Traders are Bracing for a Volatile End to August’

Nick Forster, founder at onchain options platform Derive.xyz, commented that expectations for a Fed rate cut in September have “dropped sharply.” Therefore, traders are now re-positioning ahead of Powell’s Friday speech.

“If Powell signals a continued hawkish stance, we could see a rapid correction in digital assets, particularly for BTC and ETH,” Forster says.

Moreover, over the past “turbulent” 24 hours, the crypto market saw over $270 million in liquidations, led by $170 million in ETH and $104 million in BTC.

95% of these were longs, triggered by moderate pullbacks of 3% for ETH and 2% for BTC, Forster said.

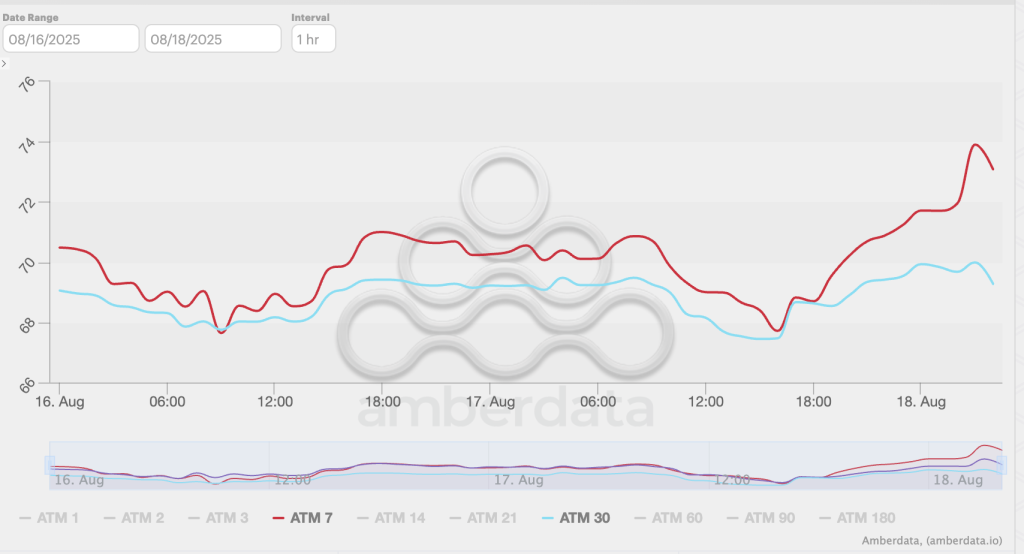

Forster continued: “In response, short-dated (7-day) ETH implied volatility spiked from 68% to 73% in the last 24 hours, while 30-day IV remains stable – a sign that markets expect heightened volatility in the immediate term.”

Meanwhile, the chance of BTC hitting $100,000 before the end of September rose from 15% to 21%.

Also, the chance of ETH hitting $4,000 in the same period rose from 45% to 60%.

“Traders are bracing for a volatile end to August, with all eyes on Jackson Hole,” Forster concluded.

Levels & Events to Watch” Next

At the time of writing on Thursday morning, BTC trades at $115,118. Earlier in the day, it fell to the week’s low of $114,740. It recuperated to $116,996, aiming for the $117,000 mark, before returning to the current level.

It’s currently down 7.3% from its all-time high of $124,128 hit five days ago. The charts signal uncertainty, with possible swings either way.

Ethereum also saw quite a choppy day of trading. It is currently trading at $4,237. Its intra-day was $4,204, while the day’s high stands at $4,382.

This is compared to the 7-day range of $4,180 at the lowest point and the intraweek high of $4,776.

Furthermore, the highest point reached over the past week is $4,776. The price will attempt to rise back to this level, per analysts. Should it hold it, it may finally fit a new ATH soon.

Furthermore, the crypto market sentiment continues dropping, but it still remains in the neutral zone. The crypto fear and greed index fell from 56 yesterday to 53 today.

This signals that the risk appetite is decreasing at the moment. That said, while the trader confidence is down, it’s still present, and the bullish sentiment persists.

Meanwhile, the US BTC spot exchange-traded funds (ETFs) continued with outflows on Monday. By the end of the trading day, another $121.81 million bled out of the funds.

While Bitwise recorded inflows of $12.66 million, BlackRock and Ark&21Shares lost $68.72 million and $65.75 million, respectively.

On the same day, the US ETH ETFs also lost $196.62 million. The cumulative total net inflow now stands at $12.47 billion, as of 18 August.

Six of the nine funds recorded flows, all of them negative. The highest among these is BlackRock’s $87.16 million, followed by Fidelity’s $78.4 million.

Meanwhile, US (Illinois) Governor JB Pritzker signed two new bills to regulate crypto activity in the state and criticised US President Donald Trump’s approach to digital assets.

“While the Trump Administration is letting crypto bros write federal policy, Illinois is implementing common-sense protections for investors and consumers,” Pritzker said.

Speaking of the US and regulation, the US Treasury has called on the public to provide feedback required by the GENIUS Act on how the government could help prevent “illicit finance risks” tied to digital assets.

“This request for comment offers the opportunity for interested individuals and organizations to provide feedback on innovative or novel methods, techniques, or strategies that regulated financial institutions use, or could potentially use, to detect illicit activity involving digital assets,” the U.S. Treasury states.

Quick FAQ

- Why did crypto move with stocks today?

Both the crypto and the stock markets have largely decreased over the past day. By Monday’s closing time, the S&P 500 was down by 0.010%, the Nasdaq-100 increased by 0.0071%, and the Dow Jones Industrial Average fell by 0.076%. Investors are preparing for the Fed Chair speech this week, as well as a series of retail sector earnings reports that will show tariff impacts and consumer spending.

- Is this dip sustainable?

The current dip is still within the range predicted by analysts as possible before the next leg up in the mid- to long-term. That said, the markets are paying close attention to the incoming macroeconomic signals.

But what else is happening in crypto news today? Follow our up-to-date live coverage…

The post Why Is Crypto Down Today? – August 19, 2025 appeared first on Cryptonews.