Digital asset investment products recorded a staggering US$3.7 billion in inflows last week, marking the second-largest weekly total in history, according to CoinShares analyst James Butterfill.

In a blog post the analyst reports the surge in capital drove total assets under management (AuM) across crypto exchange-traded products (ETPs) to an all-time high of US$211 billion.

Trading activity also intensified, with ETP volumes reaching US$29 billion—double the year’s weekly average.

Butterfill notes that July 10 alone saw the third-largest daily inflow on record, showing intensifying institutional appetite and reinforcing the bullish sentiment that has sustained 13 consecutive weeks of net inflows.

Bitcoin and Ethereum Lead the Charge

Bitcoin remains the dominant asset of choice, attracting US$2.7 billion in inflows, raising its total AuM to US$179.5 billion. This milestone means that Bitcoin ETPs now account for 54% of the value held in gold exchange-traded products, underscoring the asset’s growing stature as digital gold.

Despite the rally, short bitcoin products recorded little activity, suggesting a prevailing bullish bias. Ethereum also made headlines, securing its twelfth straight week of positive flows.

With US$990 million added last week alone—the fourth-highest weekly figure on record—Ethereum’s 12-week cumulative inflows now represent 19.5% of its AuM, outpacing Bitcoin’s 9.8% over the same period.

According to Butterfill, this indicates a growing investor conviction in Ethereum’s long-term fundamentals.

Regional Divergence and Altcoin Trends

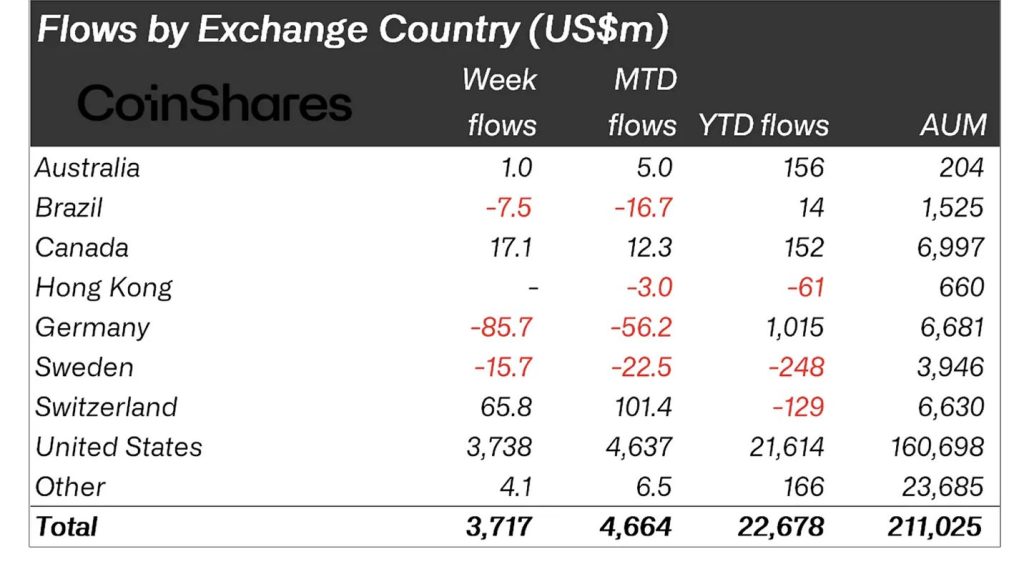

Regionally, the United States dominated flows with the entirety of the US$3.7 billion weekly inflow.

Meanwhile, Germany experienced notable outflows of US$85.7 million, pointing to possible regional profit-taking or shifting regulatory sentiment. Switzerland and Canada bucked the trend, posting moderate inflows of US$65.8 million and US$17.1 million, respectively.

Among altcoins, Solana stood out with US$92.6 million in inflows, reinforcing its position as a favored layer-1 bet outside of Ethereum. In contrast, XRP suffered the largest weekly outflows at US$104 million, hinting at waning investor confidence or reactionary moves following recent price action.

Butterfill emphasized that despite some mixed altcoin performance, the sustained capital inflow across the broader market is a strong indicator of renewed institutional and retail engagement in the digital asset sector.

The post Digital Asset Inflows Hit $3.7B in Second-Biggest Week Ever, Pushing Total AuM to $211B: Coinshares appeared first on Cryptonews.