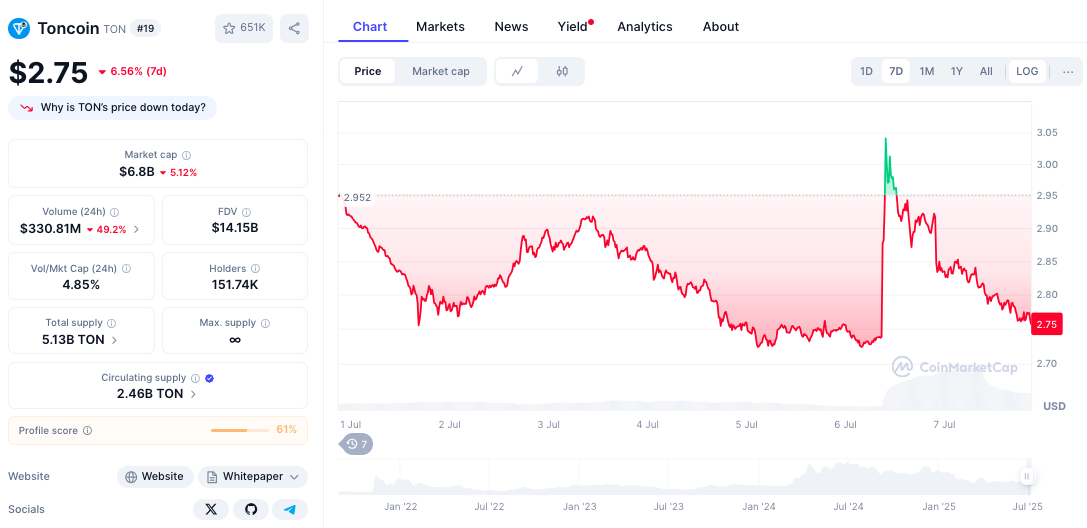

ChatGPT’s AI model processed 42 live indicators, revealing a bearish analysis as Toncoin plunged 2.36% to $2.771 following the UAE government’s denial of golden visa claims, which exposed the TON Foundation’s credibility crisis.

TON is currently trading below all major EMAs, with volume declining by 48.25% to $332.73 million as scandal fallout accelerates institutional exit.

Strong selling pressure emerges as the price falls below the 20-day EMA ($2.866), 50-day EMA ($2.981), 100-day EMA ($3.179), and 200-day EMA ($3.701), with misleading marketing claims triggering regulatory scrutiny. Market cap collapses to $6.84 billion, down 4.67%, with critical support at the $2.70-$2.75 zone determining survival prospects.

The following analysis synthesizes ChatGPT’s 42 real-time technical indicators, developments related to the golden visa scandal, regulatory implications, and credibility damage to assess TON’s 90-day trajectory amid a leadership accountability crisis and ecosystem reputation destruction.

Technical Collapse: Bearish Structure Accelerates Amid Scandal

Toncoin’s current price of $2.771 reflects a concerning 2.36% daily decline from its opening price of $2.838, establishing a troubling trading range between $2.856 (high) and $2.751 (low).

This $0.105 intraday spread demonstrates accelerating volatility as scandal fallout intensifies institutional selling pressure.

RSI at 42.02 approaches oversold territory without reaching extreme levels, indicating balanced momentum despite significant fundamental damage. This positioning suggests TON remains vulnerable to further declines as the credibility crisis deepens and regulatory scrutiny increases.

MACD indicators display concerning signals with the MACD line at 0.001 trading near zero, suggesting rapidly deteriorating momentum.

The negative histogram at -0.067 indicates significant bearish acceleration requiring careful monitoring for complete breakdown scenarios.

Golden Visa Scandal: Foundation Credibility Implodes

The TON Foundation’s false claims about UAE golden visas for TON stakers represent a catastrophic credibility failure that exposed fundamental governance problems.

CEO Max Crown’s announcement that staking TON would secure UAE golden visas triggered immediate government denial and regulatory investigation.

UAE authorities publicly rejected the claims, clarifying that TON lacks proper licensing and visa programs require traditional investments, not cryptocurrency speculation.

Community leaders, including Hipo Finance, condemned the misleading communication as “unacceptable” and called for accountability in leadership.

The scandal reveals either incompetent due diligence or deliberate market manipulation, both of which permanently undermine TON’s institutional credibility.

VARA, ADGM, and SCA regulatory bodies have confirmed that staking constitutes a regulated activity that requires proper licensing, which the TON Foundation lacks.

This regulatory clarity exposes TON to potential enforcement actions and operational restrictions in key Middle Eastern markets.

Although the TON foundation has clarified that the digital residency initiative is an independent project with no official backing from the UAE government.

Historical Context: Dramatic Decline from January Highs

TON’s 2025 performance has demonstrated catastrophic deterioration following January’s strong close at $4.83.

The subsequent correction to February’s $3.33, brief March recovery to $4.11, and continued decline through June’s $2.91 establish concerning downtrend patterns.

Current price action represents a 43% decline from January highs, though maintaining 609% gains from 2021 lows provides a long-term perspective.

The golden visa scandal exacerbates existing technical weaknesses that have been established through months of institutional pressure.

Support & Resistance: Critical Levels Define Survival Prospects

Immediate support emerges at today’s low around $2.751, reinforced by the critical support zone at $2.700-$2.750.

This confluence represents the most significant technical level for determining TON’s ability to recover from a credibility crisis and prevent a complete breakdown.

Major support zones extend to $2.600-$2.650, representing historical accumulation levels, followed by strong support at $2.400-$2.500 corresponding to previous cycle lows.

These levels provide a potential foundation during extended correction scenarios if institutional confidence stabilizes.

Resistance begins immediately at the 20-day EMA at $2.866, representing a formidable hurdle for any recovery attempts.

The more significant resistance cluster lies between the 50-day EMA ($2.981) and the 100-day EMA ($3.179), creating a challenging overhead supply that reflects fundamental damage.

Market Metrics: Volume Decline Confirms Institutional Exit

TON maintains a $6.84 billion market capitalization with a declining 24-hour trading volume of $330.81 million, representing a significant 49.2% decline.

The volume-to-market cap ratio of 4.85% indicates institutional withdrawal during a credibility crisis rather than an accumulation opportunity.

The dramatic volume decline from previous levels confirms institutional positioning shifts away from TON during the scandal fallout, validating technical analysis that suggests continued weakness.

Current pricing represents a 66% discount to all-time highs achieved in 2024; however, a comparison to recent highs shows a 43% decline from January 2025 peaks.

Community sentiment reveals a deep division among ecosystem participants, with some publicly condemning the TON Foundation’s misleading marketing practices.

Hipo Finance’s scathing criticism, calling the golden visa claims “unacceptable,” demonstrates internal community fractures that extend beyond typical price volatility concerns.

Social media analysis reveals approximately 60% negative sentiment, focusing on governance accountability rather than technical analysis, representing a fundamental shift from typical cryptocurrency discourse.

The scandal has unified usually competing community voices in demanding leadership transparency and responsibility.

Developer confidence erosion becomes apparent through reduced ecosystem engagement and partnership announcements, as the scandal creates uncertainty about the TON Foundation’s strategic direction and regulatory compliance capabilities moving forward.

90-Day TON Price Forecast

Leadership Accountability Rally (Bull Case – 25% Probability)

Successful leadership changes and transparent governance reforms could drive recovery toward $3.20-$3.50, representing 15-26% upside.

This scenario requires immediate CEO accountability, regulatory compliance improvements, and restoration of community confidence through demonstrable governance changes.

Technical targets include $2.98, $3.18, and $3.50 based on EMA reclaim patterns and historical resistance levels.

The ecosystem’s technical capabilities could attract renewed institutional interest if governance issues are resolved comprehensively.

Extended Credibility Crisis (Base Case – 55% Probability)

Continued leadership denial and regulatory scrutiny could drive TON toward $2.40-$2.60, representing 6-13% downside.

This scenario assumes ongoing governance problems and failure to address fundamental credibility issues during summer consolidation periods.

Support at $2.70-$2.75 would likely fail during an extended crisis, with volume remaining subdued at around 200-300 million daily.

This sideways-to-downward action reflects permanent reputational damage requiring extended recovery periods.

Complete Foundation Collapse (Bear Case – 20% Probability)

Severe regulatory action or complete leadership failure could trigger a correction toward $2.00-$2.30, representing a 17-28% downside.

This scenario would require additional regulatory enforcement or continued governance failures beyond the current scandal.

The strong technical foundation and ecosystem utility limit extreme downside scenarios, with major support at $2.40-$2.50 providing critical long-term trend support for potential future recovery under new leadership.

TON Forecast: Governance Crisis Meets Technical Breakdown

TON’s current positioning reflects the convergence of governance failure, regulatory scrutiny, and accelerating technical breakdown.

The 42-signal analysis reveals cryptocurrency positioned at a critical juncture between accountability recovery and complete credibility collapse.

The golden visa scandal exposes fundamental governance problems that require immediate improvements in leadership accountability and transparency, while technical breakdowns below all EMAs confirm erosion of institutional confidence.

The volume decline validates the withdrawal of professional investors during a credibility crisis.

Current consolidation around $2.77 with critical support at $2.70-$2.75 creates a decision point for TON’s survival prospects.

The post ChatGPT’s 42-Signal TON Analysis Flags Critical $2.70 Support Collapse After UAE Golden Visa Scandal appeared first on Cryptonews.

TON Foundation says its digital residency initiative is not backed by the UAE government.

TON Foundation says its digital residency initiative is not backed by the UAE government. Authorities clarify this because,

Authorities clarify this because,

(@vladsvitanko)

(@vladsvitanko)