As a former manager of Guns N’ Roses and Morrissey, Merck Mercuriadis knows a few things about making a comeback. Now, the veteran music executive is attempting to stage his own after a rollercoaster ride on the public markets left him out of a job and on the sidelines of an industry he helped transform.

Hipgnosis, which Mercuriadis launched in 2018 to buy song rights and was sold last year, is back with bigger ambitions. Mercuriadis plans a new investment group under the same name, bringing together artists and their managers as co-owners in a partnership structure to make music and to buy the rights to songs from others.

The 61-year-old Canadian-born executive can already claim to have transformed the modern music business, taking a once esoteric industry in owning composition rights and helping create a multibillion-dollar asset class on the radar of the world’s biggest investors.

He was at the vanguard of a wave of institutional money into the sector as Hipgnosis went on a $2bn spending spree, buying the catalogues of artists including Shakira and Mark Ronson.

Now, having kept his silence since leaving Hipgnosis when it was sold to Blackstone (and rebranded as Recognition Music), he says he has unfinished business. He acknowledges, given he found the investment community to be as cut-throat as the music business, that there were questions about why he would want to return to the industry. But he adds: “The work that we started is not complete yet, because the music industry is only beginning to be institutionalised.”

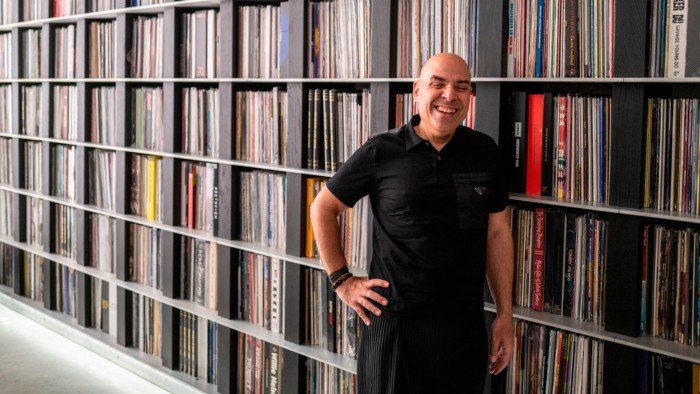

Meeting in his London home — with its vast collection of floor-to-ceiling vinyl — Mercuriadis is clad in trademark black Prada that he says he always wears to avoid having to spend time choosing something else. He would rather think, he says, about music, an art form that has been a life-long passion and that still seeps into his every conversation.

Mercuriadis says he came up with the idea for Hipgnosis in 2009 when he saw the growing popularity of Spotify. A US platinum record used to mean selling 1mn copies in a country that has almost 340mn people, he says, but “streaming [gave] the other 339mn a reason to pay for music”.

Mercuriadis often seems to know everyone in music, dropping anecdotes about helping one 1970s legend prepare for Glastonbury and others to reinvent their careers. He has a neat trick of asking people about their favourite artist only to respond that he has worked with them, counts them as friends, owned their songs or at least seen them before they were famous.

This is the reason many musicians trust him as a manager or owner of their music. One former colleague describes him as a music obsessive and “ultimate fanboy who just wants to be part of the world that his heroes inhabit”.

Investors, however, have had a trickier relationship with the LA-based executive, who was previously an artist manager and boss of Sanctuary, a UK-based music company that came close to collapse amid questions over its accounting.

Mercuriadis encouraged Wall Street, hungry for new sources of returns, to buy into his vision of a long-term asset class, alongside his own higher-minded ambitions to help songwriters whose work could, he says, “languish after they’ve had their hit parade time”.

He sold the concept of song rights bringing a steady income based on performance, streaming and use in TV, gaming and films and Hipgnosis and its rivals’ abilities to “work” assets by encouraging this use and giving a new lease of life to many tracks.

“The opportunity for institutional investors was massive, and massive enough to be able to both change valuations and give people a great return,” he says.

By the end of 2021, his public company was trading at its highest ever share price. But its fortunes turned when the sharp rise in interest rates after the start of the Ukraine war pushed up the discount rate used to calculate asset values and its dividend looked less attractive.

Cuts to the value of Hipgnosis’s portfolio and questions over its debt levels and corporate governance brought a strategic review by a new board, which led to last year’s sale of the company. Mercuriadis stepped down following the acquisition, with some rivals in the industry predicting that this time it would be tough for the music executive to bounce back.

Mercuriadis was accused of fuelling excessive pricing by rivals by flooding the market with money and overpaying for rights. He rejects this, saying Hipgnosis’s portfolio was valued in line with industry “average” multiples of close to 16 times, with returns guaranteed by a “101-year copyright-protected income stream”.

Former colleagues say he often seemed better suited to being a manager of music than money. But he does not seem bruised by the downfall of Hipgnosis and the criticism he faced, blaming activist investors for the sudden end of his former company. The $1.6bn sale to Blackstone — and subsequent returns for the US private equity fund — has shown the deals he led to be good, he says.

“I’m proud of the work, I’m very proud of the catalogue, I am proud of the return that we gave to the investors . . . You pay the price that you know is the right price because the asset is going to become more valuable. You’re only ever going to be able to buy the Red Hot Chili Peppers once.”

The wave of dealmaking started by Hipgnosis shows no sign of stopping: last year Sony alone struck deals worth more than $1bn for songs written and performed by Queen and Pink Floyd.

Mercuriadis’s new venture already has investor commitments in the “hundreds of millions” of dollars, according to people familiar with the matter. Talks are taking place for the first two acquisitions.

“I’m going to amass five or six really important management companies, all of which have superstar artists and superstar managers that go with them”, Mercuriadis says. “It’s all about them having control and all about them making the majority of the money [rather than labels].”

Increasingly, he says power lies with artists that have amassed large followings on social media before record labels approach them. Why should they hand over the financial benefit to labels?

Mercuriadis describes this as a “value shift” from music companies to artists and managers. The company will work with labels, streaming platforms and talent agencies as “service providers” but the “equity [and income] will be in favour of the artist”.

Mercuriadis will also buy music catalogues that will provide “very predictable, reliable, low-risk” income, and sit alongside the new music being created by its artists. His ultimate ambition would be to buy back the $2bn of music he amassed at Hipgnosis.

“One of my goals is to buy the catalogue back. Blackstone are very smart people. They’re getting a great return on the catalogue that I put together. So I’m going to have to pay properly for it. The one thing that everyone has said post the sale is, ‘OK, this now seems cheap.’”

Mercuriadis also wants to create a songwriters’ “guild” to help them negotiate with streaming platforms. “It all starts with the song . . . yet these people continue to be the lowest-paid people in the room,” he says.

“It’s these people who helped make me who I am . . . and I want to keep giving back.”