Bitcoin Cash (BCH) fell 7.8% this week as $BCH crashed through $485, just as futures open interest pumped 24%, exposing a dangerous gap between speculative bets and a six-year low in network activity.

The altcoin’s 20% rally in June now appears to be built on quicksand. While derivatives traders piled in, daily active addresses cratered to 2018 levels. With RSI flashing bearish divergences, BCH must hold $400 support to avoid surrendering all recent gains.

Can $BCH Sustain Its Speculative Rally Into a Real Bull Run?

Launched in August 2017 as a Bitcoin fork, Bitcoin Cash ($BCH) was designed to facilitate faster and cheaper transactions by increasing the block size limit from 1 MB to 8 MB.

The network, secured by a proof-of-work consensus mechanism, currently has approximately 19.8 million $BCH in circulation, with a maximum supply capped at 21 million $BCH.

A major upgrade on May 15, 2025, introduced targeted virtual-machine limits, high-precision arithmetic, and an adaptive block-size algorithm to improve scalability and reliability.

While these enhancements are intended to support more complex on-chain applications, adoption remains low—daily active addresses recently hit six-year lows, indicating that recent price movements may be driven more by speculation than utility.

Despite muted on-chain activity, institutional engagement has increased.

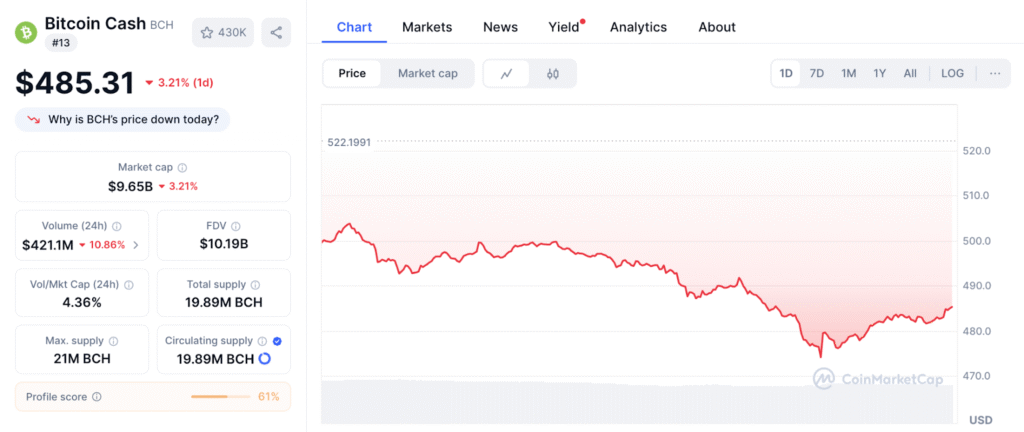

Open interest in $BCH futures rose by over 24% in June, while trading volume more than doubled after $BCH surpassed $500 on June 27. This briefly pushed its market capitalization above $10 billion, ranking it 12th, though it has since slipped to 13th with a $9 billion valuation.

Analysts point to $BCH’s scalability and stability above $400 as key bullish factors but warn that bearish RSI divergences could curb further gains.

Bitcoin Cash’s DeFi ecosystem shows potential but struggles for traction. Despite $BCH’s low fees and high throughput—advantages that attract niche developers—the chain’s $7.9 million total value locked (TVL) and meager $13,841 daily DEX volume reveal scant real-world usage.

This disconnect grows starker when examining recent price action. While $BCH rocketed 20% in June, on-chain activity hit six-year lows, confirming the rally was fueled by derivatives speculation rather than organic growth.

BCH must convert its technical strengths (like May’s scalability upgrades) into merchant adoption and developer incentives for sustainable adoption. The 24% increase in futures open interest suggests that market confidence exists; now, the network needs to deliver corresponding on-chain utility.

For $BCH to sustain long-term growth, it must strengthen merchant adoption and developer incentives. While recent upgrades and rising futures interest provide a foundation, broader adoption will depend on whether the network can translate technical improvements into real-world usage.

BCH/USDT Chart Analysis: From Bullish Breakout to Bearish Retracement and Potential Reversal

The BCH/USDT chart reflects a clear transition through multiple market phases, beginning in late June and continuing into early July.

Initially, the price exhibited a strong uptrend, characterized by a steep breakout and large green candles with substantial volume support. This rapid rally propelled BCH from around $475 to just under $510.

This bullish momentum stalled as the price entered a sideways consolidation phase, forming a range-bound pattern between approximately $500 and $510. During this period, volume declined, and MACD flattened, indicating indecision and weakening buying pressure.

As consolidation broke to the downside, BCH entered a steady downtrend, creating a sequence of lower highs and lower lows. Price declined consistently with minor relief bounces, eventually breaking below the $480 support region. The downtrend was accompanied by increasing red volume bars, suggesting rising selling pressure.

Most recently, the chart shows signs of a bullish bounce, with a sharp reversal from the $472–$474 zone. This was confirmed by a bullish MACD crossover beneath the zero line, indicating that bearish momentum has slowed and buyers are stepping in. The volume also picked up slightly, reinforcing the short-term bullish reversal.

However, for this recovery to be sustainable, BCH needs to reclaim the $488–$490 resistance zone and maintain momentum above the MACD baseline. If rejected, the price risks retesting the $474 support.

The post Bitcoin Cash Futures Jump 24% as Active Addresses Hit Six-Year Low – Risk Ahead? appeared first on Cryptonews.