Japan’s Metaplanet Inc. has intensified its aggressive Bitcoin (BTC) strategy, acquiring an additional 1,005 BTC and issuing ¥30 billion in zero-interest ordinary bonds to expand its holdings even further.

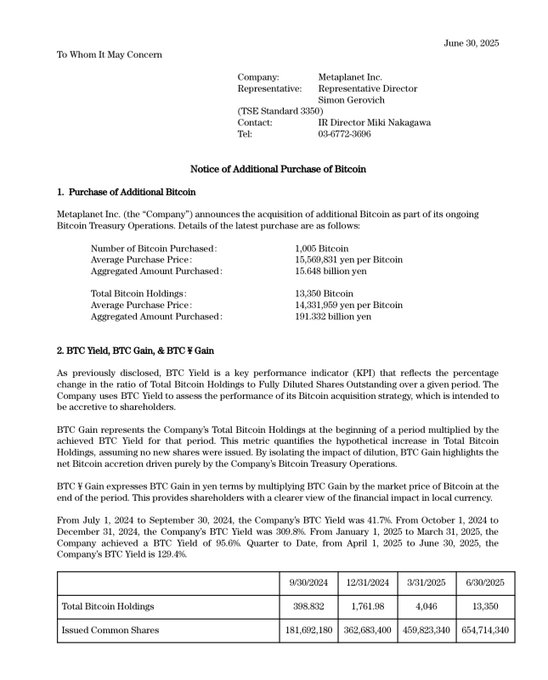

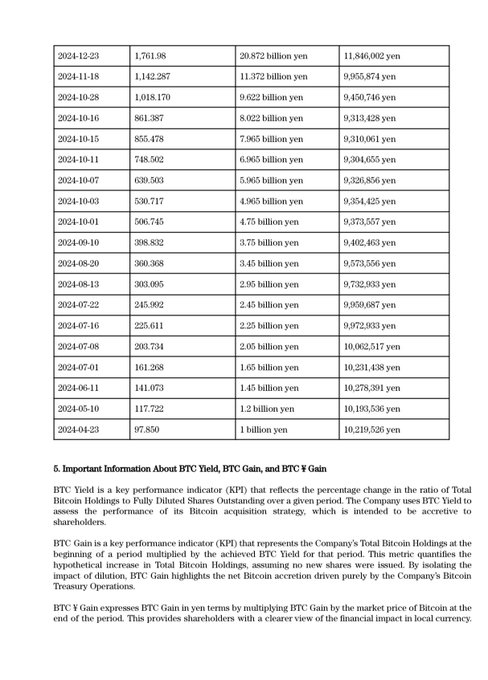

The Tokyo-based company disclosed the move in a public filing on June 30, confirming that it spent ¥15.648 billion (approximately $108 million) to complete the latest purchase at an average price of ¥15,569,831, or around $107,430 per Bitcoin.

*Metaplanet Acquires Additional 1,005 $BTC, Total Holdings Reach 13,350 BTC*

Metaplanet’s BTC holding has surged past Galaxy Digital and CleanSpark

With this latest acquisition, Metaplanet’s total Bitcoin holdings now stand at 13,350 BTC, valued at over $1.4 billion at current market prices.

Metaplanet has officially become the fifth-largest corporate holder of Bitcoin, overtaking both Galaxy Digital, which holds 12,830 BTC, and CleanSpark, with 12,502 BTC.

This leap comes just a week after the company surpassed Tesla in total Bitcoin reserves, highlighting Metaplanet’s rapid rise among top public BTC holders worldwide.

Just three months ago, the firm held only 3,350 BTC, meaning it has added an impressive 10,000 BTC in a span of weeks, showcasing its unparalleled accumulation pace.

CEO Simon Gerovich emphasised the speed of progress, noting that the firm hit its year-end goal of 10,000 BTC by June 16, far ahead of schedule.

Metaplanet has been funding the Bitcoin spree with 0% bonds

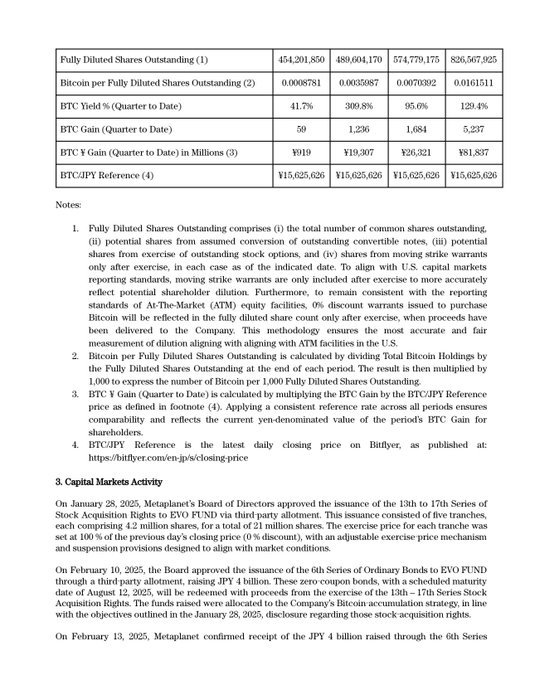

To support its ambitious accumulation strategy, Metaplanet has issued 18 series of 0% ordinary bonds, and it has now issued its 19th series of ordinary bonds worth ¥30 billion, or roughly $207 million, to EVO FUND.

The bonds, which carry zero interest and mature in December 2025, will partly refinance ¥1.75 billion in existing secured debt and partly fund further Bitcoin acquisitions.

This zero-interest bond issuance underlines investor confidence in Metaplanet’s long-term strategy and reflects institutional appetite for exposure to Bitcoin-linked growth without direct crypto risk.

Despite the absence of interest, the bond was swiftly secured, underscoring the unique positioning of Metaplanet in bridging traditional finance with digital assets.

Metaplanet shares jumped 10% after the announcement

Following the Bitcoin purchase news, Metaplanet’s stock surged over 10% on Monday, climbing to ¥1,647 per share, according to Google Finance data.

The stock has now gained 53.5% in the past month and is up a staggering 370.7% year-to-date, reflecting growing investor enthusiasm for its Bitcoin-centric strategy.

Even though Metaplanet remains Japan’s most shorted stock, the positive market reaction suggests a shift in sentiment as institutional and retail investors take note of its performance.

The BTC Yield, a key metric used by the company to track Bitcoin’s value growth per share, jumped from 95.6% to 129.4% in the April–June quarter, further validating its approach.

Looking beyond 2025 with the ‘555 Million Plan’

Metaplanet has made it clear that Bitcoin is more than a treasury asset—it’s a cornerstone of its business model and a hedge against inflation and fiat devaluation.

Earlier this month, the company launched its “555 Million Plan,” aiming to raise ¥555 billion ($5.4 billion) to accumulate 210,000 BTC by 2027, or 1% of Bitcoin’s total supply.

*Metaplanet Announces Accelerated 2025-2027 Bitcoin Plan: Targeting 210,000 $BTC by 2027*

Full Presentation: contents.xj-storage.jp/xcontents/3350…

This goal marks a dramatic expansion from its earlier target of 21,000 BTC by 2026 and signals the company’s long-term commitment to becoming a global Bitcoin powerhouse.

Although scepticism persists, especially from traditional investors, Metaplanet’s transparency and pace of execution have drawn attention across markets.

As Bitcoin (BTC) trades around $107,786 and macroeconomic uncertainty lingers, Metaplanet’s bold strategy may continue to redefine corporate treasury management in Asia and beyond.

The post Metaplanet buys 1,005 BTC, issues over $200M in 0% bonds to acquire more Bitcoin appeared first on Invezz