The Aptos (APT) layer-1 blockchain has successfully penetrated the crucial $5 psychological resistance level for the second time this June, reigniting bullish sentiment as exchange-traded fund (ETF) developments gain momentum.

Following its dramatic decline from $8 in February, APT has remained constrained within a $4.19 – $6.08 trading range, forming double bottoms in April and again on June 22, technical patterns that often signal an impending breakout.

At the time of writing, APT trades at $4.99, marking a 7% daily increase after briefly touching a session high of $5.297 from an intraday low of $4.68.

This surge has propelled the expanding layer-1 blockchain back above the $3 billion market capitalization threshold, accompanied by a substantial 75.59% increase in trading volume, which has generated over $447 million in APT transactions within the past 24 hours.

Bitwise Files for First-Ever Aptos ETF—Wall Street Coming?

The positive momentum follows a significant regulatory development on June 26, when the U.S. Securities and Exchange Commission (SEC) provided updates suggesting the potential debut of an Aptos ETF, stemming from Bitwise Investment’s S-1 amendment filing to list such a product.

Bloomberg analyst Eric Balchunas highlighted that the key advancement in the amendment involves the inclusion of “in-kind” creation and redemption mechanisms, a feature absent from the initial March filing.

Beyond ETF prospects, the Aptos ecosystem has experienced notable expansion with the recent launch of Shelby, a decentralized storage protocol that has contributed to the network’s growing adoption.

Shelby has enhanced the Real World Asset (RWA) capabilities of the Aptos blockchain, positioning it as a cloud-grade, Web3-native storage solution that competes with established platforms like Arweave and Filecoin.

The network has now surpassed $540 million in on-chain RWAs, securing its position among the top three blockchains for real-world asset tokenization.

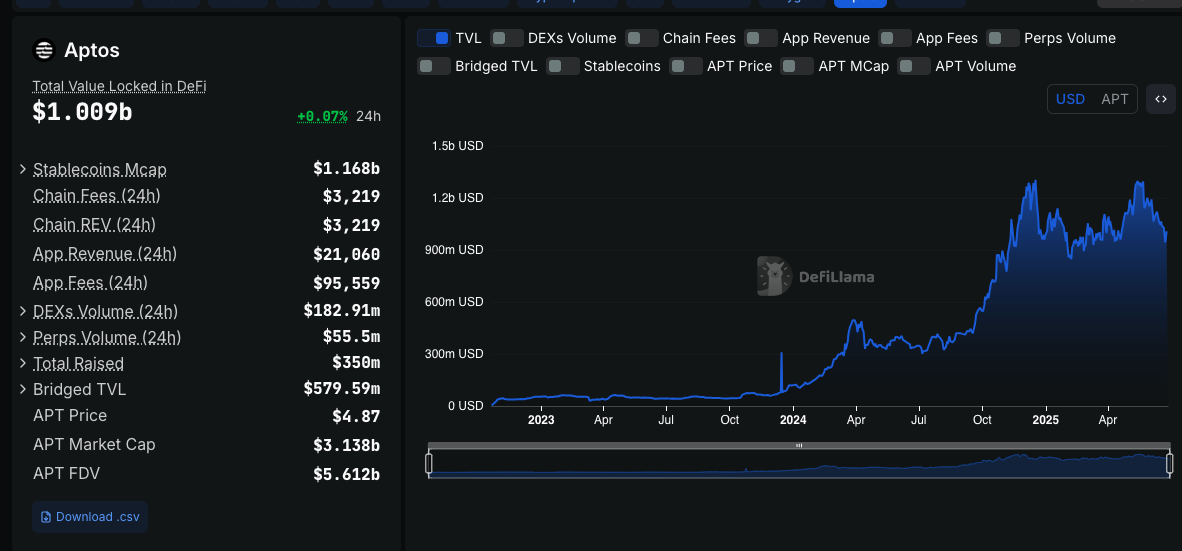

According to DefiLlama data, Aptos has also crossed the $1 billion milestone in total value locked (TVL) for on-chain assets, placing it in direct competition with established networks, including Avalanche, Sui, and Hyperliquid, all of which are members of the exclusive $1 billion TVL club.

$1 Billion Milestone: Aptos Layer-1 Blockchain Crushes TON, Cardano in Stablecoin Race

Aptos has distinguished itself as the highest-rated blockchain for stablecoin integration, evidenced by robust growth in stablecoin issuance across the network.

Stablecoin circulation on Aptos has exceeded the $1 billion threshold, at least $500 million more than comparable networks, including TON, Cardano, and Sei blockchain.

Veteran cryptocurrency traders anticipate significant price appreciation for APT given the confluence of growth catalysts and bullish technical developments.

First1Bitcoin, a Bitcoin investor since 2015, observed that Aptos exhibits strong reversal signals following an extended downtrend.

After the recent price recovery from the critical demand zone near $5, he projects $8 and $10 as the next logical price targets.

Another market analyst noted that Aptos has rebounded from long-term support levels while successfully flipping above the 50-day exponential moving average, anticipating a potential 100-200% increase from current price levels.

Falling Wedge Breakout Targets 65% Surge to $8 Level

The APT/USDT daily chart displays a bullish breakout from a prolonged falling wedge pattern, a classic reversal formation.

After months of declining highs and lows, price action has decisively closed above the upper trendline, indicating a potential trend reversal.

The breakout pattern suggests an upside target of approximately 65.19%, projecting the $8 level based on the height of the wedge formation.

This technical structure suggests that sustained trading above the former wedge resistance (now support) could drive prices higher in the short-to-medium term.

The APT/USDT weekly timeframe shows a robust multi-touch support zone within the $4.00-$4.20 range, which has served as a launching pad for multiple bullish reversals since late 2022.

Price is currently rebounding from this key zone after forming a potential double bottom pattern, suggesting renewed bullish interest if the level is maintained.

The structure indicates that a sustained close above this support could initiate a new upward cycle, initially targeting the $10.52 level, followed by intermediate resistance levels at $15.26 and $19.43.

The bullish projection remains valid as long as APT maintains trading above the critical demand zone; a breakdown below this level would invalidate the setup and shift sentiment bearish.

The post Aptos Explodes 7% as Bitwise Engages SEC on APT ETF – $7.5 Next Target? appeared first on Cryptonews.

BREAKING:

BREAKING: