Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Amazon, Microsoft and Google parent Alphabet look set to ramp up capital spending, as the world’s biggest cloud computing groups build up capacity to serve the growth of generative artificial intelligence.

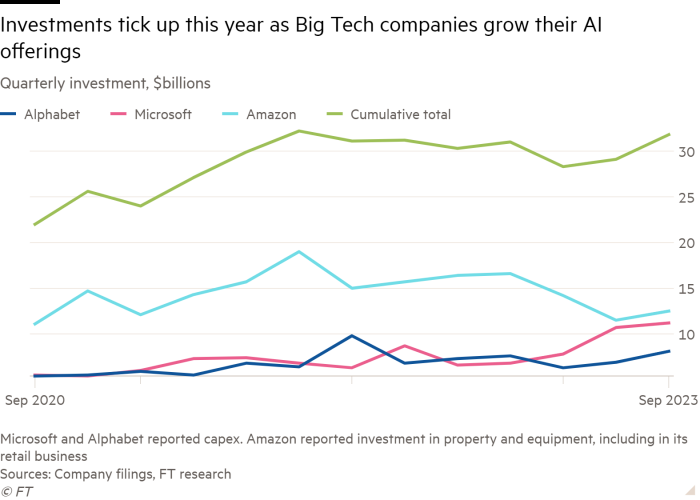

The Big Tech groups, which together dominate the global cloud market, have boosted investment in computing infrastructure over the past few years.

Capital spending rose to a combined $42bn in the three months to September, almost 20 per cent more than the same period in 2021. That figure, which comprises reported corporate capex from Alphabet and Microsoft and Amazon’s businesswide investment in property and equipment, marked a 10 per cent rise from the quarter to June. Analysts expect the pace of cloud-related spending to accelerate next year.

Executives from the companies said last month that significant chunks of capital spending are going towards the generative AI systems that require huge amounts of computing power and data-crunching. Amazon chief executive Andy Jassy predicted that generative AI will drive “tens of billions in revenues”.

The three tech giants are vying to increase their shares of the cloud market — the business drives Amazon’s overall profits in particular — and must remain competitive in AI to hold on to their customers. Each wants to win new customers with a suite of state of the art AI tools and services, and use the technology to enhance other core products.

The rivals “have to compete on generative AI or they’ll lose relevance and market share”, said Jeff Pearson, managing director at technology consultancy Slalom. “All that is going to require a tremendous amount of capex”, for equipment such as servers and data centres.

Bank of America analysts predict the collective cloud-related capex of Amazon, Alphabet and Microsoft will rise at an accelerated 22 per cent next year to $116bn. This year they raised their 2023 forecast from no growth to 14 per cent. Last year the companies’ combined investment increased 20 per cent from 2021 to $84bn, BofA said.

Microsoft is “ramping up” investment at the fastest pace to support “an uptick in AI workloads” and their broader cloud business, said BofA analyst Justin Post. All three companies, however, were “investing ahead of future revenues”, he added.

Amazon’s quarterly investment figures include assets for its retail business, which it invested heavily in during the pandemic. Analysts said the fall in Amazon’s third-quarter investments, compared with last year, reflected a pullback in ecommerce spending. Amazon said in October its retail capex would fall this year while its cloud-related investment would rise.

The need for huge amounts of costly computing capacity to develop generative AI has pushed AI start-ups to seek partnerships with the Big Tech groups. Microsoft took an early lead and signed an exclusive deal with start-up OpenAI, now seeking a valuation of $86bn. The tie-up gives Microsoft’s customers access to the technology behind ChatGPT.

Microsoft this month became the first in the industry to make the technology behind ChatGPT available as a standard feature in a widely used software product, with the launch of its Copilot generative AI assistant. The upgrade will add as much as 83 per cent to businesses’ monthly software bill.

Microsoft said AI-related demand delivered an unexpected boost to cloud growth in the most recent quarter. Alphabet and Amazon were vaguer in their earnings reports about the impact of their AI investment.

None of the three has “unique advantages on the capex side”, said Charles Fitzgerald, an angel investor and former Microsoft executive. “All have a ton of money on the balance sheet. All are committed to leading in the AI era, so will spend what needs to be spent.”

The focus on growing a capital-intensive business could squeeze margins, analysts warned. High levels of capex were “not going to show up right away” but could be a “headwind” to margins over time and also hit cash flow, said BNP Paribas analyst Stefan Slowinski.

Alphabet said in October that it was committed to “re-engineering our cost base” to “create capacity” for AI-related investments. Microsoft said margins “may decrease” as a result of cloud and AI investments.