Bim

The Industrial Select Sector (XLI) halted its two week losing streak to close the week ending Nov. 3 +5.35%, and so did the SPDR S&P 500 Trust ETF (SPY) which gained +5.85%.

All the 11 S&P 500 sectors were in the green for the week, which saw the Federal Reserve keeping the interest rates steady. Year-to-date, XLI has risen +3.45%, while SPY has soared +13.67%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +20% each this week. YTD, all these 5 stocks are in the green.

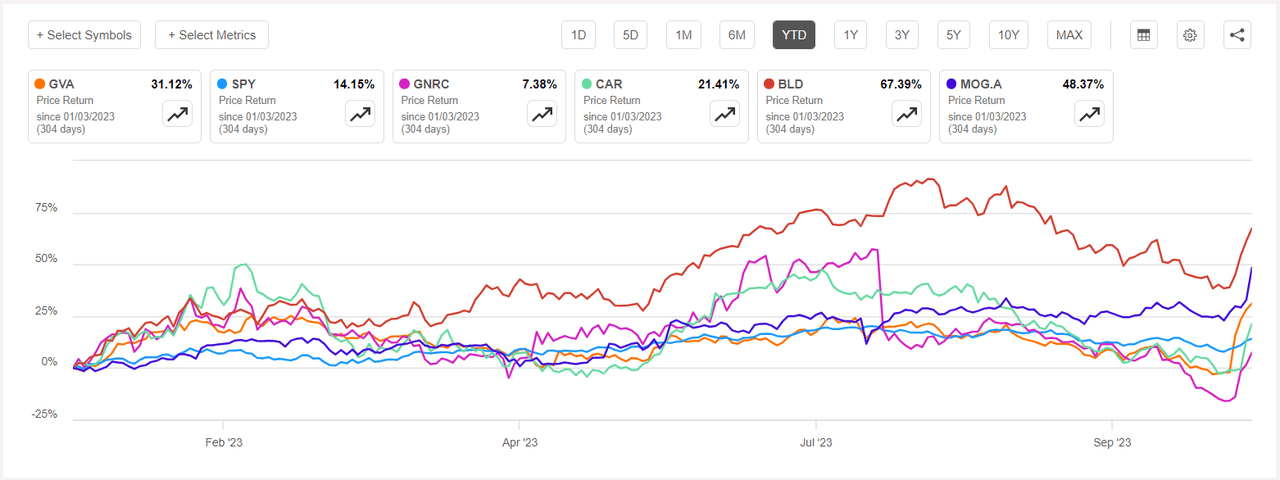

Granite Construction (NYSE:GVA) +34.02%. The Watsonville, Calif.-based company’s stock surged the most on Tuesday (+17.98%) after Q3 results beat estimates and it saw record projects in the quarter. YTD, +30.97%.

GVA has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Buy. The stock has a factor grade of C- for Profitability and A+ for Growth. The average Wall Street Analysts’ Rating agrees with a Buy rating of its own, wherein 3 out of 4 analysts tag the stock as Strong Buy.

Generac (GNRC) +27.64%. The generator maker’s stock surged throughout the week, with the most on Wednesday after Q3 results surpassed analysts’ expectations. The stock also saw upgrades at Stifel and Guggenheim during the week. YTD, +4.23%.

The SA Quant Rating on GNRC is Hold with score of C+ for both, Momentum and Valuation. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 13 out of 28 analysts see the stock as Strong Buy.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Avis Budget (CAR) +24.27%. Earnings was the common factor again as the car rental company’s stock rose 14.01% on Thursday following its third quarter results post market on Wednesday. YTD, +22.02%.

The SA Quant Rating on CAR is Hold with score of C for Momentum and A- for Profitability. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 2 out of 6 analysts view the stock as such.

TopBuild (BLD) +20.91%. The Daytona Beach, Fla.-based company stock climbed throughout the week. TopBuild’s Q3 results also exceeded Street estimates. YTD, the shares have soared +68.92%, the most among this week’s top five gainers for this period. The SA Quant Rating on BLD is Strong Buy, while the average Wall Street Analysts’ Rating is Buy.

Moog (MOG.A) +20.67%. The aero-defense company’s shares soared +11.68% on Friday after fourth quarter results exceeded analysts’ expectations. YTD, +51.14%. The SA Quant Rating on MOG.A is Buy and so is the the average Wall Street Analysts’ Rating.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -6% each. YTD, all these 5 stocks are in the red.

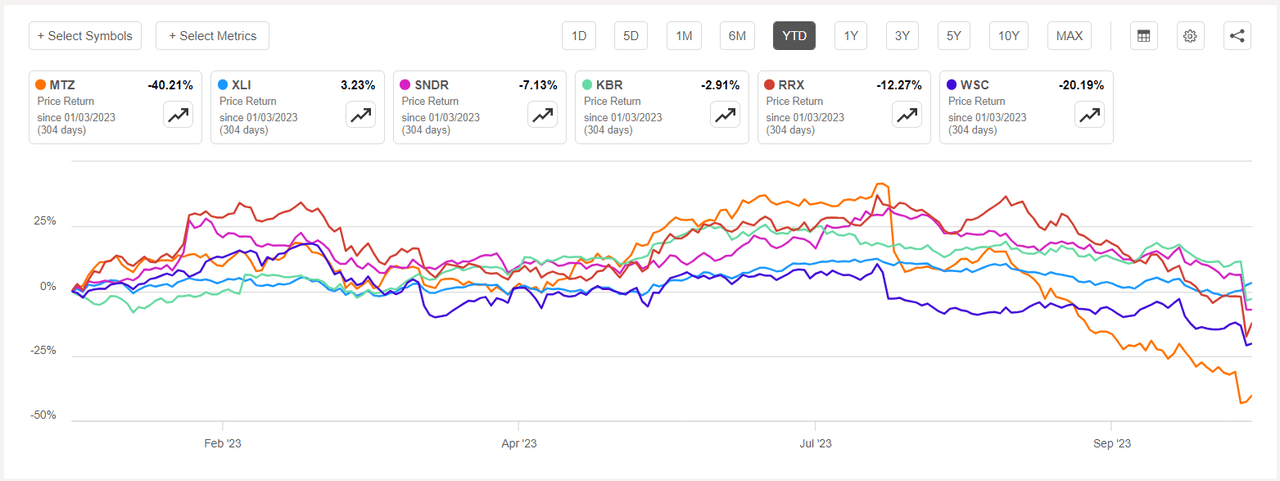

MasTec (NYSE:MTZ) -12.80%. The Florida-based construction company’s stock fell the most on Wednesday (-17.60%) after missing estimates for Q3 adjusted earnings and revenues while cutting its full-year EBITDA and revenue forecast. YTD, the stock has fallen -39.55%, the most among this week’s top five decliners for this period.

The SA Quant Rating on MTZ is Sell with a factor grade of C for Profitability and D- for Momentum. The rating is in stark contrast to the average Wall Street Analysts’ Rating of Strong Buy rating, wherein 6 out of 10 analysts view the stock as such.

Schneider National (SNDR) -11.51%. Shares of the transportation and logistics solutions provider declined -12.62% on Thursday after Q3 results missed estimates. YTD, -5.38%.

The SA Quant Rating on SNDR is Hold with score of D+ for Momentum and B+ for Valuation. The average Wall Street Analysts’ Rating disagrees and has a Buy rating, wherein 7 out of 15 analysts tag the stock as Strong Buy.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

KBR (KBR) -11.20%. The Houston-based company’s shares fell -13.56% on Thursday after third quarter revenue came below expectations. YTD, -3.90%. The SA Quant Rating on KBR is Hold with score of C for Profitability and B for Growth. The average Wall Street Analysts’ Rating differs and has a Strong Buy rating, wherein 8 out of 10 analysts view the such.

Regal Rexnord (RRX) -10.81%. The industrial powertrain solutions maker’s stock tumbled -15.76% on Thursday after Q3 Non-GAAP EPS and revenue missed analysts expectations. YTD, -11.73%. The SA Quant Rating on RRX is Hold, while the average Wall Street Analysts’ Rating is Strong Buy.

WillScot Mobile Mini Holdings (WSC) -6.77%. The Phoenix-based company, which provides work space and portable storage solutions, saw its stock -8.77% on Thursday after third quarter revenue missed estimates. YTD, -20.79%. The SA Quant Rating on WSC is Hold, which differs with the average Wall Street Analysts’ Rating of Strong Buy.