Bitcoin price is on the edge again.

Price swings are getting crazy, and it’s sitting around $67,400 like it’s not sure which way to jump. Traders are nervous. Really nervous.

On Polymarket, bettors now put the odds of a U.S. strike on Iran this month at 61%. Crypto felt it fast. Liquidations rolled in. Risk-off mode kicked on. And suddenly, everyone’s playing defense.

Key Takeaways

The Signal: Polymarket bettors price in a 61% chance of imminent US military action.

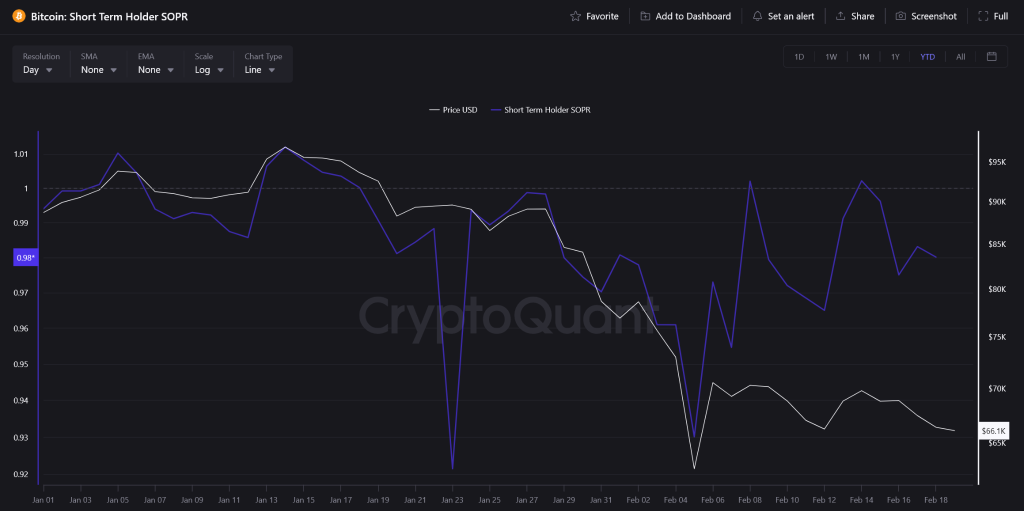

The Risk: Short-Term Holder SOPR has dipped below 1.0, indicating panic selling at a loss.

The Impact: Bitcoin risks breaking critical $65,000 support if conflict escalates this weekend.

Why Is This Happening Now?

Tensions between Washington and Tehran feels almost certain now.

Reports say the Pentagon has strike options ready after nuclear talks stalled. That kind of headline pushes investors straight into gold and cash. Risk assets get dumped first.

On chain data backs it up. The Short Term Holder SOPR is below 1. That means recent buyers are selling at a loss just to get out.

Add in uncertainty around possible Fed policy tweaks and you get a messy mix. Geopolitics plus macro pressure. While the US Iran story dominates, Bitcoin is trading like a classic risk asset, with sharp intraday drops and fragile sentiment.

What Does This Mean for Bitcoin Price?

Bitcoin is leaning hard on the $66,000 to $65,729 support zone. Lose that on a daily close and $60,000 comes into focus fast.

The short term Sharpe ratio has flipped negative, showing ugly risk adjusted returns during the panic. Nearly $80M in longs have already been wiped out since the drop from $70,000.

While retail is dumping, some political insiders are floating massive long term targets. That hints whales may see this dip as opportunity. Arthur Hayes also pointed to Treasury liquidity dynamics that could support crypto once the dust settles.

Volatility into the weekend looks guaranteed. But talks in Oman on Friday could change the tone. If tensions cool, a sharp relief rally could trap late shorts.

Discover: Here are the crypto likely to explode!