Crypto sentiment has cooled heavily in the past few months. Bitcoin dipped from $126k to $65k, most altcoins dipped 50-80% from local highs and with this in mind, capital allocation has become more selective. In this climate, speculative narratives tend to fade quickly, and infrastructure-focused projects receive closer scrutiny.

That does not mean development has slowed. Historically, quieter market phases have often been when core infrastructure is built and refined. Investors and builders alike begin paying closer attention to structural efficiency, sustainability, and long-term utility instead of short-lived momentum.

LiquidChain ($LIQUID) enters the conversation from that angle. Its ongoing crypto presale centers on liquidity coordination and staking mechanics rather than trend-driven hype. Instead of positioning itself as another isolated blockchain, the project frames its Layer 3 architecture around unifying liquidity across major ecosystems while integrating staking as a core network function.

LiquidChain’s Unified Liquidity Model

Liquidity fragmentation remains one of decentralized finance’s most persistent inefficiencies. Bitcoin, Ethereum, and Solana each command deep capital pools, yet these reserves operate largely within separate ecosystems. Moving capital between them introduces additional steps, infrastructure complexity, and operational risk.

LiquidChain proposes a unified liquidity framework designed to coordinate execution across these major chains. Rather than relying entirely on traditional bridging mechanisms, the protocol introduces a settlement layer intended to manage cross-chain interactions under a single execution environment.

Unified liquidity pools sit at the center of this design. Assets from Bitcoin, Ethereum, and Solana can be represented within a shared structure, allowing capital to interact across ecosystems without remaining siloed. The objective is to reduce duplicated liquidity and improve capital efficiency across decentralized markets.

The architecture is supported by a high-performance virtual machine capable of processing multi-chain operations in real time. Combined with cross-chain verification mechanisms, the system aims to minimize the additional trust assumptions that have historically accompanied bridging solutions.

By operating as a Layer 3 meta-layer, LiquidChain does not attempt to replace existing blockchains. Instead, it focuses on coordinating liquidity and execution across them.

$LIQUID Crypto Presale and Staking Model

The $LIQUID token underpins participation within this framework. The current crypto presale marks the early distribution phase prior to broader infrastructure rollout and mainnet milestones.

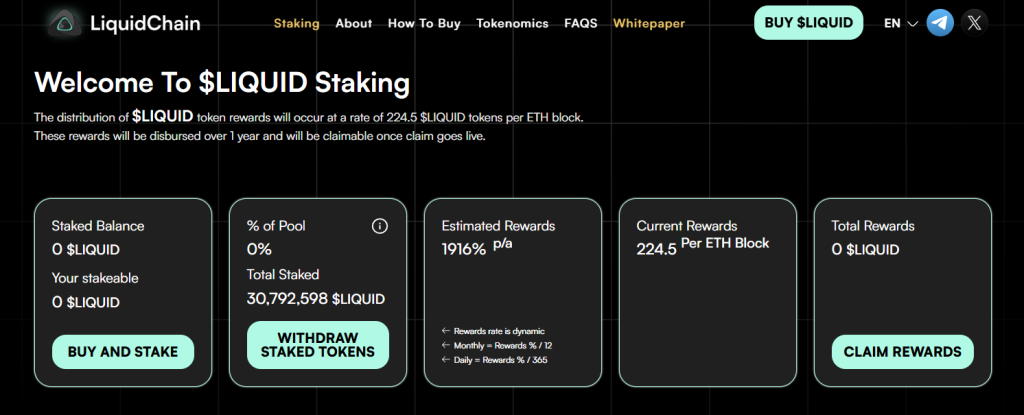

Staking plays a central role in the token’s utility design. Public data indicates that over 30.5 million $LIQUID tokens are currently staked. This early staking participation signals engagement from presale participants and introduces supply dynamics that influence circulating availability.

High annual percentage yields (APYs) are currently offered as staking incentives. However, these yields are structured dynamically. As more participants stake $LIQUID, reward distribution becomes spread across a larger pool of tokens. This naturally reduces the APY over time. The mechanism is common in staking-based systems: early participants receive a larger proportional share of rewards, and as the staking pool grows, returns normalize.

This design creates a time-sensitive incentive without guaranteeing outcomes. Early participation benefits from higher reward distribution rates, yet long-term sustainability depends on ecosystem growth and network usage. The staking framework therefore functions both as an incentive layer and as a mechanism to align token holders with network development.

Beyond staking, $LIQUID is positioned to interact with unified liquidity pools, cross-chain settlement processes, and future ecosystem modules outlined in the roadmap. As infrastructure components go live, token utility is expected to expand alongside them.

As with all early-stage blockchain initiatives, development milestones, market conditions, and adoption will influence long-term dynamics. The crypto presale phase provides exposure to the project prior to full deployment, but it also carries the typical risks associated with infrastructure buildout.

Infrastructure Before Momentum

Market cycles tend to reward infrastructure only after it proves resilience. During periods of muted sentiment, attention shifts toward structural gaps that remain unresolved. Cross-chain liquidity coordination remains one of those gaps.

LiquidChain’s thesis centers on reducing capital fragmentation across major ecosystems while aligning token holders through staking incentives. Unified liquidity pools, cross-chain execution, and staking participation form the core pillars of its design.

Whether the model achieves broad integration will depend on technical execution and developer adoption. Yet the focus on liquidity efficiency and incentive alignment positions the project within a longer-term infrastructure narrative rather than a short-term price narrative.

In an environment where sentiment fluctuates, infrastructure development continues. LiquidChain’s crypto presale represents an early-stage entry into a framework built around coordination, staking mechanics, and cross-chain liquidity efficiency; areas that remain central to the next phase of decentralized finance expansion.

Explore LiquidChain and its ongoing crypto presale: