Bitcoin Funding rates across major exchanges have collapsed to their most negative levels since August 2024.

Back then, the market looked equally convinced that lower prices were inevitable. Instead, that extreme short crowding marked a major bottom and preceded an 83% rally over the following months.

We are seeing a similar structure now. Traders are aggressively positioned for downside. Shorts are piling in.

At the same time, on-chain data shows profit cushions are thin. NUPL has returned to the 0.18 zone, historically associated with Hope and Fear.

In this regime, markets become reactive. Small moves trigger outsized responses because holders lack deep unrealized gains to buffer volatility.

Sentiment remains cautious. ETF outflows and macro uncertainty keep the bearish narrative alive. But crowded trades rarely unwind quietly.

The setup is not about pure technical strength. It is about positioning risk. If Bitcoin’s price clears the $70,000 to $70,600 range, the short squeeze thesis will gain credibility quickly.

- Negative funding rates across exchanges have hit 2024 lows, indicating extreme bearish sentiment.

- A break above the $70,610 resistance level could trigger a massive Bitcoin short squeeze targeting $76,000.

- On-chain signals show thin profit margins, guaranteeing high market volatility in the short term.

Bitcoin Price Prediction: Is BTC Setting Up for a Violent Squeeze?

On the chart, Bitcoin has already broken out of that steep descending channel and is now grinding just below the $70K to $71K supply zone.

That area matters. It lines up cleanly with prior resistance. Above $71K, resistance thins out toward $80K, with $90K and even $98K acting as higher air pockets if momentum builds.

$64K remains the line that holds the structure together. If that fails, $60K becomes the final major demand zone before the chart starts looking unstable again.

Now add positioning. Funding is deeply negative. Shorts are crowded. NUPL sits in the Hope and Fear range. That combination often creates fuel for a sharp upside when resistance breaks.

So technically, Bitcoin is compressing under a key ceiling. Structurally, it is no longer in free fall. And positioning suggests the market is leaning heavily short.

When Bitcoin Sets Up for a Squeeze, Bitcoin Hyper Adds Fuel

Bitcoin still moves in heavy waves. It needs macro alignment, ETF stability, and strong spot demand to fully ignite. That takes time.

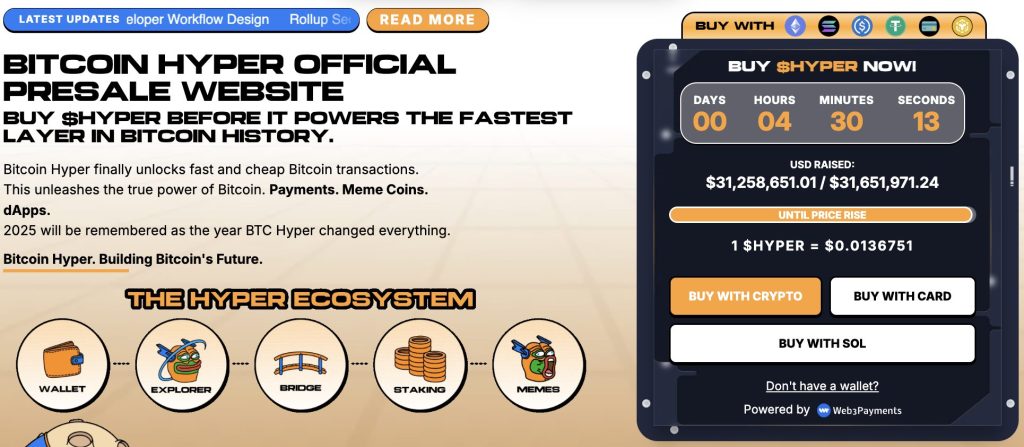

Bitcoin Hyper ($HYPER) is built for speed.

This Bitcoin-focused Layer-2, powered by Solana technology, makes BTC faster, cheaper, and usable for real on-chain activity without changing core security. It captures Bitcoin’s narrative strength while unlocking functionality that the base layer cannot provide on its own.

Momentum is already visible. The Bitcoin Hyper presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next increase. Staking rewards currently reach up to 37%.

If Bitcoin squeezes, Bitcoin Hyper accelerates. If Bitcoin stalls, Bitcoin Hyper still moves.

Visit the Official Bitcoin Hyper Website Here