Bitcoin just got hit with one of its most extreme warnings yet. A well known strategist is calling this an imploding bubble, with a potential slide toward $10,000 price point.

That would mean roughly 85% downside from current levels. A scenario that sounds unthinkable to many, but impossible to ignore when it is coming from experienced market voices.

Is the Bubble Finally Bursting?

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, is not calling this a healthy pullback. He says the crypto story needs a reality check.

In his view, capital is rotating into the so called AI scare trade and away from digital assets.

McGlone describes it as a post inflation deflation cycle. When inflation fades, the most speculative assets usually feel it first.

He also points to Bitcoin’s tight link with tech stocks. That correlation used to help. Now it is a risk. If tech gets pressured by AI disruption fears, crypto can get dragged down with it.

Bitcoin Price “Possible” Path to $10,000

The numbers are not comforting. McGlone points to $64,000 as the key level right now.

If Bitcoin price closes below that level, he believes the door opens to a much deeper deflationary slide, potentially all the way toward $10,000.

Technical breakdowns can accelerate downside momentum, but projecting a drop from $64,000 to $10,000 implies a full macro reset comparable to 2018 or 2022. Those episodes were driven by forced deleveraging events and systemic liquidity shocks, conditions not currently evident in credit markets.

Roughly $678 million left Bitcoin ETFs in February, extending a multibillion dollar selloff that started in November. Still, ETF positioning must be viewed in context.

Total assets under management across major vehicles remain significantly higher than pre-approval levels. A multi-billion-dollar unwind would be more concerning if it erased the entirety of prior inflows — which has not occurred.

Some on chain models place a more moderate bear market floor near $55,000. But McGlone’s thesis assumes a harsher unwind.

He also highlights aggressive profit taking in gold and silver, arguing that liquidity is being pulled from risk assets broadly. In that kind of environment, Bitcoin would not be immune.

It is important to note that Mike McGlone is mostly bearish on Bitcoin. He has been accurate on some longer-term upside milestones in the distant past, but his Bitcoin-specific predictions have mostly not come true on schedule, or at all.

Mike Mcglone Can’t Say The Same About Bitcoin Hyper

Bitcoin still depends on macro liquidity, ETF flows, and correlation with tech. When those wobble, price grinds. Momentum fades. Traders wait.

Bitcoin Hyper ($HYPER) is built differently.

This Bitcoin-focused Layer-2, powered by Solana technology, adds speed, lower fees, and real on-chain utility without changing Bitcoin core security. It is designed for activity, not just holding through volatility.

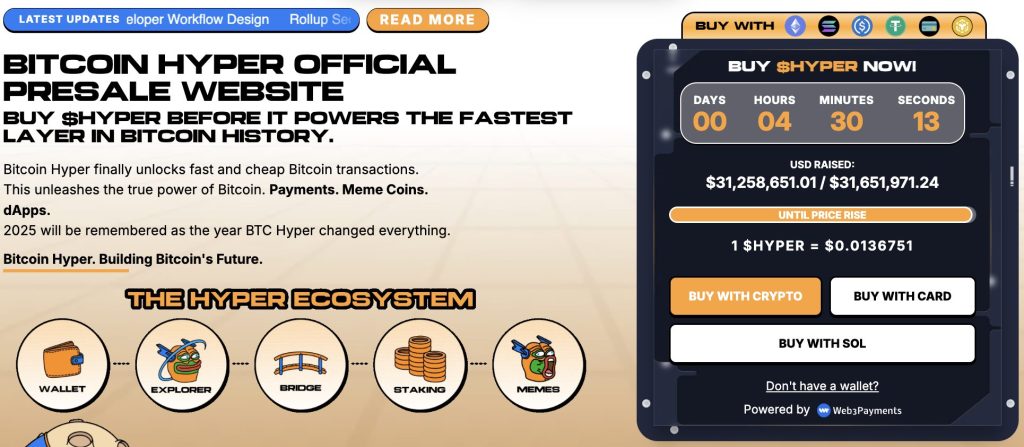

And traction is already building. The Bitcoin Hyper presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next increase. Staking rewards currently reach up to 37%.

If Bitcoin spends months debating whether $64K holds or collapses, Bitcoin Hyper is positioned to move regardless of that macro noise.

Visit the Official Bitcoin Hyper Website Here