Bitcoin may not have hit true capitulation yet. On chain analytics firm CryptoQuant is warning that the real bear market floor could sit closer to $55,000. That is lower than many bulls want to admit.

If their data is right, the market still has some pain to process before a proper structural base forms. Weak hands may not be fully flushed. And until that final reset happens, calling this the ultimate bottom might be a bit premature.

Key Takeaways

- CryptoQuant data suggests the “ultimate” bear market bottom is near $55,000 based on realized price models.

- Bitcoin recently saw $5.4 billion in realized losses on Feb. 5, the highest since March 2023.

- Key valuation metrics like MVRV and NUPL have not yet reached historical capitulation zones.

Is The Selling Finally Over?

CryptoQuant says we are still in a normal bear phase, not the extreme panic zone that usually marks once in a cycle buying opportunities. In their view, bottoms are not single candles. They are long, messy processes that take time to build.

Meanwhile, price action keeps slipping. ETF outflows are stacking up and Bitcoin losing $66,000 has traders nervous. But according to the data, we still have not seen the kind of pain that typically resets the market.

Bitcoin price is trading more than 25% above its realized price, a level that has historically acted as strong support.

In past cycles like 2018 and the FTX collapse, Bitcoin bottomed 24% to 30% below realized price. If that pattern plays out again, the $55,000 area becomes the zone to watch.

Realized Losses And Valuation Metrics

The latest CryptoQuant data shows real damage under the surface.

On February 5, Bitcoin holders locked in $5.4 billion in daily losses as price slid 14% to $62,000. That was the biggest single day loss since March 2023.

But even with those numbers, key valuation metrics are not flashing full bottom yet.

The MVRV ratio has not dropped into the extreme undervalued zone that usually shows up at cycle lows. The NUPL metric also has not hit the deep unrealized loss levels that typically mark capitulation.

Long term holders tell a similar story. Right now, many are selling around breakeven. In past bear market bottoms, they were sitting on losses of 30% to 40%.

If history is any guide, the final phase of capitulation may require a deeper reset before a durable floor forms. Until then, patience may prove more valuable than premature bottom calls.

If Bitcoin Needs Another Reset, Bitcoin Hyper Does Not

When analysts start talking about “true capitulation,” it means one thing. Bitcoin could stay slow and heavy for longer than bulls expect.

That is not the environment for explosive base-layer moves.

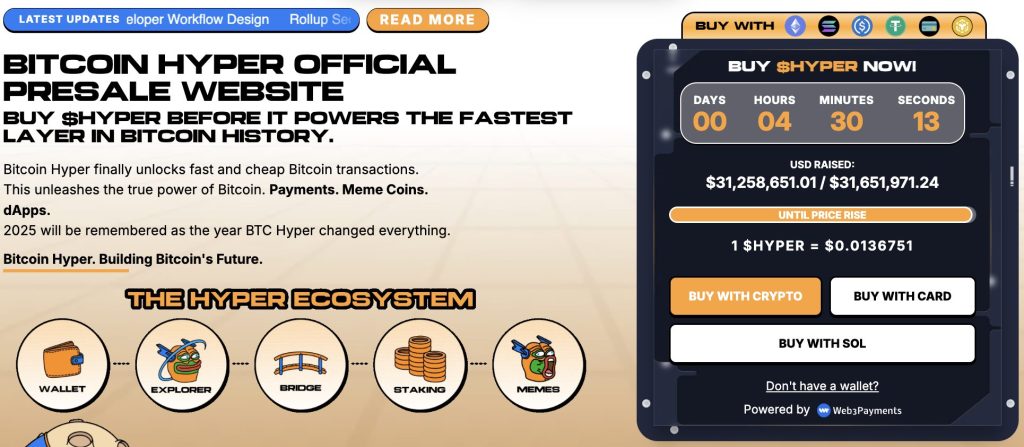

Bitcoin Hyper ($HYPER) is built for momentum regardless of where BTC chops. This Bitcoin-focused Layer-2, powered by Solana technology, adds speed, lower fees, and real on-chain utility without touching Bitcoin core security.

Bitcoin Hyper is already gaining traction. The presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next increase, plus staking rewards up to 37%.

If Bitcoin needs more time to bottom, Bitcoin Hyper is positioned to move during the wait.

Visit the Official Bitcoin Hyper Website Here