Here we are on the final day of January, with BTC slipping under the $82,000 level to hit its lowest price of the month so far. Altcoins like XRP and Solana have dropped even harder and now risk testing lows not seen in quite a while

That said, every February that followed a red January has been positive so far. Historically, it has been the best months for Bitcoin, even better than Uptober.

This has led many to believe this could be a Wyckoff phase before the next leg up. If that plays out, XRP and Solana could present some of the best opportunities in the market, and below is why.

Bitcoin Price Prediction: All Context Says BTC Could Head Toward $74,000

Some analysts play on the positive side and mention that this dip is a Wyckoff Spring that could lead to a higher price later in February.

Which may be true, but given the market context and uncertainty, Bitcoin just broke down from a descending wedge that formed after the sharp selloff.

Normally, that kind of pattern hints at downside exhaustion, but this time it failed to break higher. Price lost the lower wedge support near the January low and is now trading below $83,000, which confirms this was a bearish break, not a reversal.

RSI is sitting around 31, so conditions are getting oversold. That tells us selling pressure is stretched, but it does not mean a bounce is guaranteed yet. Structurally, the focus shifts lower from here, with the $80,000 psychological level now under threat and the $74,000 support zone coming into view if momentum continues.

Any short-term bounce from here is likely to run into resistance around $86,000 to $88,000, which used to be support but has now flipped into supply.

This move fits more with ongoing risk-off conditions and steady ETF outflows, meaning Bitcoin probably needs a broader sentiment reset or some macro relief before a real recovery can start.

XRP Price Prediction: This Does Not Look Good, 12 Month Support is Officially Gone

XRP has now broken down from its descending wedge, failing to hold the lower boundary that had been supporting the price for months.

More importantly, the daily close below $1.80 means its 12-month support is officially gone, turning what used to be strong demand into overhead resistance.

Structurally, this points to a bearish continuation, not a base. Lower highs are still in place, and momentum has not stabilized. RSI is sitting around 34, so conditions are getting oversold, but there is no clear bullish divergence yet, which means there is still room for more downside before any real relief shows up.

If XRP cannot quickly reclaim and hold above $1.80 on a daily close, the next logical level to watch is around $1.60, where prior demand and liquidity sit. Until that happens, any upside move is likely just corrective rather than the start of a real trend reversal, especially with the broader market still firmly risk off.

Solana Price Prediction: Lowest Levels Since 2024, Is $95 At The Door?

Solana is starting to look like one of the weakest large-cap coins out there right now. Price keeps grinding lower inside a clean descending channel and has now broken below multiple psychological support levels.

Losing the $120 area is a big deal, since that level had acted as a base for months. That break confirms this is a bearish continuation, not just a sideways consolidation.

Structurally, nothing has changed yet. Lower highs and lower lows are still in place, and the rejection near the upper channel around $140 just reinforced the downtrend.

RSI is hovering around 35, so downside momentum is stretched, but there is still no clear bullish divergence. That means pressure can continue before buyers really step in.

The next real demand zone sits around $100 to $106, followed by the deeper $95 area. These levels Solana has not seen since 2024.

Until SOL can reclaim $144 on a daily close and break the descending trendline, any bounce should be treated as corrective, especially in a market that is still punishing high beta assets.

This looks like late-stage capitulation (extreme fear + leverage flush), classic setup for sharp reversals if macro stabilizes. But until Fed/policy clarity or risk appetite returns, expect choppy/corrective bounces at best.

If You Fear Bitcoin, Bitcoin Hyper Might Be Your Saver In This Bear Market

As Bitcoin slips toward the low $80,000s and altcoins lose multi-month support. The market is being reminded of an old problem. Bitcoin still dominates value, but during periods of stress, it remains slow, expensive to use, and difficult to build on.

Bitcoin Hyper is positioning itself around that exact weakness. It is a Bitcoin-focused Layer 2 designed to bring Solana-level speed and low-cost transactions to the Bitcoin ecosystem. All this while keeping Bitcoin’s security intact.

They don’t compete with Bitcoin or chase altcoin narratives. The project aims to extend Bitcoin with fast payments, smart contracts, and even meme coin creation, all anchored to BTC.

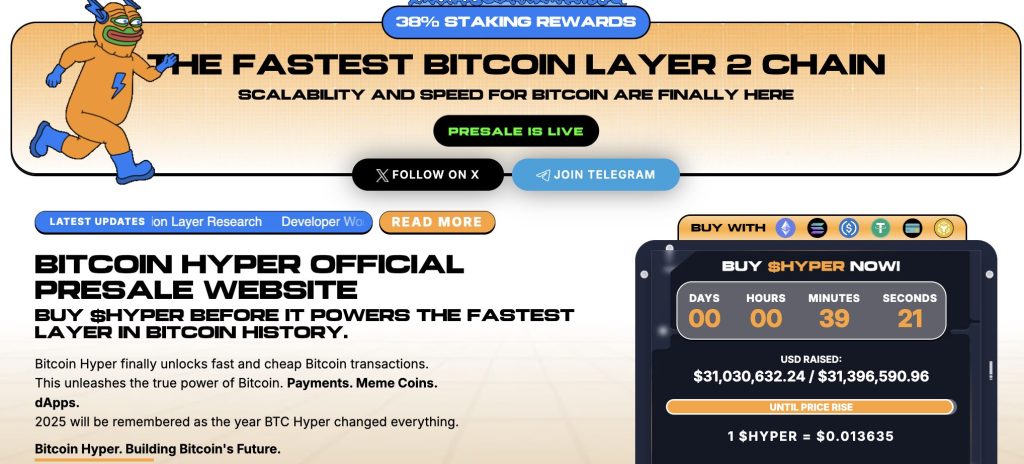

Despite the broader risk-off environment, interest in Bitcoin Hyper continues to grow. The presale has raised over $31,000,000 so far, with $HYPER priced at $0.013635 before the next increase. Staking rewards of up to 38% are also being offered. This gives early participants exposure to yield that Bitcoin itself still does not provide.

Bitcoin Hyper has completed audits by Consult. It’s building out a full ecosystem that includes wallets, bridges, staking, explorers, and on-chain tooling. The broader thesis is simple. If this market phase really is capitulation, infrastructure that improves Bitcoin’s usability could matter more than short-term price action. Once sentiment flips, of course.

In a market flushing leverage and testing conviction, Bitcoin Hyper is a longer-term play worth watching.

Visit the Official Bitcoin Hyper Website Here