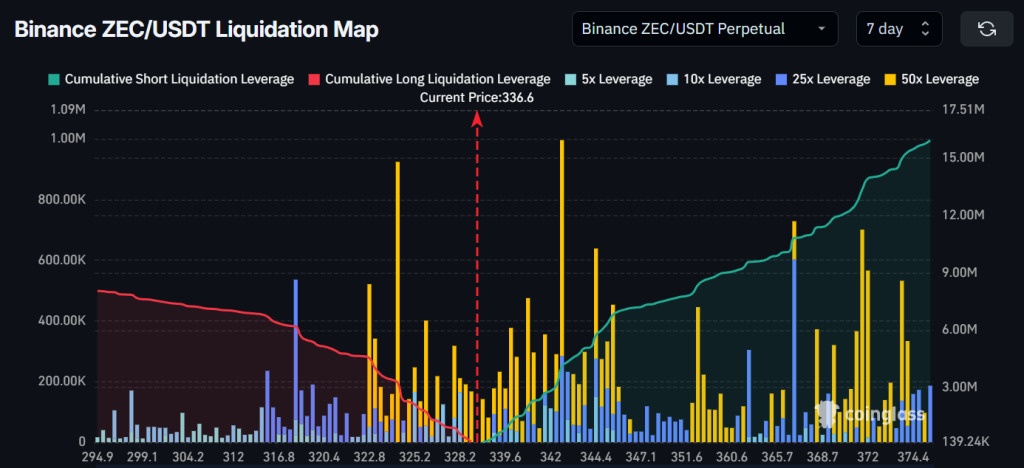

More than $16 million in short-side leverage now outweighs longs by roughly two to one, creating a bleak outlook for near-term Zcash price predictions.

Speculative demand has surged, with open interest climbing almost $50 million so far this week, yet the concentration of that capital offers little reassurance for the altcoin.

On Binance’s ZEC perpetual pair, short liquidation leverage sits above $16 million, while long-side liquidation levels hover closer to $8 million. Traders are overwhelmingly positioning for downside.

This positioning appears to follow a two-month head-and-shoulders pattern as it breaks lower, with downside targets clustering near December lows around $300.

But while derivatives traders are betting on a continued dip, spot traders appear to be buying it.

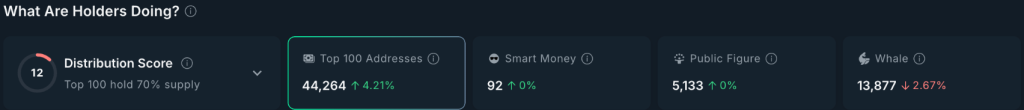

The top 100 largest Zcash whales increased their holdings by 4.21% during Thursday trading. While not aggressive accumulation, it is notable given how selective capital rotation is right now.

That divergence leaves Zcash at an inflection point. Derivatives traders are betting on further weakness, but steady whale accumulation suggests longer-term conviction may be forming beneath the surface.

Zcash Price Prediction: What Are Whales Positioning For?

These whales appear to be betting that the neckline holds or that downside becomes overextended, as $300 is once again being retested as the lower support of a wider 4-month bull flag pattern.

Momentum indicators make it a possibility. The RSI nears the 30 oversold threshold, a level that typically marks local bottoms as sell pressure exhausts.

Similarly, the MACD golden cross that has been brewing over the past month has finally been realised. This could stand as an early-stage bottom signal for the next leg higher.

The key breakout threshold sits around the head-and-shoulder resistance at $480. Flipping this level to support coin confirms a push towards all-time highs into new price discovery.

Fully realised, the bull flag pattern targets the $5,000 milestone, representing an almost 15x gain from current prices. Still, this likely hinges on a more favourable macro backdrop.

Bitcoin Hyper: New Presale Bringing Solana Technology to Bitcoin

While capital rotation into the altcoin market remains selective, those still staying true to bitcoin might already be well-positioned as its ecosystem finally tackles its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

It opens the door for Bitcoin to play a larger role in top-performing narratives like DeFi and real-world assets – where speed and efficiency matter most.

The project has already raised over $31 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website Here