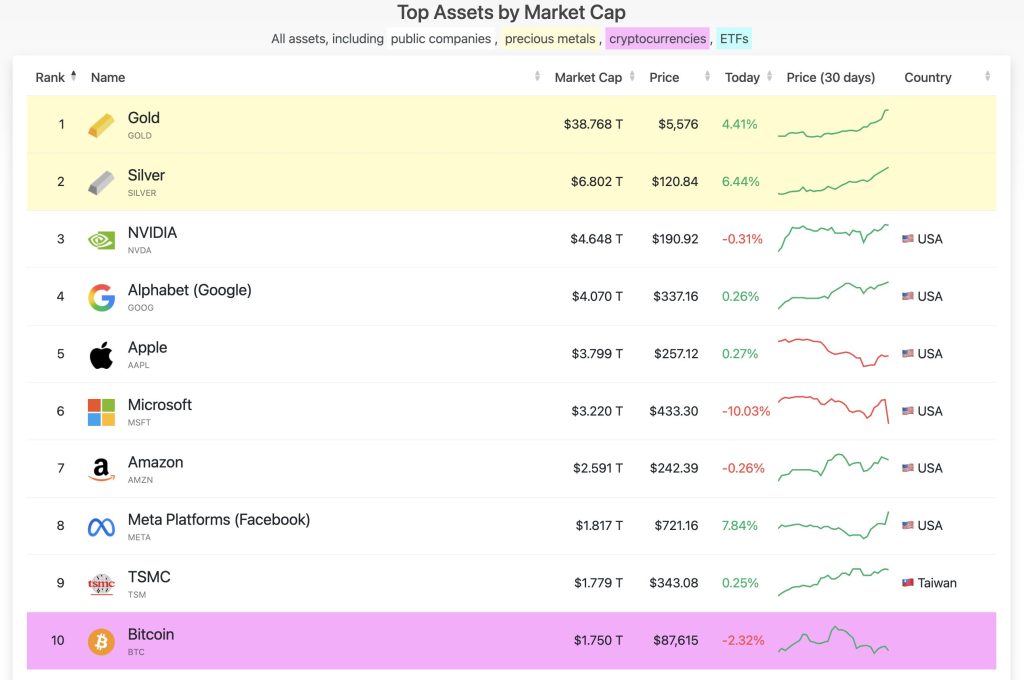

For years, Bitcoin has been championed as “digital gold” — with ardent believers arguing it’s far superior to the precious metal. Unfortunately, it seems the market disagrees.

Gold’s extraordinary bull run shows no sign of slowing down. It’s surged by 25% over the past month, 66% over the past six months, and is up 200% compared with five years ago.

That officially means that it’s outperforming the world’s biggest cryptocurrency by a large margin. By contrast, BTC is down 2.5% from a month ago, and has lost 25% of its value in the past six months. Meanwhile, its returns since 2021 stand at a more modest 156%.

Other commodities have also been on a tear. A flight to safe haven assets saw spot silver hit a fresh record of $120 this week.

An almighty flippening has happened in recent months. Back in April 2025, Bitcoin had a bigger market capitalization than silver — $1.85 trillion versus $1.84 trillion. Fast forward to now, and the picture couldn’t look any different: silver has rallied to $6.7 trillion, as BTC languishes behind on $1.75 trillion.

Even copper has been getting in on the action. Official figures show 2025 was its best-performing year for a decade, with a global shortage and a push into renewable energy propelling prices beyond $14,000 a tonne.

Indeed, Bitcoiners may be looking on enviously as precious metals experience “extreme greed” — something that the crypto world hasn’t seen for quite a few months now. And for an idea of the scale of the rally, consider this: gold added $1.6 trillion to its market cap on Wednesday alone — that’s almost as much as all of the world’s BTC put together.

So… what gives? Well, analysts argue that this is a symptom of Bitcoin maturing as an asset following the arrival of exchange-traded funds two years ago. Wall Street inflows have diminished the volatility that once made this cryptocurrency so appealing to investors. While we aren’t seeing dizzying “God candles” anymore, this also means less risk to the downside.

Some also point to extreme wariness following the dramatic and sudden crash on October 10, when speculation surrounding a fresh wave of Donald Trump’s tariffs caused mass sell-offs — and Binance’s infrastructure to buckle under the strain.

There are also reasons why gold in particular is being favored right now. Trump’s persistent attacks on Jerome Powell have triggered fears about how the Federal Reserve’s independence could be undermined during the rest of his second term. Invesco’s Christopher Hamilton told Bloomberg:

“The speed with which gold is breaking milestones underscores how quickly confidence in traditional policy tools is eroding.”

Bitcoin is beginning to enjoy wider acceptance among institutional investors, as evidenced by impressive inflows into exchange-traded funds tracking its spot price on Wall Street. However, as NYDIG notes, gold continues to benefit from much wider brand recognition.

“Gold benefits from decades of institutional precedent and a well-established role as a strategic allocation across market cycles, whereas Bitcoin remains earlier in its adoption curve. As a result, many allocators continue to view Bitcoin tactically rather than structurally, limiting its use as a portfolio hedge.”

And given Bitcoin’s tendency to operate in four-year cycles, you could argue there is a degree of wariness about piling into this cryptocurrency right now. BTC painfully contracted by 74% back in 2018, with a 64% drawdown in 2022. While there are early signs of changes in the market’s dynamics, a similar pullback in 2026 cannot be ruled out.

But just like BTC tends to cool after a sudden surge upwards, concerns are beginning to grow that “ugly and sustained reversals” could be on the cards for gold and silver — and the precious metals trade is beginning to look exceptionally overcrowded.

In the short-term, things might get worse for Bitcoin before they get better. Bloomberg recently ran a report suggesting that “longtime believers are looking to equities, precious metals and prediction markets” for returns now — a sign that BTC is no longer the fastest horse in the race.

One analyst said that Bitcoin may only be able to prove its relevance if it is able to trade meaningfully above $100,000 for a prolonged period of time. But given $90,000 is proving elusive right now, that could be a big ask.