Gold climbed to a fresh all-time high, crossing $5,100 an ounce on Monday, extending its record-breaking run as investors seek shelter amid rising geopolitical tensions and global fiscal risks.

Spot gold prices gained 2.4%, trading at $5,102 an ounce, before paring gains to $5,086.

The surge comes days after President Donald Trump warned Canada that the U.S. would impose a 100% tariff on goods sold in the U.S. if the country strikes a trade deal with China. “If Canada makes a deal with China, it will immediately be hit with a 100% Tariff against all Canadian goods and products coming into the U.S.A.,” Trump wrote in a Truth Social post.

However, Ethereum is moving in the opposite direction, trading at $2,877.15 with a 24-hour trading volume of $24.69 billion. The token now sits 36% below its $4,953.73 peak.

The $5K Race Ends

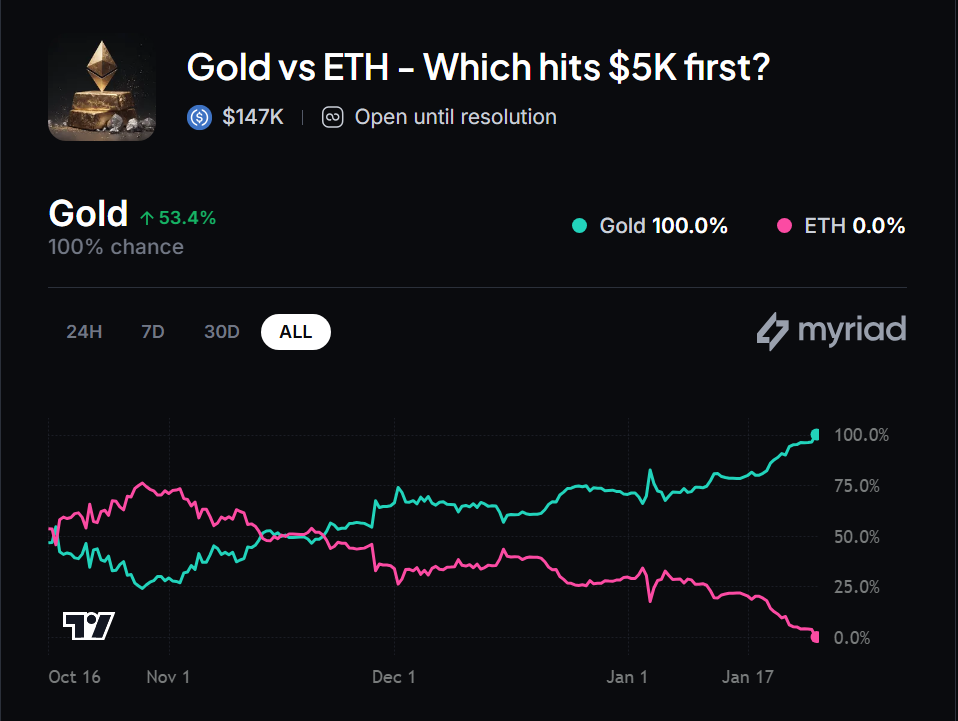

The “Gold versus ETH: Which hits $5K first?” market on Myriad has reached a resolution, with gold hitting the $5k mark first. The precious metal jumped 7.28% on the week and was recently priced at $4,938 before Monday’s breakout.

While gold is typically compared to Bitcoin, predictors on Myriad favored ETH for months, betting on its volatile upward mobility, but they’ve become less confident as crypto markets slide. The prediction market opened in October 2025.

Institutional Flows Tell the Story

Western ETF holdings have climbed by about 500 tonnes since the start of 2025. Goldman Sachs lifted its December 2026 gold price forecast to $5,400 an ounce, up from $4,900, arguing that hedges against global macro and policy risks have become “sticky.”

Central bank purchases remain robust as Goldman estimates central-bank purchases are averaging around 60 tonnes a month, far above the pre-2022 average of 17 tonnes.

“While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted,” Natasha Kaneva, head of Global Commodities Strategy at J.P. Morgan, stated. “The long-term trend of official reserve and investor diversification into gold has further to run.”

Ethereum saw $630 million in outflows last week, reflecting bearish sentiment as investors withdraw funds. A whale that had been dormant for nine years transferred 50,000 ETH, worth $145 million, to a Gemini wallet, a move often associated with liquidation intent.

Geopolitical Catalyst

The precious metal’s surge comes as flashpoints from Greenland and Venezuela to the Middle East reflect higher geopolitical risk. Trump’s tariff threat follows tensions that mounted after Canadian Prime Minister Mark Carney delivered an address at the World Economic Forum in Davos that was widely seen as a rebuke of the Trump administration’s policies.

Earlier this month, Carney announced that Canada and China reached a preliminary deal to remove trade barriers. Under the tentative agreement, Beijing cut tariffs on some Canadian agricultural products, while Ottawa increased quotas for imports of Chinese electric vehicles.

Canadian Prime Minister Mark Carney said on Sunday that Ottawa has no plans to pursue a free trade deal with China, noting that the recent agreement only reduces tariffs on select sectors. Carney’s remarks came a day after President Trump threatened a 100% tariff on Canadian goods.

What Desks Are Watching

The gold-crypto divergence indicates a broader risk recalibration. Following a record-breaking 2025, gold entered 2026 with momentum intact as geopolitical tensions, falling real interest rates, and efforts by investors and central banks to diversify away from the dollar reinforce its safe-haven role.

ETH failed to reclaim its “digital gold” narrative during peak macro stress. Analysts note that if ETH maintains support around the $2,500 level, it could reach an all-time high of $6,000 by 2026, but that thesis requires risk appetite to return. In August 2025, Trump raised the tariff on Canadian goods to 35%. A 100% tariff threat marks a major escalation.

Markets are pricing in two interest-rate cuts by the Federal Reserve later this year. Traders await this week’s FOMC meeting, where the central bank is widely expected to hold rates steady.