Bitcoin is trading near $89,500, locked in a tight range that reflects consolidation rather than weakness. While price action remains compressed, a series of institutional and regulatory developments this week is reshaping how the market views Bitcoin’s longer-term role.

South Korea’s $48M Bitcoin Custody Breach Raises Alarms

South Korean authorities are investigating the disappearance of roughly 70 bn won ($48 mn) worth of seized Bitcoin from official custody. The issue surfaced during a routine audit by the Gwangju District Prosecutors’ Office, according to local reports.

Preliminary findings suggest the loss resulted from a phishing attack, after a staff member reportedly accessed a fake website, leading to leaked credentials. While details remain limited due to the ongoing investigation, the case has reignited debate around how governments store and protect confiscated digital assets.

Importantly, the incident does not reflect a failure of the Bitcoin network itself. Instead, it underscores weaknesses in human processes and custody frameworks. Long term, this type of breach may push governments toward stricter crypto custody standards, ironically strengthening institutional confidence rather than weakening it.

UBS Explores Crypto for Private Banking Clients

In a separate but related signal, UBS is reportedly evaluating plans to offer cryptocurrency investing to select private banking clients, beginning with Bitcoin and Ether for wealthy Swiss customers. According to Bloomberg, the bank is assessing third-party partners to support the rollout.

If successful, UBS could later expand the service into the US and Asia-Pacific, aligning with similar initiatives from Morgan Stanley and JPMorgan. The move reflects growing demand among high-net-worth investors for crypto exposure through trusted, regulated institutions, rather than exchanges alone.

Bitwise’s Bitcoin-Gold ETF Signals Macro Thinking

Adding to the institutional theme, Bitwise Asset Management has launched the Bitwise Proficio Currency Debasement ETF (BPRO) on the NYSE. Unlike spot Bitcoin ETFs, BPRO is actively managed and blends Bitcoin, gold, precious metals, and mining equities, with at least 25% allocated to gold at all times.

The fund carries a 0.96% expense ratio and targets long-term investors focused on capital preservation. By pairing Bitcoin with gold, Bitwise frames BTC as a macro hedge against currency debasement, not a speculative trade.

Bitcoin Price Forecast: $89,500 Range Tightens as Breakout Pressure Builds

Bitcoin is trading near $89,500, holding inside a narrowing range after a sharp rejection from the $97,000 peak earlier this month. On the 2-hour chart, price action points to compression rather than breakdown. BTC continues to defend the $87,300–$88,000 support band, an area repeatedly tested and protected by buyers.

Long lower candlestick wicks around this zone suggest sellers are struggling to gain follow-through, signaling thinning supply at lower levels.

From a structural view, Bitcoin remains anchored to a rising trendline that has guided price higher since the $83,800 low. While price briefly slipped below the 50-EMA and 100-EMA, it has stabilized near the 200-EMA, which is flattening instead of rolling over.

This behavior typically reflects a transition phase, not a confirmed trend reversal. The broader setup resembles a descending flag within an ascending channel, a formation that often resolves in the direction of the prevailing trend.

Momentum supports this outlook. RSI has rebounded from oversold levels near 30 and is now hovering around 48–50, signaling balance rather than renewed selling pressure. Recent candles show smaller bodies and reduced volatility, often seen before range expansion. If BTC dips, $87,400 remains key support. A push above $90,980 would open the path toward $92,400 and $94,250.

Trade setup: Buy near $88,000–$87,500, target $94,000, stop below $85,500.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

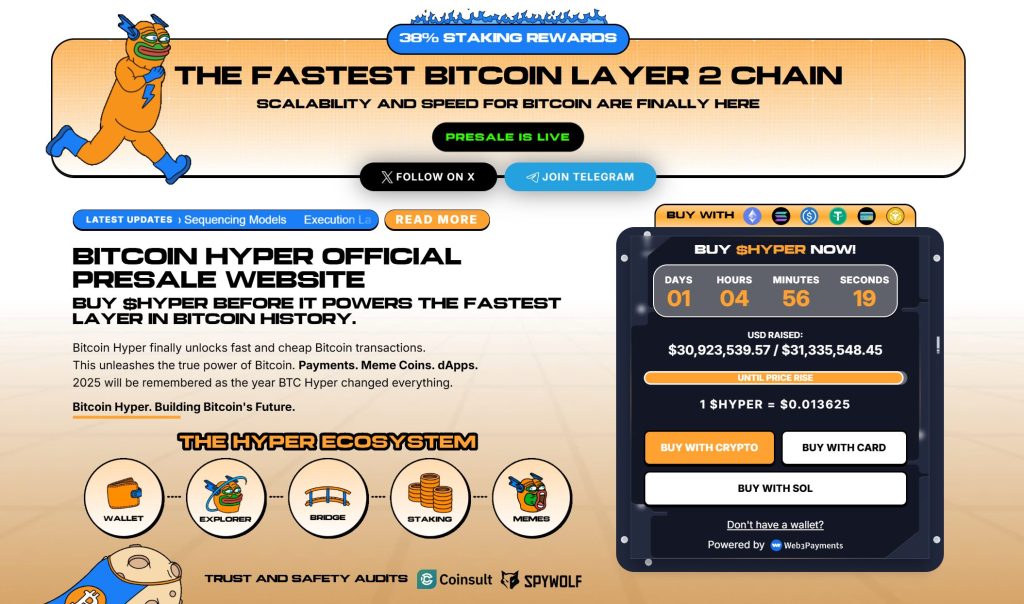

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.9 million, with tokens priced at just $0.013625 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale