Bitcoin and global markets have turned defensive after a sharp shock from Japan’s bond market and renewed geopolitical tensions, dragging BTC down by more than 6% over the past week as U.S. equities slid by more than 2% at their lows and global debt markets sold off.

According to a recent market insight from QCP Asia, the pullback has been driven by surging Japanese government bond yields and escalating U.S.–Europe trade disputes, developments analysts say are tightening financial conditions and eroding risk appetite across asset classes.

Against this development, Bitcoin has struggled to regain momentum, trading below $90,000 after only recently reclaiming $97,000, as it increasingly behaves like a rate-sensitive risk asset rather than a hedge.

Japan’s Bond Market Faces Historic Stress

At the core of the turbulence is a historic shift in Japan’s interest-rate environment after decades of near-zero yields.

Ten-year Japanese government bond yields have climbed to around 2.29%, the highest level since 1999, unsettling investors accustomed to Japan’s role as an anchor of global financial stability.

The move has exposed deep fiscal vulnerabilities, with government debt exceeding roughly 240% of GDP and total liabilities nearing ¥1,342 trillion.

Debt servicing is projected to consume about a quarter of Japan’s fiscal spending by 2026, intensifying scrutiny over long-term sustainability as borrowing costs rise.

“As yields rise, the sustainability of Japan’s public finances is being openly questioned, and the spillover to global bonds underscores Japan as a key volatility catalyst,” an analyst at QCP Asia said.

Rising JGB Yield, Yen Pressure, and Policy Fears

After decades of minimal inflation, Japan is now grappling with persistent price pressures that have made long-dated bonds with fixed payouts less attractive.

As investors sell at discounts, yields have climbed further, reinforcing higher borrowing costs for mortgages, corporate loans, and asset valuations across markets.

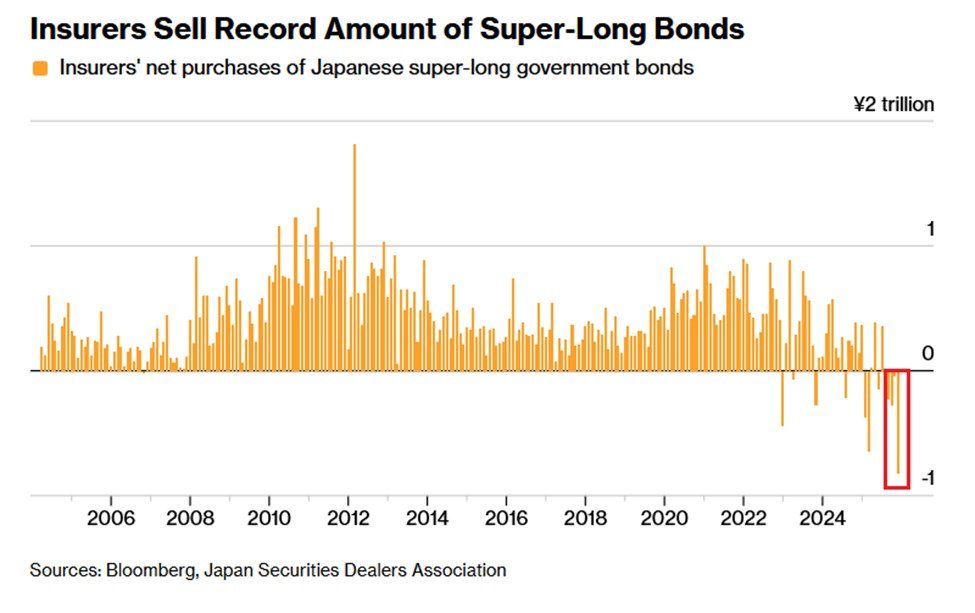

Institutional flows reveal the pressure, with Japanese insurers selling $5.2 billion of bonds with maturities beyond ten years in December alone.

That marked the fifth consecutive monthly sale and the largest since data collection began in 2004, bringing total net sales over the streak to $8.7 billion.

Demand signals have weakened as well, with Japan’s latest 20-year bond auction drawing a bid-to-cover ratio of 3.19, down from 4.1 previously and below the 12-month average.

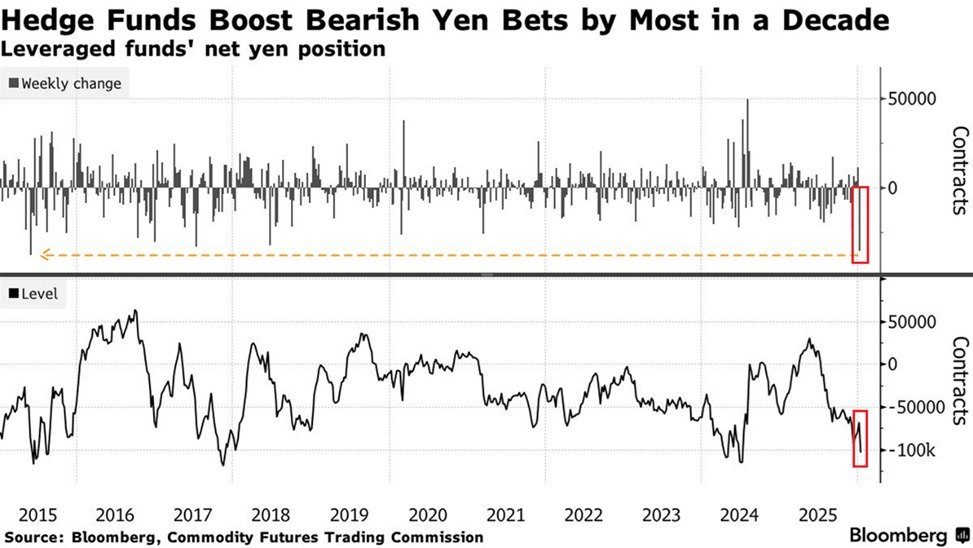

Meanwhile, hedge funds have ramped up bearish yen bets, lifting net short positions by 35,624 contracts in the week ending January 13, the biggest weekly jump since May 2015.

Tariff Escalation Sees Bitcoin Trade as High-Beta Risk Asset

Beyond Japan, geopolitical tensions have resurfaced as a fresh headwind, with trade relations between the U.S. and Europe entering a more confrontational phase.

President Trump imposed 10% tariffs on eight European countries opposing U.S. control of Greenland, with duties set to begin on February 1 and rise to 25% by June.

Europe has signaled swift retaliation, putting a transatlantic trade relationship worth an estimated $650 billion to $700 billion in bilateral goods at risk.

The European Parliament is now weighing a suspension of approval for the U.S.–EU trade deal agreed in July, a move that would mark a significant escalation.

Source: Stephanie Lecocq/AP

“With retaliatory measures lining up on both sides, the question for markets is no longer whether tensions rise, but how far they go,” QCP analyst said, asking whether this is “another round of TACO” or a policy path markets cannot ignore.

U.S. Treasury Secretary Scott Bessent added that recent market declines stemmed from “a six-standard-deviation move” in Japan’s bond market, calling it “all about the Japanese bond blowout.”

As liquidity tightens and volatility rises, crypto analyst CryptoMitch said BTC may continue drifting lower until clarity emerges from Japan, warning that $86,000 is the key support that must hold to prevent a deeper slide toward $80,000.