VanEck has declared 2026 a “risk-on” year for investors despite Bitcoin breaking its traditional four-year cycle, with CEO Jan van Eck positioning artificial intelligence, private credit, and gold as compelling opportunities following late-2025 corrections.

The asset manager’s Q1 2026 outlook emphasizes unprecedented visibility into fiscal and monetary policy, marking a sharp departure from recent years, when economic uncertainty dominated markets, and contrasting with Goldman Sachs’ forecast of 11% global stock returns driven primarily by equities over alternative assets.

Van Eck attributes the improved clarity to Treasury Secretary Scott Bessent’s influence on Federal Reserve policy direction.

“Scott Bessent snuck in an interview, a podcast interview the last week of 2025 that is so profound. I actually listened to it three times,” van Eck stated, highlighting Bessent’s articulation that current interest rates represent “normal levels” rather than requiring aggressive cuts.

The secretary’s framework suggests the Fed will maintain a restrained monetary policy, with market expectations of just 25 to 50 basis points in rate adjustments through 2026.

Van Eck emphasized that Bessent specifically criticized excessive quantitative easing following COVID, which he blamed for 10% inflation that continues to anger Americans.

Fiscal Stability and AI Opportunities Drive Optimism

The US fiscal picture shows meaningful improvement, with deficits declining as a percentage of GDP from COVID-era peaks, helping anchor long-term interest rates.

VanEck projects the fiscal 2026 deficit at 5.5% of GDP or less, contradicting more pessimistic Wall Street forecasts.

Van Eck emphasized that GDP growth could exceed consensus estimates significantly, noting that Bessent suggested analysts are “an order of magnitude wrong” with predictions barely above 2% when fourth-quarter 2025 growth reached 4%.

“The fear out there is that we are selecting a new Fed chair as we do every four years in May of 2026 and that Donald Trump is exerting too much control over the Fed,” van Eck explained in his quarterly video presentation, before arguing Bessent’s groundwork makes smooth confirmation likely.

AI valuations have reset to attractive levels following late-2025 corrections, according to VanEck’s analysis.

“I hope to show you that the bubble has popped and it’s time to reload your AI allocations,” van Eck declared in his video presentation, noting companies reliant on debt for data center buildouts experienced stock price declines exceeding 50% from summer peaks.

Oracle, a diversified technology company that announced major compute deals, saw its stock correct substantially from levels van Eck termed “nosebleed,” despite strong underlying demand for tokens and compute capacity.

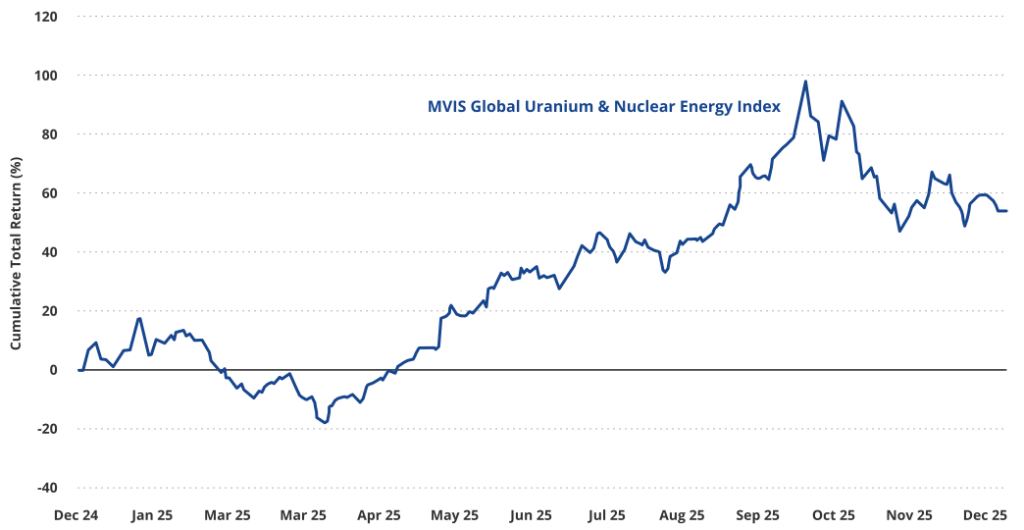

Nuclear power stocks tied to AI electricity demand also repriced meaningfully, improving risk-reward profiles for medium-term investors.

Private Credit and Gold Position as Alternative Opportunities

Business development companies now offer compelling value after a difficult 2025, with yields reaching 9% amid concerns about floating-rate debt exposure and isolated fraud cases in private markets.

Van Eck noted management companies like Ares Capital have seen valuations compress from 50 times forward earnings to approximately 35 times, bringing them back within historical ranges.

“A famous Wall Street CEO said there was a cockroach in the private credit markets. And I think that those fears are overdone but well priced and again an opportunity,” van Eck stated, acknowledging previous caution while now seeing attractive entry points.

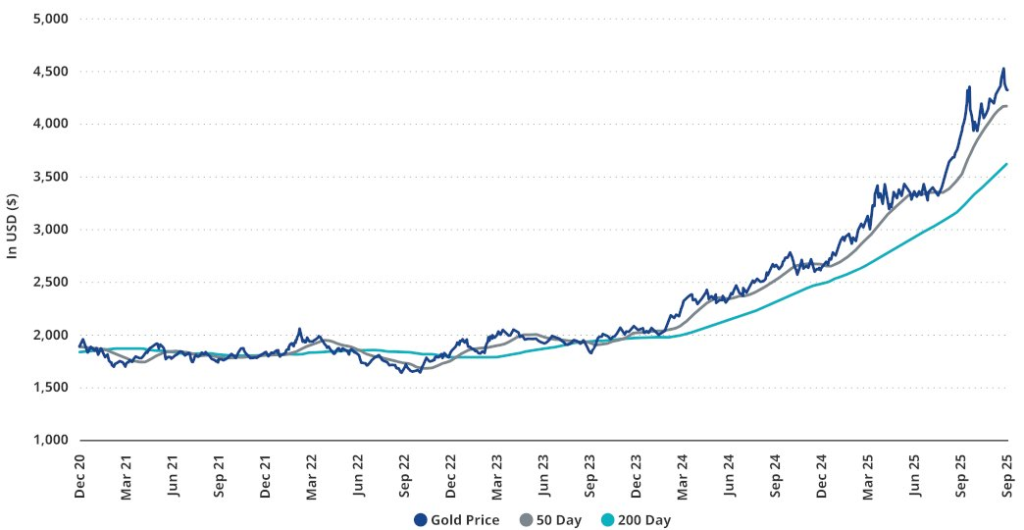

Gold continues its structural re-emergence as a global monetary asset, driven by central bank demand and a declining dollar-centricity worldwide.

VanEck characterizes recent developments in Venezuela as reinforcing geopolitical uncertainty that supports precious metals demand, as governments worldwide recognize the US’s willingness to seize assets or intervene militarily.

While gold appears technically extended in short-term charts, van Eck frames pullbacks as buying opportunities within a multi-year trend he expects to persist through 2028 and beyond, calling it a “paradigm change” akin to the 1971 transition off the gold standard.

Bitcoin Cycle Break Complicates Near-Term Outlook

Bitcoin’s traditional four-year cycle broke in 2025, creating uncertainty for the typically strong first half of post-halving years.

Van Eck expressed caution about the next three to six months, noting Bitcoin was the worst-performing asset in 2025 despite not experiencing its characteristic three-year peak period.

“Bitcoin’s traditional four-year cycle broke in 2025, complicating short-term signals,” the outlook stated, with VanEck colleagues Matthew Sigel and David Schassler maintaining more constructive immediate-term views.

This cautious stance aligns with CryptoQuant CEO Ki Young Ju’s warning that capital inflows into Bitcoin have “completely dried up,” as rotation toward stocks and precious metals creates sideways trading expectations through Q1 2026.