The crypto market is slightly lower today, with the total cryptocurrency market capitalization down 0.8% over the past 24 hours, now standing at around $3.06 trillion. Despite the pullback, the market has managed to hold above the $3 trillion level. At the same time, total crypto trading volume over the past day is approximately $87.6 billion.

TLDRs:

- The crypto market cap slipped 0.8% over the past 24 hours to about $3.06 trillion;

- Most large-cap coins traded lower, though losses were modest across the top 10;

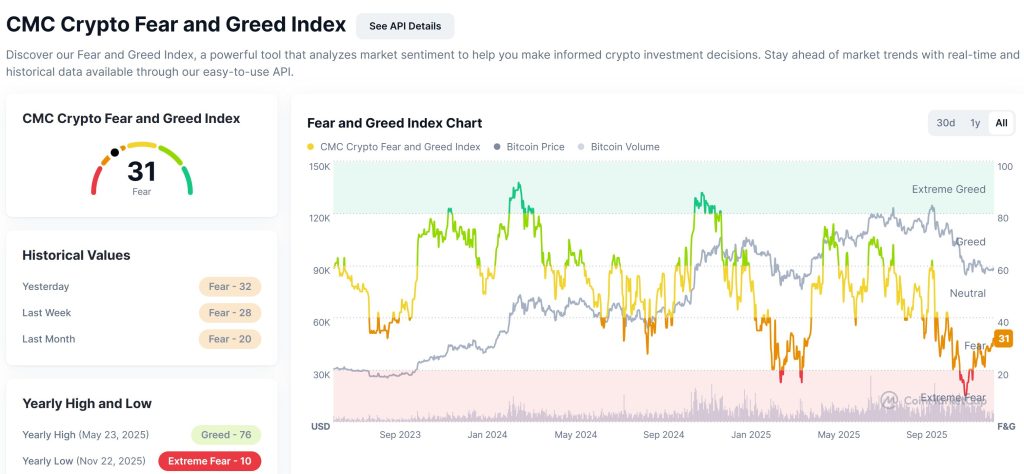

- Crypto sentiment remains cautious, with the Fear and Greed Index at 31 in the fear zone;

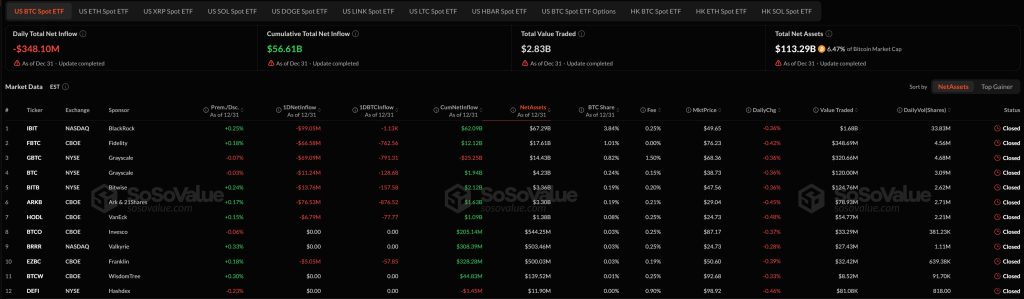

- US BTC spot ETFs recorded $348.1 million in net outflows on Dec. 31;

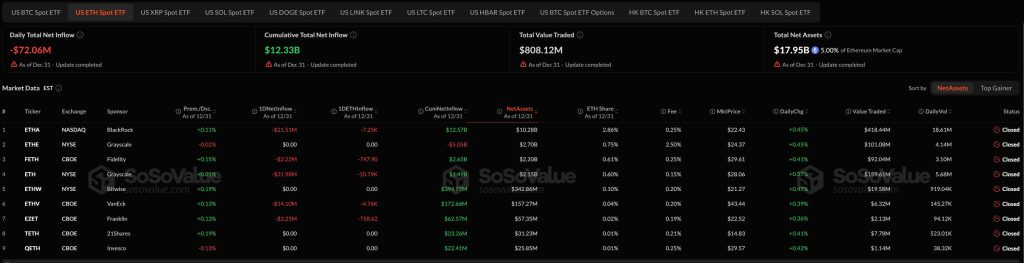

- US ETH spot ETFs also saw outflows of $72.1 million;

- Analysts expect Bitcoin gains in 2026 to be steadier, supported by easing Fed liquidity but tempered by high rates;

- BTC is consolidating between roughly $85,000 and $88,000, with key support near $80,000 and resistance above $92,000;

- ETH is stabilising above $2,900, with recovery possible above $3,100 and downside risk below $2,800;

- A US federal judge dismissed a crypto investor lawsuit against Mark Cuban and the Dallas Mavericks.

Crypto Winners and Losers

At the time of writing, price action among the top assets is mixed, though the majority of large-cap coins are trading in the red on a 24-hour basis.

Bitcoin (BTC) is down about 1.2% over the past 24 hours, trading near $87,735.

Ethereum (ETH) is showing relative strength compared with the broader market, slipping just 0.1% to around $2,981, making it one of the smallest decliners among the top 10.

Solana (SOL) has fallen roughly 1% in the last 24 hours and is currently trading at $124.87, while BNB is down close to 0.9% to $859.65.

XRP (XRP) has also declined by about 1%, changing hands at $1.85. Dogecoin (DOGE) is among the weaker performers in the top 10, sliding around 2.1% to $0.1205.

Tron (TRX) stands out for its relative resilience, posting a 0.7% gain over the past 24 hours to trade at $0.2849, making it one of the few large-cap assets in positive territory.

Outside the majors, some smaller tokens are seeing sharp moves. Bitlight is leading the gainers with a surge of more than 120%, while Collect on Fanable and Everlyn have also posted strong double-digit gains.

On the downside, Lighter is the biggest loser among trending tokens, dropping more than 8% on the day.

Meanwhile, several of the crypto industry’s most prominent figures saw their personal fortunes shrink sharply in 2025, as a violent market reversal in October wiped out gains accumulated earlier in the year.

Michael Saylor, executive chairman of Strategy, lost $2.6 billion over the past 12 months, reducing his net worth to $3.8 billion.

Fed Liquidity and Lower Rates Could Support Bitcoin Gains in 2026

Bitcoin could benefit in 2026 as easing U.S. monetary policy injects fresh liquidity into markets, according to Abra CEO Bill Barhydt. He said early signs of renewed Federal Reserve bond buying and falling interest rates, which he described as “quantitative easing light,” are typically supportive for risk assets, including Bitcoin.

Beyond liquidity, Barhydt pointed to clearer U.S. regulation and growing institutional participation as longer-term tailwinds. However, near-term expectations remain cautious, with CME data showing limited confidence in an early 2026 rate cut, suggesting that supportive conditions may take time to fully materialize.

Analysts broadly expect gains to be steadier rather than explosive. Bitwise CIO Matt Hougan sees a long-term upward grind with lower volatility, while analyst Linh Tran said Bitcoin’s recent pullback reflects a shift toward fundamentals, macro conditions, and institutional flows.

With rates still high and ETF inflows uneven, Bitcoin may remain in an accumulation phase early in 2026 rather than entering a sharp rally.

Levels & Events to Watch Next

At the time of writing, Bitcoin is trading near $87,789, showing a modest daily gain after stabilising toward the end of December. The chart shows that BTC previously fell sharply from October highs near $126,000 before finding support in the $85,000–$88,000 range, where price action has since compressed into a tighter band.

Over the past several weeks, Bitcoin has largely moved sideways, suggesting a consolidation phase following the steep correction. If downside pressure returns, a break below the $85,000 area could expose BTC to further losses toward the $81,000–$80,000 zone, which stands out as the next major support.

On the upside, a sustained move above $92,000 would be an early signal of renewed momentum, potentially opening the door toward $98,000 and higher resistance levels near $103,000.

Ethereum is currently changing hands around $2,984, slightly outperforming Bitcoin on the day. The chart shows ETH declining steadily from September highs above $4,600 before forming a base near the $2,800–$2,900 region. Recent price action suggests ETH is attempting to stabilise after repeated tests of this support zone.

In the near term, holding above $2,900 keeps Ethereum in a neutral-to-stable posture. A close above the $3,100–$3,200 range could signal a recovery phase, with potential upside targets near $3,400 and $3,600. Conversely, a drop below $2,800 would weaken the structure and could push ETH toward the next support around $2,600, where buyers previously stepped in during November’s sell-off.

Meanwhile, crypto market sentiment remains cautious as the Crypto Fear and Greed Index stands at 31, keeping the market firmly in the fear zone.

The reading shows little change from recent sessions, signaling continued uncertainty among investors, with traders largely waiting for clearer macroeconomic or policy signals before taking on additional risk.

U.S. Bitcoin spot ETFs closed the final trading day of 2025 in the red, with data showing net outflows of $348.1 million on Dec. 31, according to SoSoValue. The decline came despite the market remaining active, with total daily trading volume reaching $2.83 billion.

Outflows were led by BlackRock’s IBIT, which saw $99.05 million leave the fund, followed by Fidelity’s FBTC with $46.58 million in net outflows. Grayscale’s GBTC also continued to bleed assets, recording $69.09 million in outflows, while Ark & 21Shares’ ARKB posted $76.53 million in net redemptions.

Despite the daily pullback, cumulative net inflows across U.S. BTC spot ETFs remain strong at $56.61 billion. Total net assets across the products stand at $113.29 billion, representing about 6.47% of Bitcoin’s total market capitalization.

U.S. Ethereum spot ETFs also ended the year under pressure, posting net outflows of $72.06 million on Dec. 31. Trading activity remained moderate, with $808.1 million in total value traded during the session.

BlackRock’s ETHA led the outflows, seeing $21.51 million leave the fund, while Grayscale’s ETH product recorded $31.98 million in net redemptions. Fidelity’s FETH also posted smaller outflows of $2.22 million, reflecting broad-based caution across issuers.

Cumulative net inflows into US ETH spot ETFs remain positive at $12.33 billion. Total net assets stand at $17.95 billion, accounting for roughly 5% of Ethereum’s market capitalization.

Meanwhile, a U.S. federal judge threw out a crypto investor lawsuit against Mark Cuban and the Dallas Mavericks, ending a case that tried to pin Voyager Digital’s collapse on celebrity-style promotion and team marketing.

Judge Roy K. Altman of the U.S. District Court for the Southern District of Florida said in an order dated Friday that the plaintiffs failed to establish personal jurisdiction over Cuban and the team, and the court lacked a sufficient connection between Florida and the alleged promotion.

The post Why Is Crypto Down Today? – January 1, 2026 appeared first on Cryptonews.

Several prominent crypto figures saw their personal fortunes shrink sharply in 2025, as a violent market reversal in October wiped out gains.

Several prominent crypto figures saw their personal fortunes shrink sharply in 2025, as a violent market reversal in October wiped out gains. A US judge dismissed a crypto investor lawsuit against Mark Cuban

A US judge dismissed a crypto investor lawsuit against Mark Cuban