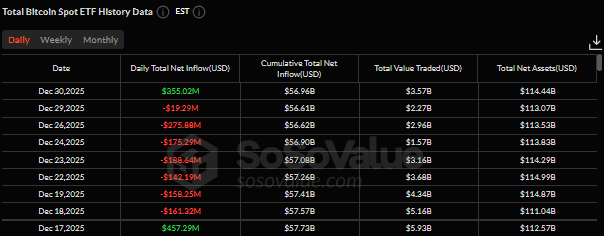

U.S. spot Bitcoin exchange-traded funds recorded a sharp reversal on December 30, pulling in $355 million in net inflows and ending a seven-day stretch of persistent capital withdrawals.

The move marked the strongest daily inflow since mid-December and came after nearly two weeks in which ETF investors steadily reduced exposure as prices softened and year-end liquidity thinned.

Sosovalue data shows that the rebound was led by BlackRock’s iShares Bitcoin Trust, which attracted $143.75 million in fresh capital on the day.

ARK Invest and 21Shares’ ARKB followed with $109.56 million, while Fidelity’s Wise Origin Bitcoin Fund added $78.59 million.

Smaller but still positive contributions came from Bitwise, VanEck, and Grayscale’s legacy Bitcoin Trust.

The turnaround followed a difficult run in which spot Bitcoin ETFs lost about $1.12 billion over seven trading days, including a heavy $275.9 million outflow on December 26, which stood out as the most aggressive selling session of the period.

Bitcoin ETFs See December Losses, Even as Trading Activity Picks Up

December as a whole remained challenging for spot Bitcoin ETFs despite its late rebound, it has posted a net monthly outflow of roughly $744 million, extending losses from November, when funds shed more than $3.4 billion.

The pressure was most visible between December 18 and December 29, when ETFs recorded outflows on seven of eight trading days, briefly interrupted only by a single large inflow on December 17.

Weekly data tells a similar story, with two deeply negative weeks preceding the modest recovery seen in the final week of the month.

Even with the volatility, cumulative net inflows across U.S. spot Bitcoin ETFs still stand at $56.96 billion, underscoring the scale of institutional participation built up earlier in the year.

Total net assets held by these products reached $114.44 billion as of December 30, representing about 6.52% of Bitcoin’s total market capitalization.

Trading activity also picked up alongside the rebound, with total value traded across Bitcoin ETFs reaching $3.57 billion for the day.

Flows remained heavily concentrated among the largest issuers. BlackRock’s IBIT continues to dominate the market, with cumulative net inflows of $62.19 billion and nearly $68 billion in assets under management, equivalent to roughly 3.9% of Bitcoin’s circulating supply.

Fidelity and ARK 21Shares followed at a distance, while Grayscale’s GBTC continued to show no fresh inflows and remains deeply negative on a cumulative basis due to long-running redemptions after its conversion from a trust structure.

Bitcoin Consolidates Below $90K While Ethereum ETFs Stay Steady

The shift in ETF flows came as Bitcoin prices stabilized after a volatile intraday cycle. Bitcoin was trading near $88,800 at the time of the latest data, up modestly over 24 hours but still well below its all-time high.

Price action over recent sessions showed a sharp move toward the $90,000 level, followed by a rejection and pullback toward the mid-$86,000 range, where buyers stepped in and halted further declines.

Since then, the market has moved sideways, with price oscillating between established support near $86,700 and resistance around $88,000, reflecting a pause as traders reassess direction.

Ethereum spot ETFs showed steadier conditions by comparison as On December 30, ETH-linked ETFs recorded $67.84 million in net inflows, lifting cumulative inflows to $12.40 billion.

Total net assets stood at just under $18 billion, representing about 5% of Ethereum’s market capitalization.

BlackRock’s ETHA remains the largest product by assets, while Grayscale’s ETHE accounted for the bulk of the day’s inflows despite still carrying a negative cumulative balance tied to earlier redemptions.

The post Spot Bitcoin ETFs Pull In $355M, Ending 7- Day Bleed — Is Liquidity Finally Turning? appeared first on Cryptonews.